Delta Airlines 2006 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2006 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314

|

|

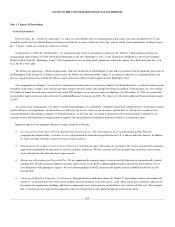

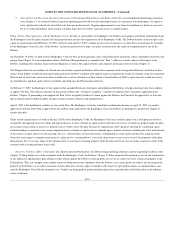

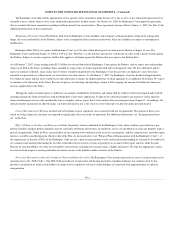

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

Under the NOL Order, any person or entity that (1) is a Substantial Equityholder (as defined below) and intends to purchase or sell or otherwise acquire

or dispose of Tax Ownership (as defined in the NOL Order) of any shares of our common stock or (2) may become a Substantial Equityholder as a result of

the purchase or other acquisition of Tax Ownership of shares of our common stock, must provide advance notice of the proposed transaction to the

Bankruptcy Court, to us and to the Creditors Committee. A “Substantial Equityholder” is any person or entity that has Tax Ownership of at least nine million

shares of our common stock. The proposed transaction may not be consummated unless written approval is received from us within the 15-day period

following our receipt of the notice. A transaction entered into in violation of these procedures will be void as a violation of the automatic stay under Section

362 of the Bankruptcy Code and may subject the participant to other sanctions. The NOL Order also requires that each Substantial Equityholder file with the

Bankruptcy Court and serve on us a notice identifying itself. Failure to comply with this requirement also may result in the imposition of sanctions.

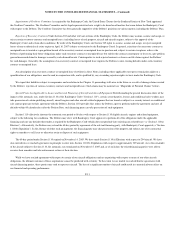

Under the NOL Order, any person or entity that (1) is a Substantial Claimholder (as defined below) and intends to purchase or otherwise acquire Tax

Ownership of certain additional claims against us or (2) may become a Substantial Claimholder as a result of the purchase or other acquisition of Tax

Ownership of claims against us, must serve on the Creditors Committee a notice in which such claimholder consents to the procedures set forth in the NOL

Order. A “Substantial Claimholder” is any person or entity that has Tax Ownership of claims against us equal to or exceeding $400 million (an amount that

could be increased in the future). Under the NOL Order, Substantial Claimholders may be required to sell certain claims against us if the Bankruptcy Court so

orders in connection with our filing of the Plan. Other restrictions on trading in claims may also become applicable pursuant to the NOL Order in connection

with our filing of the Plan.

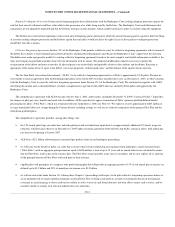

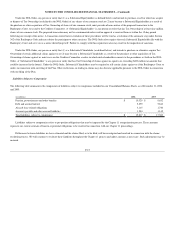

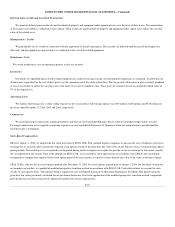

Liabilities Subject to Compromise

The following table summarizes the components of liabilities subject to compromise included on our Consolidated Balance Sheets as of December 31, 2006

and 2005:

(in millions) 2006 2005

Pension, postretirement and other benefits $ 10,329 $ 8,652

Debt and accrued interest 5,079 5,843

Aircraft lease related obligations 3,115 1,740

Accounts payable and other accrued liabilities 1,294 1,145

Total liabilities subject to compromise $ 19,817 $ 17,380

Liabilities subject to compromise refers to pre-petition obligations that may be impacted by the Chapter 11 reorganization process. These amounts

represent our current estimate of known or potential obligations to be resolved in connection with our Chapter 11 proceedings.

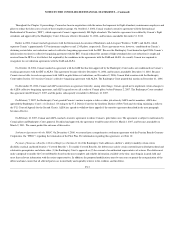

Differences between liabilities we have estimated and the claims filed, or to be filed, will be investigated and resolved in connection with the claims

resolution process. We will continue to evaluate these liabilities throughout the Chapter 11 process and adjust amounts as necessary. Such adjustments may be

material.

F-15