Delta Airlines 2005 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2005 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

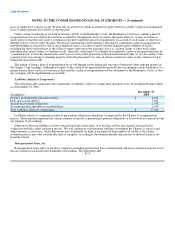

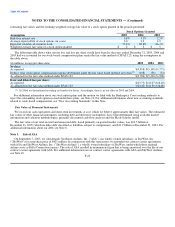

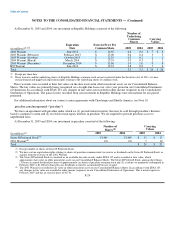

summarizes the components included in reorganization items, net on our Consolidated Statements of Operations for the year ended

December 31, 2005:

Year Ended

December 31,

(in millions) 2005

Aircraft lease rejections, renegotiations and repossessions(1)(2) $ 611

Debt issuance and discount costs(3) 163

Facility leases(2)(4) 88

Professional fees 39

Interest income (17)

Total reorganization items, net $ 884

(1) Estimated allowed claims from our rejection of the leases for 50 aircraft, the renegotiation of the leases for seven aircraft and the

repossession of 15 aircraft.

(2) We record an estimated claim associated with the rejection of an executory contract or unexpired lease when we file a motion with the

Bankruptcy Court to reject such contract or lease and believe that it is probable the motion will be approved. We record an estimated claim

associated with the renegotiation of an executory contract or unexpired lease when the renegotiated terms of such contract or lease are not

opposed or are otherwise approved by the Bankruptcy Court and there is sufficient information to estimate the claim.

(3) Reflects the write-off of certain debt issuance costs and premiums in conjunction with valuing unsecured and undersecured debt.

(4) Estimated allowed claims associated with facility leases and related bond obligations.

Claims related to reorganization items are reflected in liabilities subject to compromise in our Consolidated Balance Sheet as of

December 31, 2005.

From the Petition Date through December 31, 2005, we received approximately $15 million in interest income from the

preservation of cash, which was partially offset by payments of $6 million in professional fees related to our Chapter 11 proceedings.

Note 2. Summary of Significant Accounting Policies

Basis of Presentation

The accompanying Consolidated Financial Statements have been prepared in accordance with accounting principles generally

accepted in the United States of America ("GAAP") on a going concern basis. This contemplates the realization of assets and

satisfaction of liabilities in the ordinary course of business. Accordingly, we do not include any adjustments relating to the

recoverability of assets and classification of liabilities that might be necessary should we be unable to continue as a going concern.

As a result of sustained losses, labor issues and our Chapter 11 proceedings, the realization of assets and satisfaction of liabilities,

without substantial adjustments and/or changes in ownership, are subject to uncertainty. Given this uncertainty, there is substantial

doubt about our ability to continue as a going concern.

The accompanying Consolidated Financial Statements do not purport to reflect or provide for the consequences of our Chapter 11

proceedings. In particular, the financial statements do not purport to show (1) as to assets, their realizable value on a liquidation basis

or their availability to satisfy liabilities; (2) as to pre-petition liabilities, the amounts that may be allowed for claims or contingencies,

or the status and priority thereof; (3) as to shareowners' equity accounts, the effect of any changes that may be made in our

capitalization; or (4) as to operations, the effect of any changes that may be made to our business.

We have eliminated all material intercompany transactions in our Consolidated Financial Statements. We do not consolidate the

financial statements of any company in which we have an ownership interest of 50% or less unless we control that company. During

2005, 2004 and 2003, we did not control any company in which we had an ownership interest of 50% or less.

F-14