Delta Airlines 2005 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2005 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

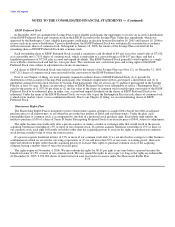

ESOP Preferred Stock

In December 2005, we amended the Savings Plan to give eligible participants the opportunity to receive an in-service distribution

of the ESOP Preferred Stock and common stock in their ESOP accounts in the Savings Plan. Under this amendment, which was

approved by the Bankruptcy Court, eligible participants could make an election between December 19, 2005 and January 18, 2006 to

receive such an in-service distribution. Upon its distribution, the ESOP Preferred Stock was automatically converted in accordance

with its terms into shares of common stock. Subsequent to January 18, 2006, the trustee of the Savings Plan converted all the

remaining shares of ESOP Preferred Stock into common stock.

Each outstanding share of ESOP Preferred Stock accrued a cumulative cash dividend of 6% per year of its stated value of $72.00;

was convertible into 1.7155 shares of common stock, which is equivalent to a conversion price of $41.97 per share; and had a

liquidation preference of $72.00, plus accrued and unpaid dividends. The ESOP Preferred Stock generally voted together as a single

class with the common stock and had two votes per share. The conversion rate, conversion price and voting rights of the ESOP

Preferred Stock were subject to adjustment in certain circumstances.

All shares of ESOP Preferred Stock were held of record by the trustee of the Savings Plan (see Note 12). At December 31, 2005,

8,007,213 shares of common stock were reserved for the conversion of the ESOP Preferred Stock.

Prior to our Chapter 11 filing, we were generally required to redeem shares of ESOP Preferred Stock (1) to provide for

distributions of the accounts of Savings Plan participants who terminate employment with us and request a distribution and (2) to

implement annual diversification elections by Savings Plan participants who are at least age 55 and have participated in the Savings

Plan for at least 10 years. In these circumstances, shares of ESOP Preferred Stock were redeemable at a price ("Redemption Price")

equal to the greater of (1) $72.00 per share or (2) the fair value of the shares of common stock issuable upon conversion of the ESOP

Preferred Stock to be redeemed, plus, in either case, accrued and unpaid dividends on the shares of ESOP Preferred Stock to be

redeemed. Under the terms of the ESOP Preferred Stock, we were able to pay the Redemption Price in cash, shares of common stock

(valued at fair market value), or in a combination thereof. Due to our Chapter 11 filing, we ceased redeeming shares of ESOP

Preferred Stock.

Shareowner Rights Plan

The Shareowner Rights Plan is designed to protect shareowners against attempts to acquire Delta that do not offer an adequate

purchase price to all shareowners, or are otherwise not in the best interest of Delta and our shareowners. Under the plan, each

outstanding share of common stock is accompanied by one-half of a preferred stock purchase right. Each whole right entitles the

holder to purchase 1/100 of a share of Series D Junior Participating Preferred Stock at an exercise price of $300, subject to adjustment.

The rights become exercisable only after a person acquires, or makes a tender or exchange offer that would result in the person

acquiring, beneficial ownership of 15% or more of our common stock. If a person acquires beneficial ownership of 15% or more of

our common stock, each right will entitle its holder (other than the acquiring person) to exercise his rights to purchase our common

stock having a market value of twice the exercise price.

If a person acquires beneficial interest of 15% or more of our common stock and (1) we are involved in a merger or other business

combination in which we are not the surviving corporation, or (2) we sell more than 50% of our assets or earning power, then each

right will entitle its holder (other than the acquiring person) to exercise their rights to purchase common stock of the acquiring

company having a market value of twice the exercise price.

The rights expire on November 4, 2006. We may redeem the rights for $0.01 per right at any time before a person becomes the

beneficial owner of 15% or more of our common stock. We may amend the rights in any respect so long as the rights are redeemable.

At December 31, 2005, 2,250,000 shares of preferred stock were reserved for issuance under the Shareowner Rights Plan.

F-53