Delta Airlines 2006 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2006 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

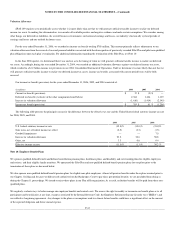

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

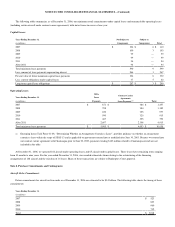

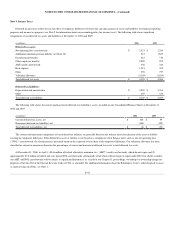

The following table shows the available seat miles (“ASMs”) and revenue passenger miles (“RPMs”) operated for us under contract carrier agreements

with unaffiliated regional air carriers:

•SkyWest Airlines, Inc. (“SkyWest Airlines”) and Chautauqua for all periods presented;

•Shuttle America for the year ended December 31, 2006 and from September 1 through December 31, 2005;

•ASA for the year ended December 31, 2006 and from September 8 through December 31, 2005. On September 7, 2005, we sold ASA to SkyWest,

Inc. (“SkyWest”); and

•Freedom Airlines, Inc. (“Freedom”) for the year ended December 31, 2006 and from October 1 to December 31, 2005.

(in millions, except for number of aircraft operated), unaudited 2006 2005

ASMs 15,390 8,275

RPMs 11,931 5,961

Number of aircraft operated, end of period 324 265

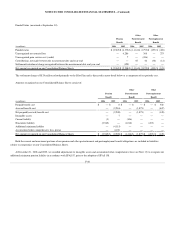

Contingencies Related to Termination of Contract Carrier Agreements

We may terminate the Chautauqua and Shuttle America agreements without cause at any time after May 2010 and January 2013, respectively, by

providing certain advance notice. If we terminate either the Chautauqua or Shuttle America agreements without cause, Chautauqua or Shuttle America,

respectively, has the right to (1) assign to us leased aircraft that the airline operates for us, provided we are able to continue the leases on the same terms the

airline had prior to the assignment and (2) require us to purchase or lease any of the aircraft that the airline owns and operates for us at the time of the

termination. If we are required to purchase aircraft owned by Chautauqua or Shuttle America, the purchase price would be equal to the amount necessary to

(1) reimburse Chautauqua or Shuttle America for the equity it provided to purchase the aircraft and (2) repay in full any debt outstanding at such time that is

not being assumed in connection with such purchase. If we are required to lease aircraft owned by Chautauqua or Shuttle America, the lease would have (1) a

rate equal to the debt payments of Chautauqua or Shuttle America for the debt financing of the aircraft calculated as if 90% of the aircraft was debt financed

by Chautauqua or Shuttle America and (2) other specified terms and conditions.

We estimate that the total fair values, determined as of December 31, 2006, of the aircraft that Chautauqua or Shuttle America could assign to us or

require that we purchase if we terminate without cause our contract carrier agreements with those airlines (the “Put Right”) are $483 million and $367 million,

respectively. The actual amount that we may be required to pay in these circumstances may be materially different from these estimates. If the Chautauqua or

Shuttle America Put Right is exercised, we must also pay to the exercising carrier 10% interest (compounded monthly) on the equity the carrier provided

when it purchased the put aircraft. These equity amounts for Chautaqua and Shuttle America total $56 million and $34 million, respectively.

Legal Contingencies

We are involved in various legal proceedings relating to antitrust matters, employment practices, environmental issues and other matters concerning our

business. We cannot reasonably estimate the potential loss for certain legal proceedings because, for example, the litigation is in its early stages or the plaintiff

does not specify the damages being sought. As a result of our Chapter 11 proceedings, virtually all pre-petition pending litigation against us is stayed and

related amounts accrued have been classified in liabilities subject to compromise on our Consolidated Balance Sheets at December 31, 2006 and 2005.

Comair Flight 5191

On August 27, 2006, Comair Flight 5191 crashed shortly after take-off in a field near the Blue Grass Airport in Lexington, Kentucky. All 47 passengers and

two members of the flight crew died in the accident. The third crew member survived with severe injuries. Lawsuits arising out of this accident have been

filed against our wholly owned subsidiary, Comair, on behalf of at least 36 of the passengers, including a number of lawsuits that also name Delta as a

defendant. Additional lawsuits are anticipated. These lawsuits, which are in preliminary stages, generally assert claims for wrongful death and related personal

injuries, and seek unspecified damages, including punitive damages in most cases. All but four of the lawsuits filed to date have been filed either in the U.S.

District Court for the Eastern District of Kentucky, or in state court in Fayette County, Kentucky. The cases filed in state court in Kentucky have been or are

expected to be removed to federal court. One lawsuit has been filed in the U.S. District Court for the Northern District of New York, one lawsuit has been

filed in state court in Broward County, Florida and two lawsuits have been filed in the U.S. District Court for the District of Kansas. The federal court in New

York has ordered the case filed there to be transferred to the federal court in Kentucky. The Debtors’ motion is currently pending in federal court in Florida to

transfer the case filed in Florida to the federal court in Kentucky. The Debtors are also seeking to transfer the lawsuits filed in Kansas to the federal court in