Delta Airlines 2006 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2006 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

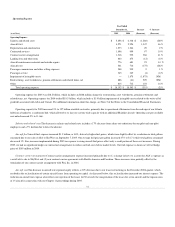

Recently Issued Accounting Pronouncements

In September 2006, the Financial Accounting Standards Board (“FASB”) issued SFAS No. 158, “Employers Accounting for Defined Benefit Pension

and Other Postretirement Plans, an amendment of SFAS Nos. 87, 88, 106 and 132(R)” (“SFAS 158”). This statement, among other things, requires that we

recognize the funded status of our defined benefit pension and other postretirement plans in our Consolidated Balance Sheet as of December 31, 2006, with

changes in the funded status recognized through comprehensive loss in the year in which such changes occur. Application of this standard resulted in (1) a

$685 million net decrease in accrued pension and other postretirement and postemployment liabilities, (2) a $248 million decrease in the intangible pension

asset in other noncurrent assets and (3) a $437 million decrease in shareowners’ deficit. The adoption of SFAS 158 had no effect on our Consolidated

Statement of Operations for any period presented. For additional information related to the adoption of SFAS 158, see Note 10 of the Notes to the

Consolidated Financial Statements.

In July 2006, the FASB issued FASB Interpretation No. 48, “Accounting for Uncertainty in Income Taxes—an interpretation of FASB Statement

No. 109” (“FIN 48”), which clarifies the accounting and disclosure for uncertainty in tax positions, as defined. FIN 48 is intended to reduce the diversity in

practice associated with certain aspects of the recognition and measurement related to accounting for income taxes. This interpretation is effective for fiscal

years beginning after December 15, 2006. The cumulative effect of applying this interpretation must be reported as an adjustment to the opening balance of

shareowners’ deficit in 2007. We are currently evaluating the impact of FIN 48 on our Consolidated Financial Statements and anticipate the adjustment to

shareowners’ deficit will not be material.

In December 2004, the FASB issued SFAS No. 123 (revised 2004), “Share-Based Payment” (“SFAS 123R”), which requires an entity to recognize

compensation expense in an amount equal to the fair value of its share based payments, such as stock options granted to employees. This standard replaces

SFAS No. 123, “Accounting for Stock-Based Compensation” (“SFAS 123”), and supersedes APB Opinion No. 25, “Accounting for Stock Issued to

Employees.” We adopted SFAS 123R on January 1, 2006. For additional information regarding SFAS 123R, see Note 2 in the Notes to the Consolidated

Financial Statement.

Market Risks Associated with Financial Instruments

We have significant market risk exposure related to aircraft fuel prices and interest rates. Market risk is the potential negative impact of adverse changes

in these prices or rates on our Consolidated Financial Statements. To manage the volatility relating to these exposures, we periodically enter into derivative

transactions pursuant to stated policies (see Note 4 of the Notes to the Consolidated Financial Statements). We expect adjustments to the fair value of financial

instruments accounted for under SFAS 133 to result in ongoing volatility in earnings and shareowners’ deficit.

The following sensitivity analyses do not consider the effects of a change in demand for air travel, the economy as a whole, or actions we may take to

seek to mitigate our exposure to a particular risk. For these and other reasons, the actual results of changes in these prices or rates may differ materially from

the following hypothetical results.

Aircraft Fuel Price Risk

Our results of operations may be materially impacted by changes in the price of aircraft fuel. To manage this risk, we periodically enter into derivative

contracts comprised of heating oil and jet fuel swap and collar contracts, to hedge a portion of our projected aircraft fuel requirements. We do not enter into

fuel hedge contracts for speculative purposes.

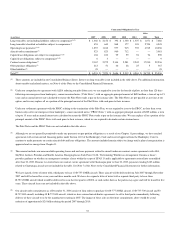

In 2006, aircraft fuel expense accounted for 25% of our total operating expenses. Aircraft fuel expense for 2006 increased 1% compared to 2005 due to

higher fuel prices, despite reduced consumption. Our average fuel price per gallon increased 19% to $2.04, while total gallons consumed decreased 15%, due

to a reduction in Mainline capacity and our sale of ASA.

41