Delta Airlines 2006 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2006 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

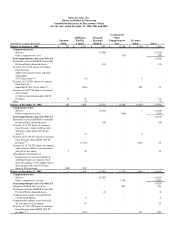

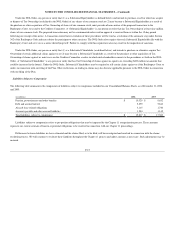

Reorganization Items, net

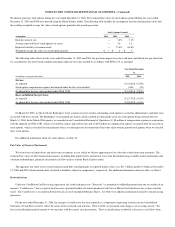

The following table summarizes the components included in reorganization items, net on our Consolidated Statements of Operations for the years ended

December 31, 2006 and 2005:

(in millions) 2006 2005

Pilot collective bargaining agreement(1) $ 2,100 $ —

Pilot pension termination(2) 1,743 —

Aircraft financing renegotiations, rejections and repossessions(3) 1,671 611

Retiree healthcare claims(4) 539 —

Professional fees 110 39

Rejection of other executory contracts(5) 89 —

Compensation expense(6) 55 —

Debt issuance and discount costs 13 163

Facility leases 8 88

Interest income(7) (109) (17)

Vendor waived pre-petition debt (36) —

Other 23 —

Total reorganization items, net $ 6,206 $ 884

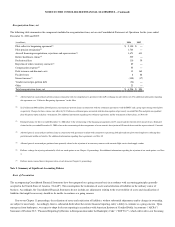

(1) Allowed general, unsecured pre-petition claim in connection with our comprehensive agreement with ALPA reducing our pilot labor costs. For additional information regarding

this agreement, see “Collective Bargaining Agreements” in this Note.

(2) $2.2 billion and $801 million allowed general, unsecured pre-petition claims in connection with our settlement agreements with the PBGC and a group representing retired pilots,

respectively. Charges for these claims were offset by $1.3 billion in settlement gains associated with the derecognition of previously recorded Pilot Plan and pilot non-qualified

plan obligations upon each plan’s termination. For additional information regarding our settlement agreements and the termination of these plans, see Note 10.

(3) Estimated claims for the year ended December 31, 2006 relate to the restructuring of the financing arrangements of 188 aircraft and the rejection of 16 aircraft leases. Estimated

claims for the year ended December 31, 2005 relate to the restructuring of the arrangements of seven aircraft, the rejection of 50 aircraft leases and the repossession of 15 aircraft.

(4) Allowed general, unsecured pre-petition claims in connection with agreements reached with committees representing both pilot and non-pilot retired employees reducing their

postretirement healthcare benefits. For additional information regarding these agreements, see Note 10.

(5) Allowed general, unsecured pre-petition claims primarily related to the rejection of an executory contract with our main flight service food supply vendor.

(6) Reflects a charge for rejecting substantially all of our stock options in our Chapter 11 proceedings. For additional information regarding the rejection of our stock options, see Note

2.

(7) Reflects interest earned due to the preservation of cash from our Chapter 11 proceedings.

Note 2. Summary of Significant Accounting Policies

Basis of Presentation

The accompanying Consolidated Financial Statements have been prepared on a going concern basis in accordance with accounting principles generally

accepted in the United States of America (“GAAP”). This contemplates the realization of assets and satisfaction of liabilities in the ordinary course of

business. Accordingly, the Consolidated Financial Statements do not include any adjustments relating to the recoverability of assets and classification of

liabilities that might be necessary should we be unable to continue as a going concern.

Due to our Chapter 11 proceedings, the realization of assets and satisfaction of liabilities, without substantial adjustments and/or changes in ownership,

are subject to uncertainty. Accordingly, there is substantial doubt about the current financial reporting entity’s ability to continue as a going concern. Upon

emergence from bankruptcy, we expect to adopt fresh start reporting in accordance with American Institute of Certified Public Accountants (“AICPA”)

Statement of Position 90-7, “Financial Reporting by Entities in Reorganization under the Bankruptcy Code” (“SOP 90-7”), which will result in our becoming