Delta Airlines 2005 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2005 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

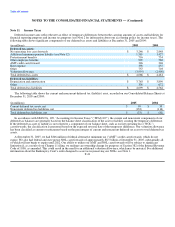

Note 11. Income Taxes

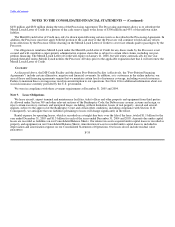

Deferred income taxes reflect the net tax effect of temporary differences between the carrying amounts of assets and liabilities for

financial reporting purposes and income tax purposes (see Note 2 for information about our accounting policy for income taxes). The

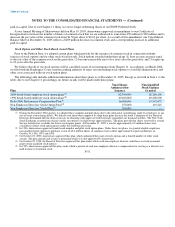

following table shows significant components of our deferred tax assets and liabilities at December 31, 2005 and 2004:

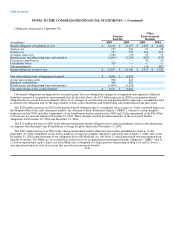

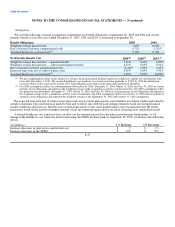

(in millions) 2005 2004

Deferred tax assets:

Net operating loss carryforwards $ 3,246 $ 2,848

Additional minimum pension liability (see Note 12) 1,565 1,427

Postretirement benefits 716 734

Other employee benefits 992 568

AMT credit carryforward 346 346

Rent expense 398 255

Other 757 703

Valuation allowance (3,954) (2,400)

Total deferred tax assets $ 4,066 $ 4,481

Deferred tax liabilities:

Depreciation and amortization $ 3,763 $ 3,890

Other 336 672

Total deferred tax liabilities $ 4,099 $ 4,562

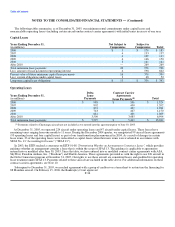

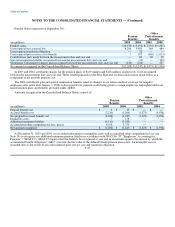

The following table shows the current and noncurrent deferred tax (liability) asset, recorded on our Consolidated Balance Sheets at

December 31, 2005 and 2004:

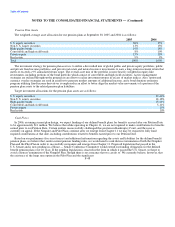

(in millions) 2005 2004

Current deferred tax assets, net $ 99 $ 35

Noncurrent deferred tax liabilities, net (132) (116)

Total deferred tax liabilities, net $ (33) $ (81)

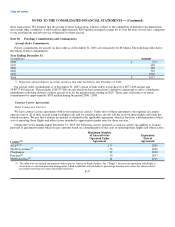

In accordance with SFAS No. 109, "Accounting for Income Taxes" ("SFAS 109"), the current and noncurrent components of our

deferred tax balances are generally based on the balance sheet classification of the asset or liability creating the temporary difference.

If the deferred tax asset or liability is not related to a component of our balance sheet, such as our net operating loss ("NOL")

carryforwards, the classification is presented based on the expected reversal date of the temporary difference. Our valuation allowance

has been classified as current or noncurrent based on the percentages of current and noncurrent deferred tax assets to total deferred tax

assets.

At December 31, 2005, we had $346 million of federal alternative minimum tax ("AMT") credit carryforwards, which do not

expire. We also had federal and state pretax NOL carryforwards of approximately $8.5 billion at December 31, 2005, substantially all

of which will not begin to expire until 2022. Our ability to utilize our AMT and NOL carryforwards will be subject to significant

limitation if, as a result of our Chapter 11 filing, we undergo an ownership change for purposes of Section 382 of the Internal Revenue

Code of 1986, as amended. This could result in the need for an additional valuation allowance, which may be material. For additional

information about the Bankruptcy Court's order designed to assist us in preserving our NOLs, see Note 1.

F-41