Delta Airlines 2006 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2006 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

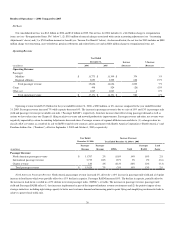

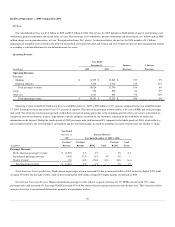

On January 31, 2007, we entered into an agreement to acquire 30 CRJ-900 aircraft from Bombardier Inc., with options to acquire an additional 30

CRJ-900 aircraft. The aircraft will be delivered in two-class, 76 seat configuration between September 2007 and February 2010. We expect these aircraft

will be operated by regional air carriers under contract carrier agreements, and the purchase agreement permits assignment of the aircraft and related

support provisions to other carriers. We have available to us long-term, secured financing commitments to fund a substantial portion of the aircraft

purchase price for the 30 firm orders. These aircraft order commitments are not included in the table above.

(6) Interest payments related to capital lease obligations are included in the table. The present value of these obligations, excluding interest, is included on

our Consolidated Balance Sheets. For additional information about our capital lease obligations, see Note 7 of the Notes to the Consolidated Financial

Statements.

(7) This amount represents our minimum fixed obligation under our contract carrier agreements with Chautauqua, Shuttle America, ASA, SkyWest Airlines,

and Freedom (excluding contract carrier lease payments accounted for as operating leases, (see footnote (4) above)). For additional information

regarding our contract carrier agreements, see Note 8 of the Notes to the Consolidated Financial Statements.

(8) Includes purchase obligations pursuant to which we are required to make minimum payments for goods and services, including but not limited to

insurance, outsourced human resource services, marketing, maintenance, obligations related to Comair, technology, and other third party services and

products. For additional information about other commitments and contingencies, see Note 8 of the Notes to the Consolidated Financial Statements.

(9) Represents other liabilities on our Consolidated Balance Sheets for which we are obligated to make future payments related to medical benefit costs

incurred but not yet paid. These liabilities are not included in any other line item on this table.

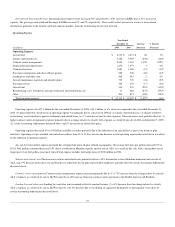

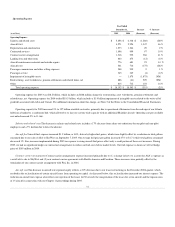

(10) In addition to the contractual obligations included in the table, we have significant cash obligations that are not included in the table. For example, we

will pay wages required under collective bargaining agreements; fund pension plans (as discussed below); purchase capacity under contract carrier

arrangements (as discussed below); and pay credit card processing fees and fees for other goods and services, including those related to fuel,

maintenance and commissions. While we are parties to legally binding contracts regarding these goods and services, the actual commitment is contingent

on certain factors such as volume and/or variable rates that are uncertain or unknown at this time. Therefore, these items are not included in the table. In

addition, purchase orders made in the ordinary course of business are excluded from the table and any amounts which we are liable for under the

purchase orders are included in current liabilities on our Consolidated Balance Sheets.

The following items are not included in the table above:

Pension Plans.We sponsor qualified defined contribution and defined benefit pension plans for eligible employees and retirees. Our funding obligations

for these plans are governed by the Employee Retirement Income Security Act of 1974 (“ERISA”). Estimates of pension plan funding requirements can vary

materially from actual funding requirements because the estimates are based on various assumptions, including those described below.

Defined Contribution Pension Plans (“DC Plans”). During the year ended December 31, 2006, we contributed approximately $110 million to our DC

Plans. Estimates of future funding requirements under our DC Plans are not reasonably estimable at this time. Under our comprehensive agreement with

ALPA reducing our pilot labor costs, ALPA received, among other things, a $2.1 billion allowed general, unsecured pre-petition claim in our bankruptcy

proceedings. The proceeds of this claim will be distributed to pilot accounts under the Delta Family-Care Savings Plan to the extent permitted by the Internal

Revenue Code, thereby reducing the amount we can contribute under the Internal Revenue Code to the DC Plan for pilots in 2007. In addition, we intend to

implement changes to our DC Plan for non-pilot employees following our exit from bankruptcy but the design of these plan changes has not yet been

finalized.

Defined Benefit Pension Plans (“DB Plans”). During the year ended December 31, 2006, we contributed approximately $4 million to our DB Plans.

Under our settlement agreement with the PBGC, the Pilot Plan was terminated effective September 2, 2006, and we agreed to initiate, prior to our emergence

from Chapter 11, a standard termination of a separate frozen qualified defined benefit pension plan for certain pilots formerly employed by Western Air Lines.

In addition, our non-qualified defined benefit pension plans for pilots were terminated effective September 2, 2006.

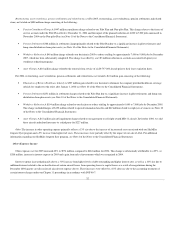

Effective December 31, 2005, future pay and service accruals under the Non-pilot Plan were frozen. The Pension Preservation Act of 2006 allows us to

reduce the funding obligations for the Non-pilot Plan over the next several years. As a result of this legislation, we intend to maintain the Non-pilot Plan.

While this legislation makes our funding obligations for the Non-pilot Plan more predictable, factors outside our control will continue to have an impact on

the funding requirements for that plan.

36