Delta Airlines 2006 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2006 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

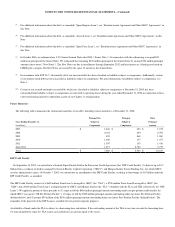

The Amended and Restated DIP Credit Facility is otherwise substantially the same as the DIP Credit Facility, including financial covenants, collateral,

guarantees, maturity date and events of default. The Amended and Restated DIP Credit Facility allowed the execution of amendments to (1) the Other GECC

Agreements (defined below) and certain other credit facilities previously entered into by us with GECC and (2) a reimbursement agreement between us and

GECC (the “Reimbursement Agreement”) related to letters of credit originally totaling $403 million which were issued on our behalf by GECC, to support

our obligations with respect to tax-exempt special facility bonds issued to refinance the construction cost of certain airport facilities leased to us. See below

for additional information about the amendments to the credit facilities and the Reimbursement Agreement.

On August 31, 2006, we entered into an amendment to the Amended and Restated DIP Credit Facility that authorized us to consummate a fuel inventory

supply agreement (see Note 8).

Financing Agreement with Amex

On September 16, 2005, we entered into an agreement (the “Modification Agreement”) with American Express Travel Related Services Company, Inc.

(“Amex”) and American Express Bank, F.S.B. pursuant to which we modified certain existing agreements with Amex, including two agreements

(collectively, the “Amex Pre-Petition Facility”) under which we had borrowed $500 million from Amex. The Amex Pre-Petition Facility consisted of

substantially identical supplements to the two existing agreements under which Amex purchases SkyMiles from us, the Membership Rewards Agreement and

the Co-Branded Credit Card Program Agreement (collectively, the “SkyMiles Agreements”). The Bankruptcy Court approved our entering into the

Modification Agreement and our assuming the SkyMiles Agreements. Amex has the right, in certain circumstances, to impose a significant holdback on our

receivables, including for tickets purchased using an American Express credit card but not yet used for travel.

As required by the Modification Agreement, on September 16, 2005, we used a portion of the proceeds of our initial borrowing under the DIP Credit

Facility to repay the principal amount of $500 million, together with interest thereon, that we had previously borrowed from Amex under the Amex Pre-

Petition Facility. Simultaneously, we borrowed $350 million from Amex pursuant to the terms of the Amex Pre-Petition Facility as modified by the

Modification Agreement (the “Amex Post-Petition Facility”). The amount borrowed under the Amex Post-Petition Facility is being repaid in equal monthly

installments, either as direct monthly payments from us or as a credit towards Amex’s actual purchases of SkyMiles during the 17-month period commencing

in July 2006. Any unused prepayment credit will carryover to the next succeeding month with a final repayment date for any then outstanding advances no

later than November 30, 2007. Prior to March 27, 2006, the outstanding advances bore a fee, equivalent to interest, at a rate of LIBOR plus a margin of

10.25%. As of the date of effectiveness of the Amended and Restated DIP Credit Facility, to which Amex consented, the fee on outstanding advances

decreased to a rate of LIBOR plus a margin of 8.75%.

On October 7, 2005, pursuant to Amendment No. 1 to the Modification Agreement (the “Amendment to the Modification Agreement”), Amex consented

to the above-described increased principal amount of the DIP Credit Facility from $1.7 billion to $1.9 billion in return for a prepayment of $50 million under

the Amex Post-Petition Facility. The prepayment was credited in inverse order of monthly installments during the 17-month period commencing in July 2006.

Our obligations under the Amex Post-Petition Facility are guaranteed by the Guarantors of the DIP Credit Facility. Our obligations under certain of our

agreements with Amex, including our obligations under the Amex Post-Petition Facility, the SkyMiles Agreements and the agreement pursuant to which

Amex processes travel and other purchases made from us using Amex credit cards (“Card Services Agreement”), and the corresponding obligations of the

Guarantors, are secured by (1) a first priority lien on our right to payment from Amex for purchased SkyMiles, our interest in the SkyMiles Agreements and

related assets and our right to payment from Amex under, and our interest in, the Card Services Agreement and (2) a junior lien on the collateral securing the

DIP Credit Facility on a first priority basis.

F-32