Delta Airlines 2006 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2006 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

Revenue Recognition

Passenger Revenue

We record sales of passenger tickets as air traffic liabilities on our Consolidated Balance Sheets. Passenger revenue is recognized when we provide

transportation or when the ticket expires unused, reducing the related air traffic liability. We periodically evaluate the estimated air traffic liability and record

any resulting adjustments in our Consolidated Statements of Operations in the period in which the evaluations are completed. These adjustments relate

primarily to refunds, exchanges, transactions with other airlines and other items for which final settlement occurs in periods subsequent to the sale of the

related tickets at amounts other than the original sales price.

We are required to charge certain taxes and fees on our passenger tickets. These taxes and fees include U.S. federal transportation taxes, federal security

charges, airport passenger facility charges and foreign arrival and departure taxes. These taxes and fees are legal assessments on the customer. We have an

obligation to act as a collection agent. As we are not entitled to retain these taxes and fees, we do not include such amounts in passenger revenue. We record a

liability when the amounts are collected and reduce the liability when payments are made to the applicable government agency or operating carrier.

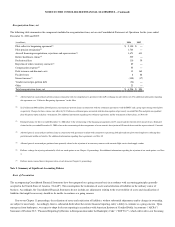

We sell mileage credits in our SkyMiles frequent flyer program to participating companies such as credit card companies, hotels and car rental agencies.

The portion of the revenue from the sale of mileage credits that approximates the fair value of travel to be provided is deferred and recognized as passenger

revenue over the period when transportation is expected to be provided. Amounts received in excess of the transportation’s fair value are recognized in

income currently and classified as other revenue. A change in assumptions as to the period over which the mileage credits are expected to be used (currently

15 to 41 months), the actual redemption activity for mileage credits or our estimate of the fair value of transportation expected to be provided could have a

material impact on our revenue in the year in which the change occurs and in future years.

Under our contract carrier agreements with six regional air carriers (see Note 8), we purchase all or a portion of their capacity and are responsible for

selling the seat inventory we purchase. We record revenue and expenses related to our contract carrier agreements as regional affiliates passenger revenue and

contract carrier agreements, respectively.

Cargo Revenue

Cargo revenue is recognized in our Consolidated Statements of Operations when we provide the transportation.

Other, net

Other, net revenue includes revenue from (1) a portion of the sale of mileage credits in our SkyMiles frequent flyer program, discussed above, (2)

codeshare agreements with certain airlines and (3) other miscellaneous service revenue. Under our codeshare agreements, we sell seats on other airlines’

flights and other airlines sell seats on our flights, with each airline separately marketing its respective seats. Our revenue from other airlines’ sale of codeshare

seats on our flights is recorded in passenger revenue on our Consolidated Statement of Operations.

Long-Lived Assets

We record property and equipment at cost and depreciate or amortize these assets on a straight-line basis to their estimated residual values over their

respective estimated useful lives. Residual values for flight equipment are generally 5% of cost except when guaranteed by a third party for a different

amount. We also capitalize certain internal and external costs incurred to develop internal-use software. For the years ended December 31, 2006 and 2005, we

recorded $109 million and $101 million, respectively, for amortization for long-lived assets. The net book value of these assets totaled $252 million and $288

million at December 31, 2006 and 2005, respectively, and is included in ground property and equipment, net on our Consolidated Balance Sheets. The

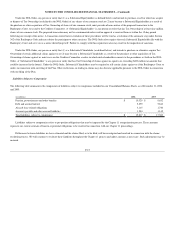

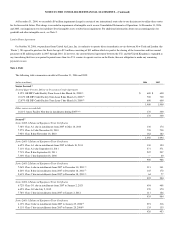

estimated useful lives for major asset classifications are as follows:

Asset Classification Estimated Useful Life

Flight equipment 25 years

Capitalized software 5-7 years

Ground property and equipment 3-40 years

Leasehold improvements

Generally shorter of lease term or

estimated useful life

Flight and ground equipment under capital lease Shorter of lease term or estimated useful

life