Delta Airlines 2006 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2006 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

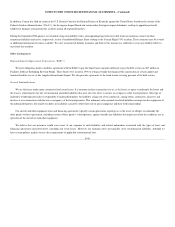

Some of the other significant terms of the PBGC Settlement Agreement include:

•as of the date we emerge from Chapter 11, the PBGC has agreed to irrevocably waive its rights to restore the Pilot Plan in full or in part;

•we have agreed not to establish any new qualified defined benefit plans for pilots for a period of five years after we emerge from Chapter 11;

•the parties agree to take steps to protect our net operating loss carryforward tax benefits;

•absent extraordinary unanticipated circumstances we will (a) elect the alternative funding schedule under section 402(a)(1) of the pension reform

legislation (“Pension Protection Act”) with respect to the qualified defined benefit pension plan for non-pilot employees (“Non-pilot Plan”); (b) not

seek a distress termination of the Non-pilot Plan; and (c) provide in our reorganization plan that we shall continue the Non-pilot Plan; and

•we confirmed our previously stated intention reached independently of the PBGC Settlement Agreement that we would make a contribution to the

Non-Pilot Plan of not less than $50 million minus any amounts contributed to such plan subsequent to our election of Airline Relief under the

Pension Protection Act and prior to our emergence from Chapter 11.

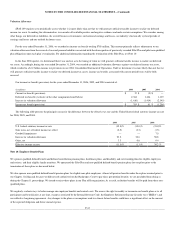

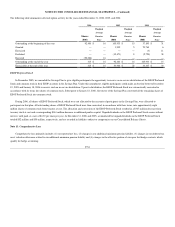

Consistent with the ALPA Agreement, we also terminated the pilot non-qualified plans as of September 2, 2006. As a result of the termination of the

non-qualified plans, retired pilots who were receiving non-qualified benefits received an $801 million allowed general, unsecured pre-petition claim and a $9

million administrative claim. As a result of the termination of both the Pilot Plan and the non-qualified plans, we recorded a settlement gain of $1.3 billion in

reorganization items, net, derecognizing the accrued pension liability and reversed the related $2.2 billion additional minimum liability to other

comprehensive loss. Additionally, the $2.2 billion claim for the PBGC and the $810 million in total claims for the retired pilots were recorded in

reorganization items, net with a corresponding offset in liabilities subject to compromise. The $3.5 billion reversal of the pension liability and the recording of

the $3.0 billion in claims resulted in a net reduction of $490 million in liabilities subject to compromise.

Claims associated with changes made in the Chapter 11 reorganization and obligations related to our defined benefit plans, other postretirement benefit

plans, and certain postemployment benefits have been classified as liabilities subject to compromise, as these obligations may be impacted by our Chapter 11

proceedings. For additional information, see “Liabilities Subject to Compromise” in Note 1.

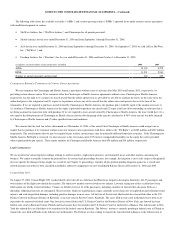

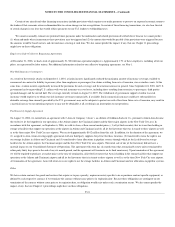

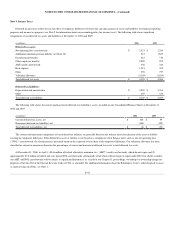

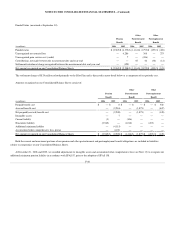

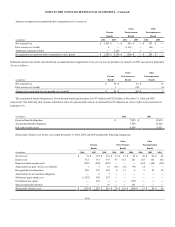

Adoption of SFAS 158

On December 31, 2006, we adopted the recognition and disclosure provisions of SFAS 158. SFAS 158 requires that we recognize the funded status of

our defined benefit pension plans, other postretirement plans, and certain of our postemployment plans on our Consolidated Balance Sheet as of December 31,

2006, with a corresponding adjustment to accumulated other comprehensive loss, net of tax. The adjustment to accumulated other comprehensive loss at

adoption represents the net unrecognized actuarial losses and unrecognized prior service costs and credits, which were previously netted against the plans’

funded status in our Consolidated Balance Sheets pursuant to the provisions of SFAS No. 87, “Employer’s Accounting for Pension” (“SFAS 87”) and SFAS

106. These amounts will be subsequently recognized as net periodic (benefit) cost pursuant to our accounting policy for amortizing such amounts. Actuarial

gains and losses that arise in subsequent periods and are not recognized as net periodic (benefit) cost in the same periods will be recognized as a component of

other comprehensive loss. These gains and losses will be subsequently recognized as a component of net periodic (benefit) cost on the same basis as the

amounts recognized in accumulated other comprehensive loss at adoption of SFAS 158.

F-45