Delta Airlines 2006 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2006 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Background

On September 14, 2005 (the “Petition Date”), we and substantially all of our subsidiaries (collectively, the “Debtors”) filed voluntary petitions for

reorganization under Chapter 11 of the United States Bankruptcy Code (the “Bankruptcy Code”), in the United States Bankruptcy Court for the Southern

District of New York (the “Bankruptcy Court”). The reorganization cases are being jointly administered under the caption, “In re Delta Air Lines, Inc., et al.,

Case No. 05-17923-ASH.”

The Debtors are operating as “debtors-in-possession” under the jurisdiction of the Bankruptcy Court and in accordance with the applicable provisions of

the Bankruptcy Code. In general, as debtors-in-possession, the Debtors are authorized under Chapter 11 to continue to operate as an ongoing business, but

may not engage in transactions outside the ordinary course of business without the prior approval of the Bankruptcy Court.

Under Section 365 and other relevant sections of the Bankruptcy Code, we may assume, assume and assign, or reject certain executory contracts and

unexpired leases, including leases of real property, aircraft and aircraft engines, subject to the approval of the Bankruptcy Court and certain other conditions.

Any description of an executory contract or unexpired lease in this Form 10-K, including where applicable our express termination rights or a quantification

of our obligations, must be read in conjunction with, and is qualified by, any overriding rejection rights we have under the Bankruptcy Code.

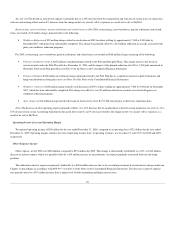

On December 19, 2006, we filed with the Bankruptcy Court our Plan of Reorganization and a related Disclosure Statement, which contemplate that

Delta will emerge from Chapter 11 as an independent airline. The Plan of Reorganization, as amended (the “Plan”), addresses various subjects with respect

to the Debtors, including the resolution of pre-petition obligations, as well as the capital structure and corporate governance after exit from Chapter 11.

The Plan provides that most holders of allowed unsecured claims against the Debtors will receive common stock of reorganized Delta in satisfaction of

their claims. Some holders of allowed unsecured claims against the Debtors would have the right to request cash proceeds of sales of common stock of

reorganized Delta in lieu of such stock, and certain others would receive cash in satisfaction of their claims. Current holders of Delta’s equity interests would

not receive any distributions, and their equity interests would be cancelled once the Plan becomes effective.

On February 7, 2007, the Bankruptcy Court approved the amended Disclosure Statement, and authorized the Debtors to begin soliciting votes from

creditors to approve the Plan. The official committee of unsecured creditors (the “Creditors Committee”) and the two official retiree committees appointed in

the Debtors’ Chapter 11 proceedings each support the Plan. To be accepted by holders of claims against the Debtors, the Plan must be approved by at least

one-half in number and two-thirds in dollar amount of claims actually voting in each impaired class.

April 9, 2007 is the deadline for creditors to vote on the Plan. The Bankruptcy Court has scheduled a confirmation hearing on April 25, 2007 to consider

approval of the Plan. If the Plan is approved by the creditors and confirmed by the Bankruptcy Court, the Debtors are planning to emerge from Chapter 11

shortly thereafter.

For additional information regarding the Debtors’ Chapter 11 proceedings, see Note 1 of the Notes to the Consolidated Financial Statements.

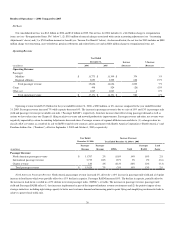

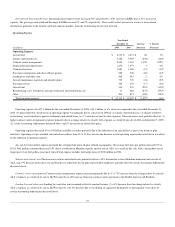

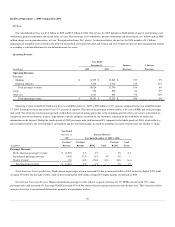

Overview of 2006 Results

In 2006, we recorded a net loss of $6.2 billion, which is primarily attributable to a $6.2 billion charge to reorganization items, net. Our 2006 financial

results also include a $765 million income tax benefit associated with the reversal of certain income tax valuation allowances and a $310 million noncash

charge associated with certain accounting adjustments. For additional information about these matters, see “Results of Operations - 2006 Compared to 2005”

and “Basis of Presentation of Consolidated Financial Statements - Accounting Adjustments” below.

21