Delta Airlines 2006 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2006 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

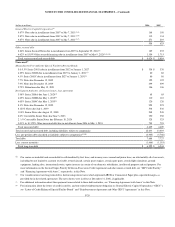

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

Unless the GECC letters of credit are extended in a timely manner, we will be required to purchase the Bonds on July 2, 2011, five calendar days prior to

the expiration of the letters of credit. In this circumstance, we could seek, but there is no assurance that we would be able (1) to sell the Bonds without credit

enhancement at then-prevailing fixed interest rates or (2) to replace the expiring letters of credit with new letters of credit from an alternate credit provider and

remarket the Bonds.

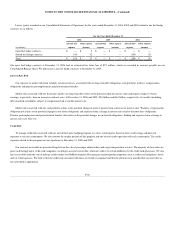

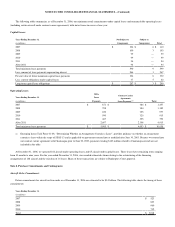

Reimbursement Agreement and Other GECC Agreements

Under the Reimbursement Agreement between us and GECC, we are required to reimburse GECC for drawings on the letters of credit that support the

Bonds. Prior to the Amendments (as defined below), our reimbursement obligations to GECC were secured by (1) nine B-767-400 and three B-777-200

aircraft (“LOC Aircraft Collateral”), (2) 93 spare Mainline aircraft engines (“Engine Collateral”) and (3) a portion of the Mainline aircraft spare parts owned

by us (“Spare Parts Collateral”), as discussed below.

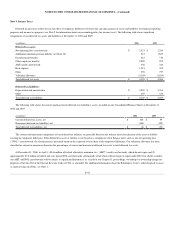

We have three additional financing arrangements with GECC (other than the Amended and Restated DIP Credit Facility), as referenced in the footnotes

to the table above in this Note. Prior to the Amendments, the Spare Engines Loan was secured by (1) the Engine Collateral, (2) so long as the letters of credit

discussed above are outstanding, the LOC Aircraft Collateral and (3) a portion of the Spare Parts Collateral, as discussed below. The Spare Engines Loan is

not repayable at our election prior to maturity.

Prior to the Amendments, the Aircraft Loan was secured by (1) five B-767-400 aircraft (“Other Aircraft Collateral”), (2) the Engine Collateral and (3) all

Spare Parts Collateral. Also prior to the Amendments, the Spare Parts Loan was secured by (1) the Other Aircraft Collateral, (2) the Engine Collateral and (3)

the Spare Parts Collateral.

Under our prior agreement with GECC, the Spare Parts Collateral secured up to $75 million of our obligations to GECC under (1) the Reimbursement

Agreement, (2) the Spare Engines Loan and (3) 12 CRJ-200 aircraft leases. Additionally, the Engine Collateral and the Spare Parts Collateral secured, on a

subordinated basis, up to $160 million of certain other existing debt and aircraft lease obligations to GECC and its affiliates (“Subordinated GECC

Obligations”).

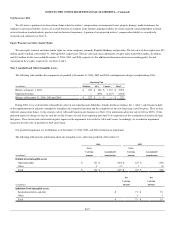

On March 31, 2006, we entered into amendments (the “Amendments”) to the Reimbursement Agreement, the Spare Engines Loan, the Aircraft Loan, the

Spare Parts Loan (these last three credit facilities will be referred to collectively as the “Other GECC Agreements”) and certain other credit facilities with

GECC (other than the Amended and Restated DIP Credit Facility).

As a result of the Amendments, the LOC Aircraft Collateral, the Spare Engines Collateral, the Spare Parts Collateral and the Other Engine Collateral

(collectively, the “Collateral Pool”) secure (1) each of the Other GECC Agreements, (2) 12 leases for CRJ-200 aircraft we previously entered into with

GECC, (3) leases of up to an additional 15 CRJ-200 aircraft pursuant to the put rights described below, (4) the Reimbursement Agreement and (5) all of the

Subordinated GECC Obligations (with no maximum amount). In addition, the expiration dates of the letters of credit issued in connection with the

Reimbursement Agreement were extended from 2008 to 2011, and the minimum collateral value test formerly in the Reimbursement Agreement was

eliminated.

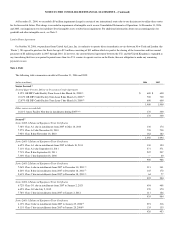

As a condition to the Amendments, we granted GECC the right, exercisable until March 30, 2007, to lease to us up to an additional 15 CRJ-200 aircraft (“put

rights”). GECC may exercise the put rights only after providing us with prior written notice, and no more than three such aircraft may be scheduled for

delivery in the same month. The leases will have terms ranging between 108 months and 172 months, as determined by GECC, and lease rates will be based

on the date of manufacture of the aircraft. We believe that the lease payments for these 15 aircraft will aggregate $215 million over the maximum 172 month

term and that the lease payments approximate current market rates. As of December 31, 2006, GECC has leased nine of these aircraft to us and we have

subleased all nine aircraft to Connection Carriers.

F-34