Delta Airlines 2006 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2006 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

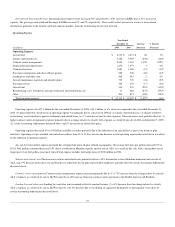

•Capturing the Benefit of Competitive Cost Structure. Through initiatives undertaken during the Chapter 11 proceedings and previous

productivity initiatives, we currently have one of the lowest mainline unit cost structures of any full service carrier. These efforts have resulted in

reduced costs throughout our organization, including reductions in employment costs, retiree pensionand healthcare costs and aircraft fleet costs.

We recognize that, to succeed, we must maintain the competitive unit cost structure that we developed through our restructuring efforts.

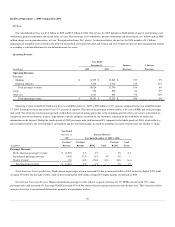

•Generating Cash Flow from Operations Necessary to Fund Capital Expenditures and Reduce Debt.Over an extended period following

emergence from Chapter 11, we intend to balance long-term operating growth with overall credit improvement. At emergence from bankruptcy,

we expectto have significantly reduced our total debt from pre-petition levels. Ongoing improvements to our financial condition are, however,

necessary for us to withstand industry and economic volatility and to have favorable, consistent access to capital markets.

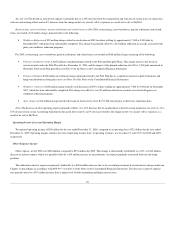

Unsolicited Merger Proposal

On November 15, 2006, US Airways Group, Inc. (“US Airways”) publicly announced an unsolicited proposal to engage in a merger transaction with us

(the “US Airways Proposal”).

Under the original US Airways Proposal, the holders of unsecured claims in our bankruptcy cases would have received $4.0 billion in cash and 78.5

million shares of US Airways common stock. In addition, US Airways contemplated that our debtor-in-possession financing agreements and all other allowed

secured claims and administrative claims in our bankruptcy cases would be assumed or paid in full. The US Airways Proposal was conditioned on satisfactory

completion of a due diligence investigation on us, the Bankruptcy Court’s approval of a mutually agreeable plan of reorganization predicated upon a merger,

regulatory approvals and approval by the shareholders of US Airways.

On December 15, 2006, our Board of Directors unanimously determined that the US Airways Proposal was inadequate, presented unacceptably high risk

that it could not be consummated in the manner suggested by US Airways, was not in our best interests or in the best interests of our creditors, as well as our

other stakeholders, and rejected the US Airways Proposal. The Board of Directors also determined that our interest and that of our creditors would be best

served if we proceeded with filing the Plan, together with the Disclosure Statement, with the Bankruptcy Court. This decision by our Board of Directors was

made after careful consideration and extensive review and consultation with its legal and financial advisors.

On January 10, 2007, US Airways increased its offer to merge with us and set forth a revised proposal (the “Revised US Airways Proposal”) under

which the holders of our unsecured claims would have received $5.0 billion in cash and 89.5 million shares of US Airways common stock. US Airways said

that the Revised US Airways Proposal would expire on February 1, 2007 unless, prior to that date, there was affirmative creditor support for the

commencement of due diligence, the required filings under the Hart-Scott-Rodino Antitrust Improvements Act had been made and the hearing on the

Disclosure Statement scheduled for February 7, 2007 had been adjourned.

On January 31, 2007, the Creditors Committee announced support for our standalone Plan of Reorganization. The Creditors Committee said that it had

considered various factors, including the risks associated with, and the likelihood of a successful consummation of, the Revised US Airways Proposal and the

Plan in reaching its conclusion in favor of the standalone Plan of Reorganization. Following this announcement, US Airways withdrew its proposal.

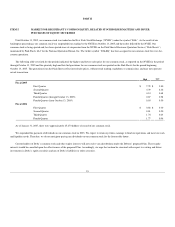

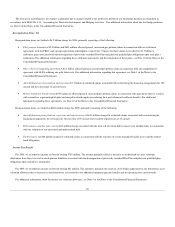

Basis of Presentation of Consolidated Financial Statements

Our Consolidated Financial Statements have been prepared on a going concern basis in accordance with accounting principles generally accepted in the

United States of America (“GAAP”), including the provisions of American Institute of Certified Public Accountants’ Statement of Position 90-7, “Financial

Reporting by Entities in Reorganization Under the Bankruptcy Code” (“SOP 90-7”). This contemplates the realization of assets and satisfaction of liabilities

in the ordinary course of business. Accordingly, our Consolidated Financial Statements do not include any adjustments relating to the recoverability of assets

and classification of liabilities that might be necessary should we be unable to continue as a going concern.

24