Delta Airlines 2006 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2006 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

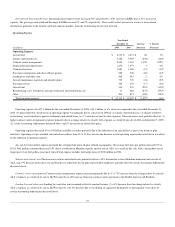

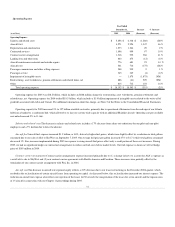

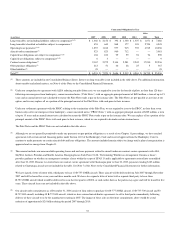

Estimates of future funding requirements for the Non-pilot Plan are based on various assumptions, including legislative changes regarding these

obligations. These assumptions also include, among other things, the actual and projected market performance of assets of the Non-pilot Plan; statutory

requirements; the terms of the Non-pilot Plan; and demographic data for participants in the Non-pilot Plan, including the number of participants and the rate

of participant attrition.

Assuming current funding rules and current plan design, we estimate that the funding requirements under the Non-pilot Plan for 2007, 2008 and 2009

will aggregate approximately $300 million.

Contract Carriers.We have long-term contract carrier agreements with the following five regional air carriers (in addition to Comair): Chautauqua,

Shuttle America, ASA, SkyWest Airlines, and Freedom. Under these agreements, the carriers operate some or all of their aircraft using our flight code, and

we schedule those aircraft, sell the seats on those flights and retain the related revenues. We pay those airlines an amount, as defined in the applicable

agreement, which is based on a determination of their cost of operating those flights and other factors intended to approximate market rates for those services.

Under these long-term contract carrier agreements, we are obligated to pay certain minimum fixed obligations, which are included in the table above.

The remaining estimated expenses are not included in the table because these expenses are contingent based on the costs associated with the operation of

contract carrier flights by those air carriers as well as rates that are unknown at this time. We cannot reasonably estimate at this time our expenses under the

contract carrier agreements in 2007 and thereafter.

We may terminate the Chautauqua and Shuttle America agreements without cause at any time after May 2010 and January 2013, respectively, by

providing certain advance notice. If we terminate either the Chautauqua or Shuttle America agreements without cause, Chautauqua or Shuttle America,

respectively, has the right to (1) assign to us leased aircraft that the airline operates for us, provided we are able to continue the leases on the same terms the

airline had prior to the assignment and (2) require us to purchase or lease any of the aircraft that the airline owns and operates for us at the time of the

termination. If we are required to purchase aircraft owned by Chautauqua or Shuttle America, the purchase price would be equal to the amount necessary to

(1) reimburse Chautauqua or Shuttle America for the equity it provided to purchase the aircraft and (2) repay in full any debt outstanding at such time that is

not being assumed in connection with such purchase. If we are required to lease aircraft owned by Chautauqua or Shuttle America, the lease would have (1) a

rate equal to the debt payments of Chautauqua or Shuttle America for the debt financing of the aircraft calculated as if 90% of the aircraft was debt financed

by Chautauqua or Shuttle America and (2) other specified terms and conditions.

We estimate that the total fair values, determined as of December 31, 2006, of the aircraft that Chautauqua or Shuttle America could assign to us or

require that we purchase if we terminate without cause our contract carrier agreements with those airlines (the “Put Right”) are $483 million and $367 million,

respectively. The actual amount that we may be required to pay in these circumstances may be materially different from these estimates. If the Chautaqua or

Shuttle America Put Right is exercised, we must also pay to the exercising carrier 10% interest (compounded monthly) on the equity the carrier provided

when it purchased the put aircraft. These equity amounts for Chautauqua and Shuttle America total $56 million and $34 million, respectively.

For additional information on contract carrier agreements see Note 8 of the Notes to the Consolidated Financial Statements.

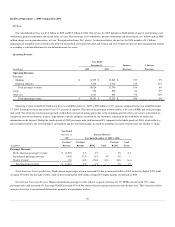

Interest and Related Payments.Estimated amounts for future interest and related payments in connection with our long-term debt obligations are based

on the fixed and variable interest rates specified in the associated debt agreements. We expect to pay $643 million related to interest on our fixed and variable

rate long-term debt not subject to compromise in 2007. Estimates on variable rate interest were calculated using implied short-term LIBOR based on LIBOR

at December 31, 2006. The related payments represent credit enhancements required in conjunction with certain financing agreements. As a result of our

Chapter 11 filing, actual interest expense in 2007 is expected to be less than the contractual interest expense. See Note 2 of the Notes to the Consolidated

Financial Statements for information about our policy relating to interest expense.

37