Delta Airlines 2006 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2006 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

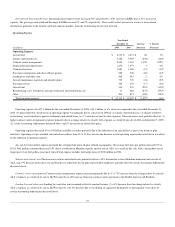

Our 2006 cash flows from operating activities also includes a $116 million decrease in our restricted cash balance primarily due to a release of cash

from restricted to operating as a result of agreements we reached with certain vendors. In 2005, our restricted cash balance increased significantly primarily

due to cash holdbacks associated with our Visa/MasterCard credit card processing agreement. For the year ended December 31, 2006, we classified changes

to our restricted cash balances primarily associated with credit card holdbacks to cash flows from operating activities to better reflect the nature of restricted

cash activities. Prior to 2006, we presented such changes as an investing activity. For additional information regarding this reclassification, see Note 2 of the

Notes to the Consolidated Financial Statements.

Cash flows from investing activities

Cash used in investing activities totaled $361 million for the year ended December 31, 2006, compared to cash provided by investing activities of $22

million for the year ended December 31, 2005. This change reflects a $401 million decrease in cash used for the purchase of flight and ground equipment in

2006. Our 2005 cash flows from investing activities also includes $842 million in proceeds from our sale of ASA and certain flight equipment.

Cash provided by investing activities totaled $22 million for the year ended December 31, 2005, compared to cash used in investing activities of $320

million for the year ended December 31, 2004. This change reflects $570 million of flight equipment additions in 2005, including $417 million we paid to

purchase 11 B-737-800 aircraft that we sold to a third party immediately after these aircraft were delivered to us by the manufacturer. Our 2005 cash flows

from investing activities also include $842 million in proceeds from our sale of ASA and certain flight equipment discussed above.

Cash flows from financing activities

Cash used in financing activities totaled $606 million for the year ended December 31, 2006, compared to cash provided by financing activities of $830

million for the year ended December 31, 2005. This change is primarily due to the net proceeds we received under our Secured Super-Priority Debtor-In-

Possession Credit Agreement (the “DIP Credit Facility”) shortly after our Chapter 11 filing in 2005. As a result of our Chapter 11 filing, we ceased making

payments on our unsecured debt. For additional information regarding our Chapter 11 proceedings and long-term debt, see Notes 1 and 6, respectively, of the

Notes to the Consolidated Financial Statements.

Cash provided by financing activities totaled $830 million and $636 million for the years ended December 31, 2005 and 2004, respectively. This change

is primarily attributable to the net proceeds we received under our DIP Credit Facility as discussed above compared to the net proceeds we received in 2004 in

connection with newly entered or amended financing arrangements in the aggregate amount of $1.8 billion and the issuance of 2⅞% Convertible Senior Notes

due 2024 in the amount of $325 million. As discussed above, after filing for bankruptcy, we ceased making payments on our unsecured debt.

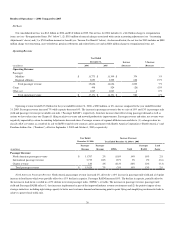

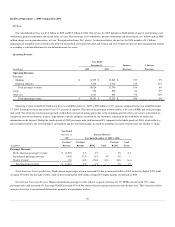

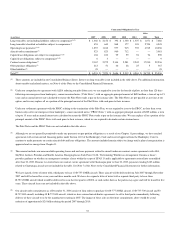

Contractual Obligations

The following table summarizes our contractual obligations as of December 31, 2006 that relate to debt; operating leases; aircraft order commitments;

capital leases; contract carrier obligations; other material, noncancelable purchase obligations; and other liabilities. We are in the process of evaluating our

executory contracts in order to determine which contracts will be assumed in our Chapter 11 proceedings. Therefore, obligations as currently quantified in the

table below and in the text immediately following the footnotes to the table will continue to change. The table below does not include contracts that we have

successfully rejected through our Chapter 11 proceedings. The table also does not include commitments that are contingent on events or other factors that are

uncertain or unknown at this time, some of which are discussed in footnotes to this table and in the text immediately following the footnotes.

34