Delta Airlines 2006 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2006 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

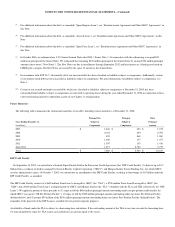

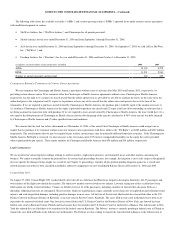

Bombardier Agreement

During the June 2006 quarter, Comair, Bombardier, Inc. (“Bombardier”) and a subsidiary of Bombardier completed, with the approval of the Bankruptcy

Court, an agreement under which, among other things, (1) Comair surrendered a letter of credit supporting certain reimbursement obligations owed by

Bombardier to Comair, which were simultaneously released by Comair and (2) Bombardier transferred to Comair $171 million aggregate principal amount of

secured notes issued to Bombardier by Delta. The transfer of the secured notes constitutes an extinguishment of debt under SFAS No. 140, “Accounting for

the Transfer and Services of Financial Assets and Extinguishment of Liabilities.” We recognized a $26 million gain as a result of this extinguishment of debt,

which is classified in reorganization items, net.

Covenants

As discussed above, the Amended and Restated DIP Credit Facility and the Amex Post-Petition Facility include certain affirmative, negative and

financial covenants. In addition, as is customary in the airline industry, our aircraft lease and financing agreements require that we maintain certain levels of

insurance coverage, including war-risk insurance. Failure to maintain these coverages may result in an interruption to our operations. See Note 8 for additional

information about our war-risk insurance currently provided by the U.S. government.

We were in compliance with these covenant requirements at December 31, 2006 and 2005.

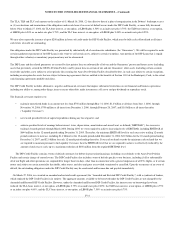

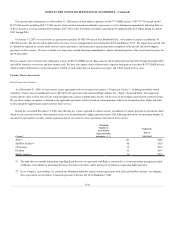

Exit Financing

On January 29, 2007, we secured commitments for a $2.5 billion exit financing facility (the “Exit Facility”) to be used in connection with our plan to exit

bankruptcy in the second quarter of 2007. The Exit Facility will be co-led by a syndicate of six lenders and will consist of a $1.0 billion first-lien revolving

credit facility, a $500 million first-lien Term Loan A and a $1.0 billion second-lien Term Loan B. Proceeds from the Exit Facility will be used to repay the

outstanding principal amounts of $1.9 billion and $176 million, together with interest thereon and all other amounts outstanding thereunder, for the Amended

and Restated DIP Credit Facility and the Amex Post-Petition Facility, respectively. The Exit Facility will be secured by substantially all of the first priority

collateral in the existing Amended and Restated DIP Credit Facility.

The scheduled maturity date for the revolving credit facility and the Term Loan A will be the fifth anniversary of the closing date of the Exit Facility.

The scheduled maturity date for the Term Loan B will be the seventh anniversary of the closing date of the closing of the Exit Facility.

The Exit Facility will contain financial covenants that will require us to maintain a minimum fixed charge coverage ratio, minimum unrestricted cash

reserves and minimum collateral coverage ratios. In addition, the Exit Facility will restrict our ability to, among other things, incur additional secured

indebtedness, make investments, sell assets if not in compliance with the collateral coverage ratio tests, pay dividends or repurchase stock. These covenants

may have a material impact on our operations.

The closing and funding of the Exit Facility is subject to the completion of definitive documentation and certain other conditions precedent.

Note 7. Lease Obligations

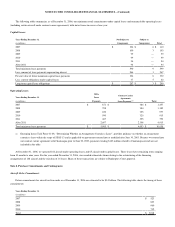

We lease aircraft, airport terminals and maintenance facilities, ticket offices and other property and equipment from third parties. As allowed under

Section 365 and other relevant sections of the Bankruptcy Code, the Debtors may assume, assume and assign, or reject certain executory contracts and

unexpired leases, including leases of real property, aircraft and aircraft engines, subject to the approval of the Bankruptcy Court and certain other conditions,

including compliance with Section 1110.

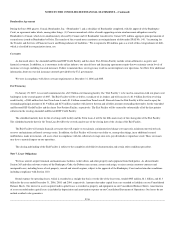

Rental expense for operating leases, which is recorded on a straight-line basis over the life of the lease term, totaled $945 million, $1.1 billion, and $1.3

billion for the years ended December 31, 2006, 2005, and 2004, respectively. Amounts due under capital leases are recorded as liabilities on our Consolidated

Balance Sheets. Our interest in assets acquired under capital leases is recorded as property and equipment on our Consolidated Balance Sheets. Amortization

of assets recorded under capital leases is included in depreciation and amortization expense on our Consolidated Statements of Operations. Our leases do not

include residual value guarantees.

F-36