Delta Airlines 2006 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2006 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

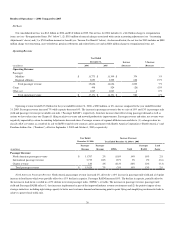

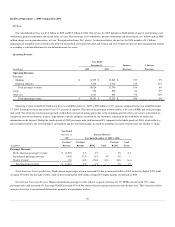

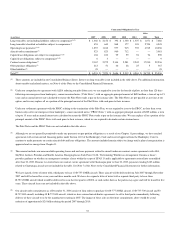

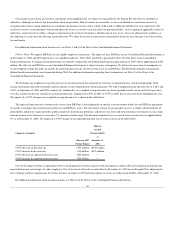

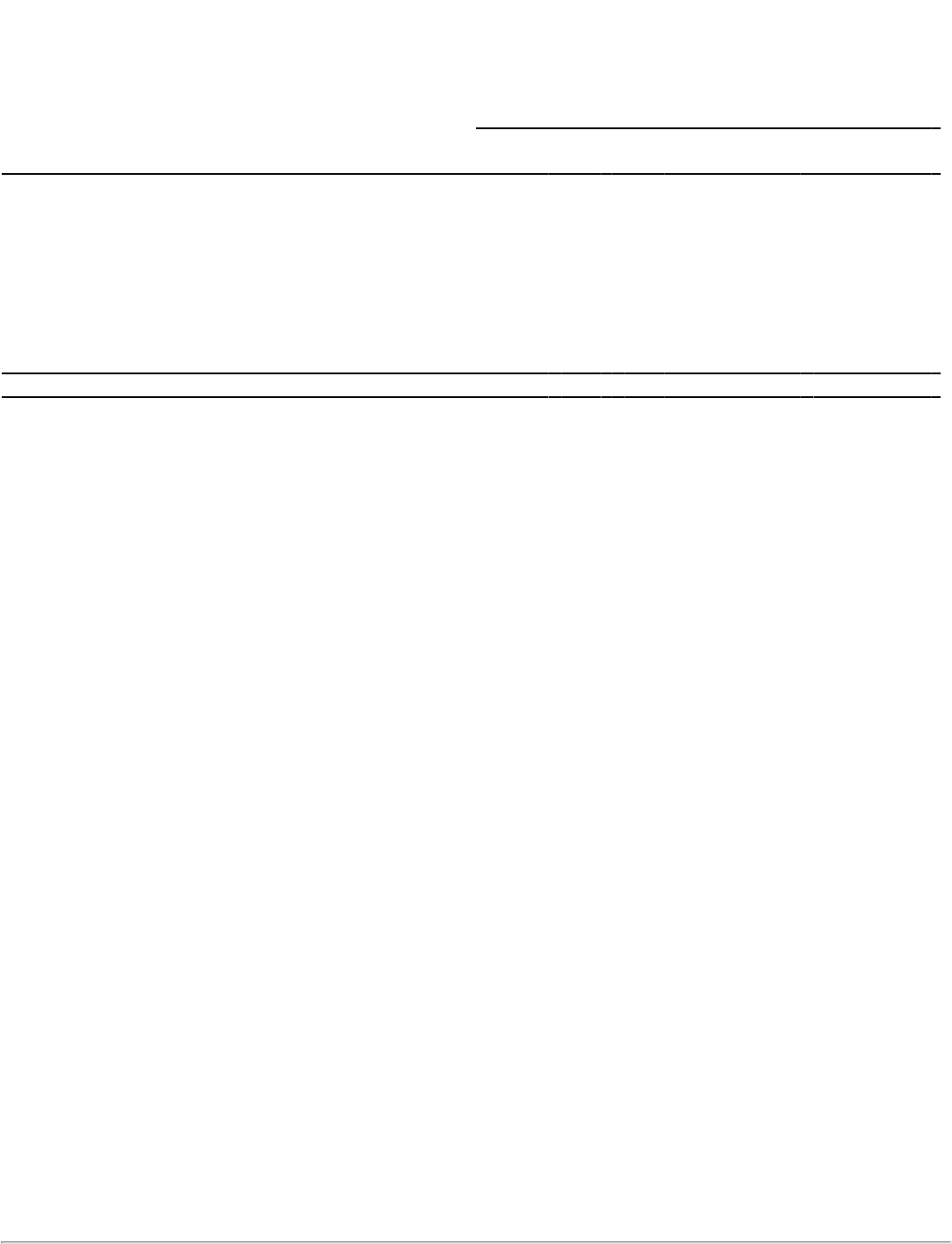

Contractual Obligations by Year

(in millions)

2007

2008

2009

2010

2011

After

2011

Total

Long-term debt, not including liabilities subject to compromise(1)(2) $ 1,466 $ 2,152 $ 392 $ 1,300 $ 1,307 $ 1,071 $ 7,688

Long-term debt classified as liabilities subject to compromise(1) 453 640 868 177 103 2,704 4,945

Operating lease payments(3)(4) 1,257 1,182 977 915 792 4,915 10,038

Aircraft order commitments(5) 523 823 960 712 — — 3,018

Capital lease obligations not subject to compromise(3)(6) 104 100 99 99 94 94 590

Capital lease obligations subject to compromise(3)(6) 6 3 — — — — 9

Contract carrier obligations(7) 2,167 2,272 2,344 2,281 2,242 17,930 29,236

Other purchase obligations(8) 212 51 46 28 25 5 367

Other liabilities(9) 45 — — — — — 45

Total(10) $ 6,233 $ 7,223 $ 5,686 $ 5,512 $ 4,563 $ 26,719 $ 55,936

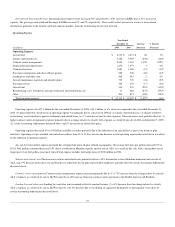

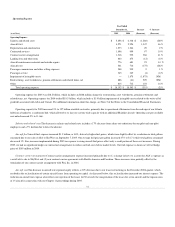

(1) These amounts are included in our Consolidated Balance Sheets. Interest on long-term debt is not included in the table above. For additional information

about our debt and related matters, see Note 6 of the Notes to the Consolidated Financial Statements.

(2) Under our comprehensive agreement with ALPA reducing our pilot labor costs, we are required to issue for the benefit of pilots, no later than 120 days

following our emergence from bankruptcy, senior unsecured notes (“Pilot Notes”) with an aggregate principal amount of $650 million, a term of up to 15

years and an annual interest rate calculated to ensure the Pilot Notes trade at par on the issuance date. The Pilot Notes are pre-payable at any time at our

option, and we may replace all or a portion of the principal amount of the Pilot Notes with cash prior to their issuance.

Under our settlement agreement with the PBGC relating to the termination of the Pilot Plan, we are required to issue to the PBGC, no later than seven

business days after our emergence from bankruptcy, senior unsecured notes (“PBGC Notes”) with an aggregate principal amount of $225 million, a term

of up to 15 years and an annual interest rate calculated to ensure the PBGC Notes trade at par on the issuance date. We may replace all or a portion of the

principal amount of the PBGC Notes with cash prior to their issuance, which we are required to do under certain circumstances.

The Pilot Notes and the PBGC Notes are not included in the table above.

(3) Although we are not generally permitted to make any payments on pre-petition obligations as a result of our Chapter 11 proceedings, we have reached

agreements with certain aircraft financing parties under Section 1110 of the Bankruptcy Code and received approval from the Bankruptcy Court to

continue to make payments on certain aircraft debt and lease obligations. The amounts included remain subject to change until a plan of reorganization is

approved and we emerge from Chapter 11.

(4) This amount includes our noncancelable operating leases and our lease payments related to aircraft under our contract carrier agreements with ASA,

SkyWest Airlines, Freedom and Shuttle America. Emerging Issues Task Force 01-08, “Determining Whether an Arrangement Contains a Lease”,

provides guidance on whether an arrangement contains a lease within the scope of SFAS 13 and is applicable to agreements entered into or modified

after June 30, 2003. Because we entered into our contract carrier agreement with Chautauqua prior to June 30, 2003, payments totaling $183 million

related to Chautauqua aircraft are not included in the table. See Note 7 of the Notes to the Consolidated Financial Statements for further information.

We have signed a letter of intent with a third party to lease 10 B-757-200ER aircraft. These aircraft will be delivered from July 2007 through November

2007 and will be leased for seven years and three months each. We have also signed a letter of intent with a separate third party to lease three

B-757-200ER aircraft which would be delivered to us in the first quarter of 2008, or such earlier dates as the parties may agree and will be leased for five

years. These aircraft leases are not included in the table above.

(5) Our aircraft order commitments as of December 31, 2006 consist of firm orders to purchase five B-777-200LR aircraft, 10 B-737-700 aircraft and 50

B-737-800 aircraft, including 48 B-737-800 aircraft, which we have entered into definitive agreements to sell to third parties immediately following

delivery of these aircraft to us by the manufacturer starting in 2007. The impact of these sales on the future commitments above would be a total

reduction of approximately $2.0 billion during the period 2007 through 2010.

35