Delta Airlines 2006 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2006 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

The accompanying Consolidated Financial Statements do not reflect or provide for the consequences of our Chapter 11 proceedings. In particular, the

financial statements do not show (1) as to assets, their realizable value on a liquidation basis or their availability to satisfy liabilities; (2) as to pre-petition

liabilities, the amounts that may be allowed for claims or contingencies, or their status and priority; (3) as to shareowners’ equity accounts, the effect of any

changes that may be made in our capitalization; and (4) as to operations, the effect of any changes that may be made to our business.

We have eliminated all material intercompany transactions in our Consolidated Financial Statements. We do not consolidate the financial statements of

any company in which we have an ownership interest of 50% or less unless we control that company. We did not control any company in which we had an

ownership interest of 50% or less for any period presented in our Consolidated Financial Statements.

In preparing our Consolidated Financial Statements, we applied SOP 90-7 which requires that the financial statements, for periods subsequent to the

Chapter 11 filing, distinguish transactions and events that are directly associated with the reorganization from the ongoing operations of the business.

Accordingly, certain revenues, expenses, realized gains and losses and provisions for losses that are realized or incurred in the bankruptcy proceedings are

recorded in reorganization items, net on the accompanying Consolidated Statements of Operations. In addition, pre-petition obligations that may be impacted

by the bankruptcy reorganization process have been classified as liabilities subject to compromise on our Consolidated Balance Sheets at December 31, 2006

and 2005. These liabilities are reported at the amounts expected to be allowed by the Bankruptcy Court, even if they may be settled for lesser amounts (see

Note 1).

Subject to the approval of the Bankruptcy Court or otherwise as permitted in the ordinary course of business, the Debtors may sell or otherwise dispose

of or liquidate assets or settle liabilities in amounts other than those reflected in the Consolidated Financial Statements. Further, our plan of reorganization

could materially change the amounts and classifications in our historical Consolidated Financial Statements.

Accounting Adjustments

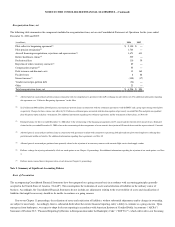

During 2006, we recorded certain out-of-period adjustments (“Accounting Adjustments”) in our Consolidated Financial Statements that are reflected in our

results for the year ended December 31, 2006. These adjustments resulted in an aggregate net noncash charge approximating $310 million to our Consolidated

Statement of Operations consisting primarily of:

•A $112 million charge in landing fees and other rents. This adjustment is associated primarily with our airport facility leases at John F. Kennedy

International Airport in New York. It resulted from historical differences associated with recording escalating rent expense based on actual rent

payments instead of on a straight-line basis over the lease term as required by Statement of Financial Accounting Standards (“SFAS”) No. 13,

“Accounting for Leases” (“SFAS 13”).

•A $108 million net charge related to the sale of mileage credits under our SkyMiles frequent flyer program. This includes an $83 million decrease

in passenger revenues, a $106 million decrease in other, net operating revenues, and an $81 million decrease in other operating expenses. This net

charge primarily resulted from the reconsideration of our position with respect to the timing of recognizing revenue associated with the sale of

mileage credits that we expect will never be redeemed for travel.

•A $90 million charge in salaries and related costs to adjust our accrual for postemployment healthcare benefits. This adjustment is due to healthcare

payments applied to this accrual over several years, which should have been expensed as incurred.

We believe the Accounting Adjustments, considered individually and in the aggregate, are not material to our Consolidated Financial Statements for

each of the years ended December 31, 2006, 2005 and 2004. In making this assessment, we considered qualitative and quantitative factors, including our

substantial net loss in each of these three years, the noncash nature of the Accounting Adjustments, our substantial shareowners’ deficit at the end of each of

these three years and our status as a debtor-in-possession under Chapter 11 of the Bankruptcy Code.

F-17