Delta Airlines 2006 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2006 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our income tax provisions are based on calculations and assumptions that are subject to examination by the Internal Revenue Service and other tax

authorities. Although we believe that the positions taken on previously filed tax returns are reasonable, we have established tax and interest reserves in

recognition that various taxing authorities may challenge the positions we have taken, which could result in additional liabilities for taxes and interest. We

review the reserves as circumstances warrant and adjust the reserves as events occur that affect our potential liability, such as lapsing of applicable statutes of

limitations, conclusion of tax audits, a change in exposure based on current calculations, identification of new issues, release of administrative guidance, or

the rendering of a court decision affecting a particular issue. We adjust the income tax provision in the period in which the facts that give rise to the revision

become known.

For additional information about income taxes, see Notes 2 and 9 of the Notes to the Consolidated Financial Statements.

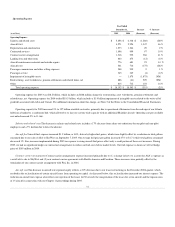

Pension Plans. We sponsor DB Plans for our eligible employees and retirees. The impact of these DB Plans on our Consolidated Financial Statements as

of December 31, 2006 and 2005 and for the years ended December 31, 2006, 2005, and 2004 is presented in Note 10 of the Notes to the Consolidated

Financial Statements. Assuming current plan design, we currently estimate that our defined benefit pension plan expense in 2007 will be approximately $100

million. The effect of our DB Plans on our Consolidated Financial Statements is subject to many assumptions. We believe the most critical assumptions are

(1) the weighted average discount rate and (2) the expected long-term rate of return on the assets of our DB Plans. The Pilot Plan and pilot non-qualified

defined benefit pension plans were terminated during 2006. For additional information regarding these terminations, see Note 10 of the Notes to the

Consolidated Financial Statements.

We determine our weighted average discount rate on our measurement date primarily by reference to annualized rates earned on high quality fixed

income investments and yield-to-maturity analysis specific to our estimated future benefit payments. We used a weighted average discount rate of 5.88% and

5.69% at September 30, 2006 and 2005, respectively. Additionally, our weighted average discount rate for net periodic benefit cost in each of the past three

years has varied from the rate selected on our measurement date, ranging from 6.09% in 2004 to 5.67% in 2006, due to remeasurements throughout the year.

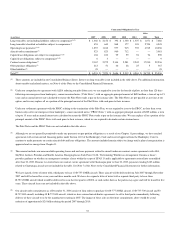

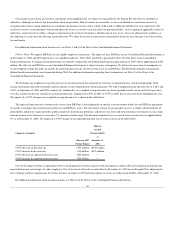

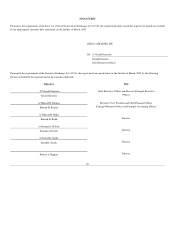

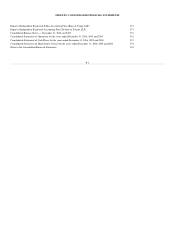

The impact of a 0.50% change in our weighted average discount rate is shown in the table below.

The expected long-term rate of return on the assets of our DB Plans is based primarily on specific asset investment studies for our DB Plans performed

by outside consultants who used historical returns on our DB Plans’ assets. The investment strategy for pension plan assets is to utilize a diversified mix of

global public and private equity portfolios, public and private fixed income portfolios, and private real estate and natural resource investments to earn a long-

term investment return that meets or exceeds a 9% annualized return target. Our historical annualized ten-year rate of return on plan assets is approximately

9% as of December 31, 2006. The impact of a 0.50% change in our expected long-term rate of return is shown in the table below.

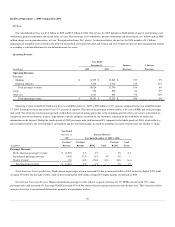

Change in Assumption

Effect on 2007

Pension Expense

Effect on

Accrued

Pension Liability

at

December 31,

2006

0.50% decrease in discount rate +$15 million +$475 million

0.50% increase in discount rate -$15 million -$475 million

0.50% decrease in expected return on assets +$20 million —

0.50% increase in expected return on assets -$20 million —

Our rate of change in future compensation levels is based primarily on labor contracts with our employees under collective bargaining agreements and

expected future pay rate changes for other employees. Due to the freeze of benefit accruals effective December 31, 2005 in our Non-pilot Plan, adjusting the

rate of change in future compensation levels does not have an impact on 2007 pension expense or on the accrued pension liability at December 31, 2006.

For additional information about our pension plans, see Note 10 of the Notes to the Consolidated Financial Statements.

40