Delta Airlines 2005 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2005 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

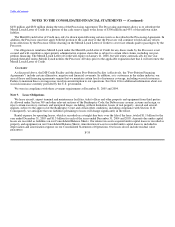

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Our obligations under the Amex Post-Petition Facility are guaranteed by the Guarantors of the DIP Credit Facility. Our obligations

under certain of our agreements with Amex, including our obligations under the Amex Post-Petition Facility, the SkyMiles

Agreements and the agreement pursuant to which Amex processes travel and other purchases made from us using Amex credit cards

("Card Services Agreement"), and the corresponding obligations of the Guarantors, are secured by (1) a first priority lien on our right

to payment from Amex for purchased SkyMiles, our interest in the SkyMiles Agreements and related assets and our right to payment

from Amex under, and our interest in, the Card Services Agreement and (2) a junior lien on the collateral securing the DIP Credit

Facility.

With certain exceptions, the Amex Post-Petition Facility contains affirmative, negative and financial covenants substantially the

same as in the DIP Credit Facility. The Amex Post-Petition Facility contains customary events of default, including cross-defaults to

our obligations under the DIP Credit Facility and to defaults under certain other of our agreements with Amex. The Amex Post-

Petition Facility also includes events of default specific to our business, including upon cessation of 50% or more of our business

operations (measured by net revenue) and other events of default comparable to those in the DIP Credit Facility. Upon the occurrence

of an event of default under the Amex Post-Petition Facility, the loan under the Amex Post-Petition Facility may be accelerated and

become due and payable immediately. An event of default under the Amex Post-Petition Facility results in an immediate cross-default

under the Amended and Restated DIP Credit Facility.

The Amended and Restated DIP Credit Facility and the Amex Post-Petition Facility are subject to an intercreditor agreement that

generally regulates the respective rights and priorities of the lenders under each Facility with respect to collateral and certain other

matters.

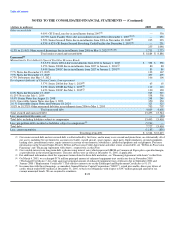

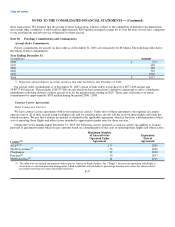

Boston Airport Terminal Project

During 2001, we entered into lease and financing agreements with the Massachusetts Port Authority ("Massport") for the

redevelopment and expansion of Terminal A at Boston's Logan International Airport. The new terminal opened in March 2005 and

has enabled us to consolidate all of our domestic operations at that airport into one location. Project costs were funded with

$498 million in proceeds from Special Facilities Revenue Bonds issued by Massport on August 16, 2001. We agreed to pay the debt

service on the bonds under an agreement with Massport and issued a guarantee to the bond trustee covering the payment of the debt

service. For additional information about these bonds, see the debt table above. Because we have issued a guarantee of the debt service

on the bonds, we have included the bonds, as well as the related bond proceeds, on our Consolidated Balance Sheets. The bonds are

reflected as liabilities subject to compromise and the related remaining proceeds, which are held in a trust, are reflected as restricted

investments in other assets on our Consolidated Balance Sheets.

Letter of Credit Enhanced Special Facility Bonds

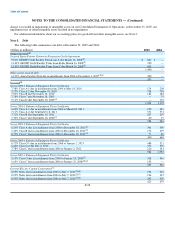

At December 31, 2005, there were outstanding $397 million aggregate principal amount of special facility bonds ("Bonds")

enhanced by letters of credit, including:

• $295 million principal amount of bonds issued by the Development Authority of Clayton County ("Clayton Authority")

to refinance the construction cost of certain facilities leased to us at Hartsfield-Jackson Atlanta International Airport.

We pay debt service on these bonds pursuant to loan agreements between us and the Clayton Authority.

• $102 million principal amount of bonds issued by other municipalities to refinance the construction cost of certain

facilities leased to us at Cincinnati/ Northern Kentucky International Airport, Salt Lake City International Airport and

Tampa International Airport. We pay debt service on these bonds pursuant to long-term lease agreements.

The Bonds (1) have scheduled maturities between 2029 and 2035; (2) currently bear interest at a variable rate that is determined

weekly; and (3) may be tendered for purchase by their holders on seven days notice. Tendered Bonds are remarketed at prevailing

interest rates. F-33