Delta Airlines 2005 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2005 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

obligations, there is no assurance that such efforts will be successful or that there will be no adverse effect on us or our operations.

See Notes 8 and 9 to the Notes of the Consolidated Financial Statements for further information.

Basis of Presentation of Consolidated Financial Statements

Our Consolidated Financial Statements have been prepared in accordance with accounting principles generally accepted in the

United States of America ("GAAP"), including the provisions of American Institute of Certified Public Accountants' Statement of

Position 90-7, "Financial Reporting by Entities in Reorganization Under the Bankruptcy Code" ("SOP 90-7"), on a going concern

basis. This contemplates the realization of assets and satisfaction of liabilities in the ordinary course of business. Accordingly, our

Consolidated Financial Statements do not include any adjustments relating to the recoverability of assets and classification of

liabilities that might be necessary should we be unable to continue as a going concern.

As a result of sustained losses, labor issues and our Chapter 11 proceedings, the realization of assets and satisfaction of liabilities,

without substantial adjustments and/or changes in ownership, are subject to uncertainty. Given this uncertainty, there is substantial

doubt about our ability to continue as a going concern.

The accompanying Consolidated Financial Statements do not purport to reflect or provide for the consequences of the Chapter 11

proceedings. In particular, the financial statements do not purport to show (1) as to assets, their realizable value on a liquidation basis

or their availability to satisfy liabilities; (2) as to pre-petition liabilities, the amounts that may be allowed for claims or contingencies,

or the status and priority thereof; (3) as to shareowners' equity accounts, the effect of any changes that may be made in our

capitalization; or (4) as to operations, the effect of any changes that may be made in our business.

Results of Operations — 2005 Compared to 2004

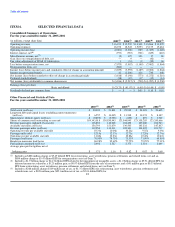

Net Loss

We recorded a consolidated net loss of $3.8 billion in 2005, compared to a consolidated net loss of $5.2 billion in 2004.

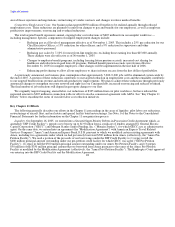

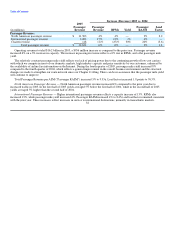

Operating Revenues

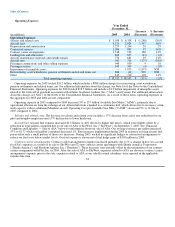

Year Ended

December 31,

Increase % Increase

(in millions) 2005 2004 (Decrease) (Decrease)

Operating Revenue:

Passenger:

Mainline $ 11,399 $ 10,880 $ 519 5%

Regional affiliates 3,225 2,910 315 11%

Total passenger revenue 14,624 13,790 834 6%

Cargo 524 500 24 5%

Other, net 1,043 945 98 10%

Total operating revenue $ 16,191 $ 15,235 $ 956 6%

31