Delta Airlines 2006 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2006 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

For SkyMiles accounts with sufficient mileage credits to qualify for a free travel award, we record a liability for the estimated incremental cost of flight

awards that are earned and expected to be redeemed for travel on Delta or other airlines. Our incremental costs include our system average cost per passenger

for fuel, food and other direct passenger costs for awards to be redeemed on Delta. These estimates are generally updated based on our 12-month historical

average for such costs. We also accrue a frequent flyer liability for the mileage credits that are expected to be used for travel on participating airlines based on

historical usage patterns and contractual rates. We periodically record adjustments to this liability in other operating expenses on our Consolidated Statements

of Operations based on awards earned, awards redeemed, changes in our estimated incremental costs and changes to the SkyMiles program. Changes in these

estimates could have a material impact on the liability in the year in which the change occurs and in future years. The liability is recorded in other accrued

liabilities on our Consolidated Balance Sheets.

At December 31, 2006 and 2005, we estimated that approximately eight million and seven million free travel awards, respectively, were expected to be

redeemed for free travel on Delta or other airlines. This estimate excludes mileage credits in SkyMiles accounts which (1) do not have sufficient mileage

credits to qualify for a free travel award or (2) have sufficient mileage credits to qualify for a free travel award but which are not expected to be redeemed for

such an award.

We sell mileage credits in our SkyMiles frequent flyer program to participating companies such as credit card companies, hotels and car rental agencies.

The portion of the revenue from the sale of mileage credits that approximates the fair value of travel to be provided is deferred and recognized as passenger

revenue over the period when transportation is expected to be provided. Amounts received in excess of the transportation’s fair value are recognized in

income currently and classified as other revenue. A change in assumptions as to the period over which the mileage credits are expected to be used (currently

15 to 41 months), the actual redemption activity for mileage credits or our estimate of the fair value of transportation expected to be provided could have a

material impact on our revenue in the year in which the change occurs and in future years.

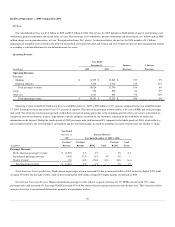

Our total liability for future SkyMiles award redemptions for free travel on us or participating airlines as well as unrecognized revenue from selling

SkyMiles mileage credits was approximately $887 million and $607 million at December 31, 2006 and 2005, respectively. These amounts were recorded as

components of other accrued liabilities on our Consolidated Balance Sheets.

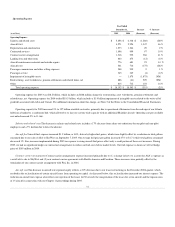

Long-Lived Assets.Our flight equipment and other long-lived assets have a recorded value of $13.0 billion on our Consolidated Balance Sheet at

December 31, 2006. This value is based on various factors, including the assets’ estimated useful lives and their estimated salvage values. In accordance with

SFAS No. 144, “Accounting for the Impairment or Disposal of Long-Lived Assets” (“SFAS 144”), we record impairment losses on long-lived assets used in

operations when events and circumstances indicate the assets might be impaired and the estimated future cash flows generated by those assets are less than

their carrying amounts. The impairment loss recognized is the amount by which the asset’s carrying amount exceeds its estimated fair value.

In order to evaluate potential impairment as required by SFAS 144, we group assets at the fleet type level (the lowest level for which there are

identifiable cash flows) and then estimate future cash flows based on projections of passenger yield, fuel costs, labor costs and other relevant factors. We

estimate aircraft fair values using published sources, appraisals and bids received from third parties, as available. For additional information about our

accounting policy for the impairment of long-lived assets, see Notes 2 and 5 of the Notes to the Consolidated Financial Statements.

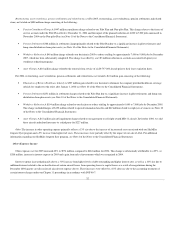

Income Tax Valuation Allowance and Contingencies.In accordance with SFAS No. 109, “Accounting for Income Taxes” (“SFAS 109”), deferred tax

assets should be reduced by a valuation allowance if it is more likely than not that some portion or all of the deferred tax assets will not be realized. The future

realization of our net deferred tax assets depends on the availability of sufficient future taxable income. In making this determination, we consider all

available positive and negative evidence and make certain assumptions. We consider, among other things, our deferred tax liabilities; the overall business

environment; our historical earnings and losses; our industry’s historically cyclical periods of earnings and losses; and our outlook for future years.

39