Delta Airlines 2006 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2006 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

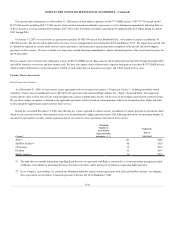

With certain exceptions, the Amex Post-Petition Facility contains affirmative, negative and financial covenants substantially the same as in the DIP

Credit Facility. The Amex Post-Petition Facility contains customary events of default, including cross-defaults to our obligations under the DIP Credit Facility

and to defaults under certain other of our agreements with Amex. The Amex Post-Petition Facility also includes events of default specific to our business,

including upon cessation of 50% or more of our business operations (measured by net revenue) and other events of default comparable to those in the DIP

Credit Facility. Upon the occurrence of an event of default under the Amex Post-Petition Facility, the loan under the Amex Post-Petition Facility may be

accelerated and become due and payable immediately. An event of default under the Amex Post-Petition Facility results in an immediate cross-default under

the Amended and Restated DIP Credit Facility.

In connection with the Amended and Restated DIP Credit Facility, we executed a conforming amendment and restatement of the Amex Post-Petition Facility.

The financial covenants, collateral, guarantees, maturity dates and events of default are not changed by the amendment and restatement. As of the date of

effectiveness of the Amended and Restated DIP Credit Facility, to which Amex consented, the fee on outstanding advances under the Amex Post-Petition

Facility decreased to a rate of LIBOR plus a margin of 8.75%.

On August 31, 2006, we entered into an amendment to the Amex Post-Petition Facility that authorized us to consummate a fuel inventory supply agreement

(see Note 8).

The Amended and Restated DIP Credit Facility and the Amex Post-Petition Facility are subject to an intercreditor agreement that generally regulates the

respective rights and priorities of the lenders under each facility with respect to collateral and certain other matters.

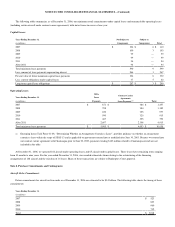

Letter of Credit Enhanced Special Facility Bonds

At December 31, 2006, there were outstanding $381 million aggregate principal amount of tax exempt special facility bonds (“Bonds”) enhanced by

letters of credit, including:

• $295 million principal amount of bonds issued by the Development Authority of Clayton County (“Clayton Authority”) to refinance the

construction cost of certain facilities leased to us at Hartsfield-Jackson Atlanta International Airport. We pay debt service on these bonds pursuant

to loan agreements between us and the Clayton Authority.

• $86 million principal amount of bonds issued by other municipalities to refinance the construction cost of certain facilities leased to us at

Cincinnati/Northern Kentucky International Airport and Salt Lake City International Airport. We pay debt service on these bonds pursuant to long-

term lease agreements.

The Bonds (1) have scheduled maturities between 2029 and 2035, (2) currently bear interest at a variable rate that is determined weekly and (3) may be

tendered for purchase by their holders on seven days notice. Tendered Bonds are remarketed at prevailing interest rates.

Principal and interest on the Bonds are currently paid through drawings on irrevocable, direct-pay letters of credit currently totaling $387 million issued

by GECC pursuant to the Reimbursement Agreement. In addition, if tendered Bonds cannot be remarketed, the purchase price is paid by drawings on these

letters of credit. The GECC letters of credit were originally scheduled to expire on May 20, 2008. Pursuant to the Amendments (defined below), the GECC

letters of credit will now expire on July 7, 2011. The GECC letters of credit were originally issued in the amount of $403 million, but a draw on one of the

letters of credit paid off approximately $16 million in special facility bonds related to a Tampa maintenance base when we rejected the lease for this facility in

June 2006 to streamline our maintenance operations and obtain other cost savings.

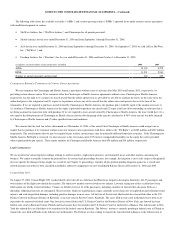

If a drawing under a letter of credit is made to pay the purchase price of Bonds tendered for purchase and not remarketed, our resulting reimbursement

obligation to GECC will bear interest at a base rate or three-month LIBOR plus a margin. The principal amount of any outstanding reimbursement obligation

will be repaid quarterly through July 7, 2011. Our obligation to reimburse GECC for the drawing on the letter of credit that secured the Tampa maintenance

base special facility bonds is on these terms as well.

F-33