Delta Airlines 2006 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2006 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

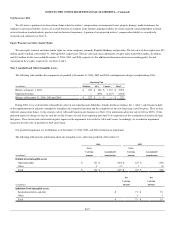

Boston Airport Terminal Project

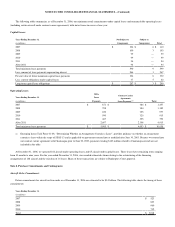

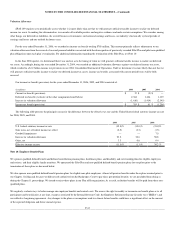

During 2001, we entered into lease and financing agreements with the Massachusetts Port Authority (“Massport”) for the redevelopment and expansion

of Terminal A at Boston’s Logan International Airport. The construction of the new terminal was funded with $498 million in proceeds from Special

Facilities Revenue Bonds issued by Massport on August 16, 2001. We agreed to pay the debt service on the bonds under an agreement with Massport and

issued a guarantee to the bond trustee covering the payment of the debt service. For additional information about these bonds, see the debt table above.

Because we have issued a guarantee of the debt service on the bonds, we have included the bonds, as well as the related bond proceeds, on our Consolidated

Balance Sheets. The bonds are reflected as liabilities subject to compromise and the related remaining proceeds, which are held in a trust, are reflected as

restricted investments in other assets on our Consolidated Balance Sheets.

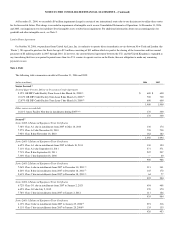

As part of our restructuring efforts, we have entered into a settlement agreement with Massport, the bond trustee and the bond insurer providing, among

other things, for a reduction in our leasehold premises, the ability to return some additional space in 2007 and 2011 and the reduction of our lease term to ten

years. The settlement agreement also provides that our obligations with respect to the bonds shall be eliminated, including the guarantee of debt service, and

that all rental payments for the leased space shall be made to Massport. On February 14, 2007, the Bankruptcy Court approved a consent motion authorizing

the settlement agreement, the assumption of the amended lease and the restructuring of related agreements.

Letter of Credit Facility Related to Visa/MasterCard Credit Card Processing Agreement

On January 26, 2006, with the authorization from the Bankruptcy Court, we entered into a letter of credit facility with Merrill Lynch. Under the Letter of

Credit Reimbursement Agreement, Merrill Lynch issued a $300 million irrevocable standby letter of credit (“Merrill Lynch Letter of Credit”) for the benefit

of our Processor. As contemplated in our Visa/MasterCard credit card processing agreement (“Processing Agreement”), we are providing the Merrill Lynch

Letter of Credit as a substitution for a portion of the cash withholding that the Processor maintains.

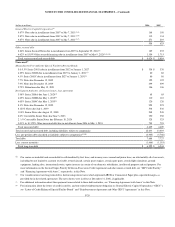

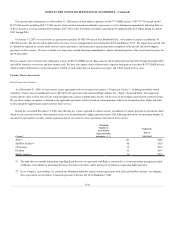

Under the Processing Agreement, the Processor is permitted to withhold a Cash Reserve that is equal to the Processor’s potential liability for tickets

purchased with Visa or MasterCard which have not yet been used for travel (the “unflown ticket liability”). We estimate that the Cash Reserve, which adjusts

daily, will range between $450 million and $1.1 billion during the term of the Processing Agreement. The Processing Agreement allows us to substitute the

Merrill Lynch Letter of Credit for a portion of the Cash Reserve equal to the lesser of $300 million and 45% of the unflown ticket liability. See Note 2 for

additional information about our reclassification of the change in Cash Reserve on our Consolidated Statements of Cash Flows.

The Merrill Lynch Letter of Credit may only be drawn upon following certain events as described in the Processing Agreement. In addition, the

Processor must first apply both the portion of the Cash Reserve that the Processor will continue to hold and any offsets from collections by the Processor

before drawing on the Merrill Lynch Letter of Credit to cover fare refunds paid to passengers by the Processor.

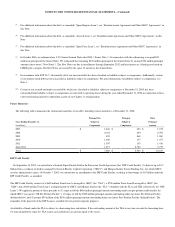

Our obligation to reimburse Merrill Lynch under the Merrill Lynch Letter of Credit for any draws made by the Processor is not secured and will

constitute a super-priority administrative expense claim that is subject to certain other claims, including our post-petition financing. The Merrill Lynch Letter

of Credit was originally due to expire on January 21, 2008. In July 2006, with the approval of the Bankruptcy Court, we amended the Merrill Lynch Letter of

Credit to, among other matters, extend the expiration date to September 14, 2008 and to reduce the fees payable by us. The Merrill Lynch Letter of Credit will

renew automatically for one-year periods after September 14, 2008 unless Merrill Lynch notifies the Processor 420 days prior to the applicable expiration date

that it will not renew the Merrill Lynch Letter of Credit.

F-35