Delta Airlines 2006 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2006 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

Valuation Allowance

SFAS 109 requires us to periodically assess whether it is more likely than not that we will generate sufficient taxable income to realize our deferred

income tax assets. In making this determination, we consider all available positive and negative evidence and make certain assumptions. We consider, among

other things, our deferred tax liabilities, the overall business environment, our historical earnings and losses, our industry’s historically cyclical periods of

earnings and losses and our outlook for future years.

For the year ended December 31, 2006, we recorded an income tax benefit totaling $765 million. This amount primarily reflects adjustments to our

valuation allowance from the reversal of accrued pension liabilities associated with the derecognition of previously recorded Pilot Plan and pilot non-qualified

plan obligations upon each plan’s termination. For additional information regarding the termination of the Pilot Plan, see Note 10.

In the June 2004 quarter, we determined that it was unclear as to the timing of when we will generate sufficient taxable income to realize our deferred

tax assets. Accordingly, during the year ended December 31, 2004, we recorded an additional valuation allowance against our deferred income tax assets,

which resulted in a $1.2 billion income tax provision on our 2004 Consolidated Statement of Operations. Until we determine it is more likely than not that we

will generate sufficient taxable income to realize our deferred income tax assets, income tax benefits associated with current period losses will be fully

reserved.

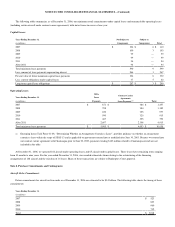

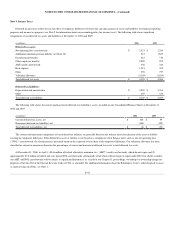

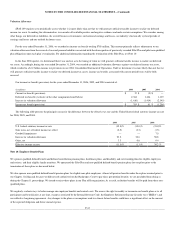

Our income tax benefit (provision) for the years ended December 31, 2006, 2005, and 2004 consisted of:

(in millions) 2006 2005 2004

Current tax benefit (provision) $ 17 $ (9) $ —

Deferred tax benefit (exclusive of the other components listed below) 2,364 1,464 1,139

Increase in valuation allowance (1,616) (1,414) (2,345)

Income tax benefit (provision) $ 765 $ 41 $ (1,206)

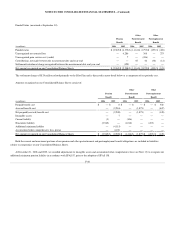

The following table presents the principal reasons for the difference between the effective tax rate and the United States federal statutory income tax rate

for 2006, 2005, and 2004:

2006 2005 2004

U.S. federal statutory income tax rate (35.0)% (35.0)% (35.0)%

State taxes, net of federal income tax effect (2.5) (3.3) (1.5)

Goodwill impairment — — 7.5

Increase in valuation allowance 23.2 36.6 58.8

Other, net 3.3 0.6 0.4

Effective income tax rate (11.0)% (1.1)% 30.2 %

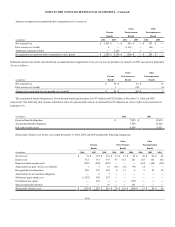

Note 10. Employee Benefit Plans

We sponsor qualified defined benefit and defined contribution pension plans, healthcare plans, and disability and survivorship plans for eligible employees

and retirees, and their eligible family members. We sponsored the Pilot Plan and non-qualified defined benefit pension plans for our pilots prior to the

termination of these plans as discussed below.

We also sponsor non-qualified defined benefit pension plans for eligible non-pilot employees. Almost all pension benefits under these plans accrued prior to

our Chapter 11 filing and, because we did not seek authority from the Bankruptcy Court to pay those pre-petition benefits, we are precluded from doing so

during the Chapter 11 proceedings. We intend to reject these plans in our Plan of Reorganization. As a result, no further benefits will be paid from these non-

qualified plans.

We regularly evaluate ways to better manage our employee benefits and control costs. We reserve the right to modify or terminate our benefit plans as to all

participants and beneficiaries at any time, except as restricted by the Internal Revenue Code, the Employee Retirement Income Security Act (“ERISA”) and

our collective bargaining agreements. Any changes to the plans or assumptions used to estimate future benefits could have a significant effect on the amount

of the reported obligation and future annual expense.

F-43