Delta Airlines 2006 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2006 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

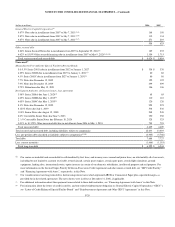

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

Equity Method Investments

We use the equity method to account for our investment in a company when we have significant influence but not control over the company’s

operations. Under the equity method, we initially record our investment at cost and then adjust the carrying value of the investment to recognize our

proportional share of the company’s net income (loss). In addition, dividends received from the company reduce the carrying value of our investment.

During 2004, we sold our remaining ownership and voting interest in Orbitz, Inc. for $143 million. We recognized a gain of $123 million on this

transaction in gain from sale of investments, net in our Consolidated Statement of Operations for the year ended December 31, 2004.

Income Taxes

In accordance with SFAS No. 109, “Accounting for Income Taxes” (“SFAS 109”), we account for deferred income taxes under the liability method.

Under this method, we recognize deferred tax assets and liabilities based on the tax effects of temporary differences between the financial statement and tax

bases of assets and liabilities, as measured by current enacted tax rates. A valuation allowance is recorded to reduce deferred tax assets when necessary.

Deferred tax assets and liabilities are recorded net as current and noncurrent deferred income taxes on our Consolidated Balance Sheets (see Note 9).

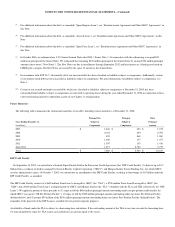

Our income tax provisions are based on calculations and assumptions that are subject to examination by the Internal Revenue Service and other tax

authorities. Although we believe that the positions taken on previously filed tax returns are reasonable, we have established tax and interest reserves in

recognition that various taxing authorities may challenge the positions we have taken, which could result in additional liabilities for taxes and interest. We

review the reserves as circumstances warrant and adjust the reserves as events occur that affect our potential liability, such as lapsing of applicable statutes of

limitations, conclusion of tax audits, a change in exposure based on current calculations, identification of new issues, release of administrative guidance, or

the rendering of a court decision affecting a particular issue. We would adjust the income tax provision in the period in which the facts that give rise to the

revision become known.

Investments in Debt and Equity Securities

We record our investments classified as available-for-sale securities at fair value in other noncurrent assets on our Consolidated Balance Sheets. Any

change in the fair value of these securities is recorded in accumulated other comprehensive loss. We record our investments classified as trading securities at

fair value in current assets on our Consolidated Balance Sheets and recognize changes in the fair value of these securities in other (expense) income on our

Consolidated Statements of Operations.

Frequent Flyer Program

For SkyMiles accounts with sufficient mileage credits to qualify for a free travel award, we record a liability for the estimated incremental cost of flight

awards that are earned and expected to be redeemed for travel on Delta or other airlines. Our incremental costs include (1) our system average cost per

passenger for fuel, food and other direct passenger costs for awards to be redeemed on Delta and (2) contractual costs for awards to be redeemed on other

airlines. We periodically record adjustments to this liability in other operating expenses on our Consolidated Statements of Operations based on awards

earned, awards redeemed, changes in our estimated incremental costs and changes to the SkyMiles program. Changes in these estimates could have a material

impact on the liability in the year in which the change occurs and in future years. The liability is recorded in other accrued liabilities on our Consolidated

Balance Sheets.

F-22