Delta Airlines 2005 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2005 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

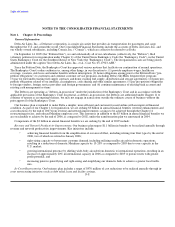

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

ascribed in the Chapter 11 proceedings to each of these constituencies or what types or amounts of distributions, if any, they would

receive. A plan of reorganization could result in holders of our liabilities and/or securities, including our common stock, receiving no

distribution on account of their interests and cancellation of their holdings. As discussed below, if the requirements of Section 1129(b)

of the Bankruptcy Code are met, a plan of reorganization can be confirmed notwithstanding its rejection by the holders of our common

stock and notwithstanding the fact that such holders do not receive or retain any property on account of their equity interests under the

plan. Because of such possibilities, the value of our liabilities and securities, including our common stock, is highly speculative. We

urge that appropriate caution be exercised with respect to existing and future investments in any of the liabilities and/or securities of

the Debtors.

Notice and Hearing Procedures for Trading in Claims and Equity Securities. The Bankruptcy Court issued a final order to assist

us in preserving our net operating losses (the "NOL Order"). The NOL Order provides for certain notice and hearing procedures

regarding trading in our common stock. It also provides a mechanism by which certain holders of claims may be required to sell some

of their holdings in connection with implementation of a plan of reorganization.

Under the NOL Order, any person or entity that (1) is a Substantial Equityholder (as defined below) and intends to purchase or sell

or otherwise acquire or dispose of Tax Ownership (as defined in the NOL Order) of any shares of our common stock, or (2) may

become a Substantial Equityholder as a result of the purchase or other acquisition of Tax Ownership of shares of our common stock,

must provide advance notice of the proposed transaction to the Bankruptcy Court, to us and to the Creditors Committee. A

"Substantial Equityholder" is any person or entity that has Tax Ownership of at least nine million shares of our common stock. The

proposed transaction may not be consummated unless written approval is received from us within the 15 day period following our

receipt of the notice. A transaction entered into in violation of these procedures will be void as a violation of the automatic stay under

Section 362 of the Bankruptcy Code and may subject the participant to other sanctions. The NOL Order also requires that each

Substantial Equityholder file with the Bankruptcy Court and serve on us a notice identifying itself. Failure to comply with this

requirement also may result in the imposition of sanctions.

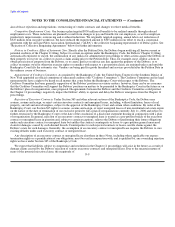

Under the NOL Order, any person or entity that (1) is a Substantial Claimholder (as defined below) and intends to purchase or

otherwise acquire Tax Ownership of certain additional claims against us, or (2) may become a Substantial Claimholder as a result of

the purchase or other acquisition of Tax Ownership of claims against us, must serve on the Creditors Committee a notice in which

such claimholder consents to the procedures set forth in the NOL Order. A "Substantial Claimholder" is any person or entity that has

Tax Ownership of claims against us equal to or exceeding $200 million (an amount that could be increased in the future). Under the

NOL Order, Substantial Claimholders may be required to sell certain claims against us if the Bankruptcy Court so orders in

connection with our filing of a plan of reorganization. Other restrictions on trading in claims may also apply following our filing of a

plan of reorganization.

Process for Plan of Reorganization. In order to successfully exit Chapter 11, the Debtors will need to propose, and obtain

confirmation by the Bankruptcy Court of, a plan of reorganization that satisfies the requirements of the Bankruptcy Code. A plan of

reorganization would, among other things, resolve the Debtors' pre-petition obligations, set forth the revised capital structure of the

newly reorganized entity and provide for corporate governance subsequent to exit from bankruptcy.

The Debtors have the exclusive right for 120 days after the Petition Date to file a plan of reorganization and, if we do so, 60

additional days to obtain necessary acceptances of our plan. The Bankruptcy Court has extended these periods until July 11, 2006 and

September 9, 2006, respectively, and these periods may be extended further by the Bankruptcy Court for cause. If the Debtors'

exclusivity period lapses, any party in interest may file a plan of reorganization for any of the Debtors. In addition to being voted on

by holders of impaired claims and equity interests, a plan of reorganization must satisfy certain requirements of the Bankruptcy Code

and must be approved, or confirmed, by the Bankruptcy Court in order to become effective. A plan of reorganization has been

accepted by holders of claims against and equity interests in the Debtors if (1) at least one-half in number and two-thirds in dollar

amount of claims actually voting in each impaired F-12