Dollar General 2014 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2014 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy

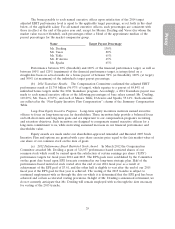

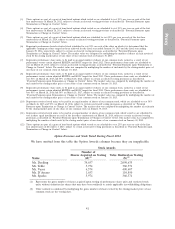

Officer Level Multiple of Base Salary

CEO 5X

COO 4X

EVP 3X

SVP 2X

Each senior officer is required to retain ownership of 50% of all net after-tax shares granted by

Dollar General until he or she reaches the target. Administrative details pertaining to these matters are

established by the Compensation Committee.

(e) Policy Against Hedging and Pledging Transactions. Our Insider Trading Policy prohibits

Board members and executive officers from pledging Dollar General securities as collateral, from

holding Dollar General securities in a margin account, and from hedging their ownership of Dollar

General stock. Examples of hedging ownership include entering into or trading prepaid variable

forward contracts, equity swaps, collars, puts, calls, options (other than those granted under a Dollar

General compensation plan) or other derivative instruments related to Dollar General stock.

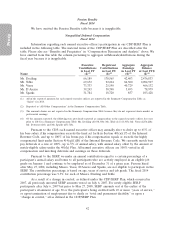

Benefits and Perquisites. Along with certain benefits offered to named executive officers on the

same terms that are offered to all of our salaried employees (such as health benefits and matching

contributions under our 401(k) Plan), we provide our named executive officers with certain additional

benefits and perquisites for retention and recruiting purposes and to replace benefit opportunities lost

due to regulatory limits. We also provide named executive officers with benefits and perquisites as

additional forms of compensation that we believe to be consistent and competitive with benefits and

perquisites provided to executives with similar positions in our market comparator group and in our

industry. We do not provide tax gross-up payments on any benefits and perquisites other than

relocation-related items.

The named executive officers have the opportunity to participate in the Compensation Deferral

Plan (the ‘‘CDP’’), and Messrs. Dreiling and Tehle further participate in the defined contribution

Supplemental Executive Retirement Plan (the ‘‘SERP,’’ and together with the CDP, the ‘‘CDP/SERP

Plan’’).

We pay the premiums for each named executive officer’s life insurance benefit equal to

2.5 times his base salary up to a maximum of $3 million.

We pay administrative fees for each named executive officer for short-term disability coverage,

which provides income replacement of up to 70% of monthly base salary in the case of a short-term

disability. We also pay the premiums for each named executive officer under a group long-term

disability plan, which provides 60% of base salary up to a maximum of $400,000.

We also provide a relocation assistance program to named executive officers under a policy

applicable to officer-level employees. Pursuant to Compensation Committee approval, Mr. D’Arezzo

was reimbursed for 9 return trips to his origination location until his family was able to relocate with

him.

We provide through a third party a personal financial and advisory service benefit to the

named executive officers, including financial planning, estate planning and tax preparation services, in

an annual amount of up to $20,000 per person. The Committee believes the financial services program

reduces the amount of time and attention that executives must spend on these matters, furthering their

ability to focus on their responsibilities to us, and maximizes the executive’s net financial reward of

compensation received from us.

32