Delta Airlines 2005 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2005 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

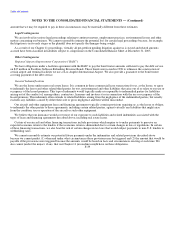

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

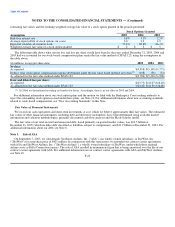

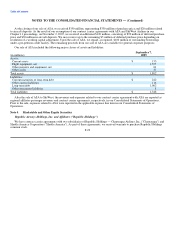

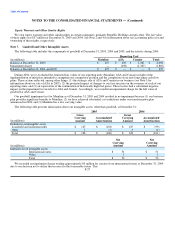

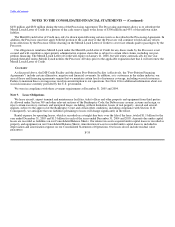

(dollars in millions) 2005 2004

Other secured debt

9.00% GE Term Loan due in installments during 2007(2) — 330

10.75% Amex Facility Notes due in installments from 2006 to December 1, 2007(2)(3) — 250

9.50% Senior Secured Notes due in installments from 2006 to November 18, 2008(9) 235 235

6.33%-6.42% GE Senior Secured Revolving Credit Facility due December 1, 2007(2) — 231

235 1,046

4.13% to 15.46% Other secured financings due in installments from 2006 to May 9, 2021(2)(9)(10) 1,715 2,773

Total senior secured and secured debt $ 8,884 $ 8,886

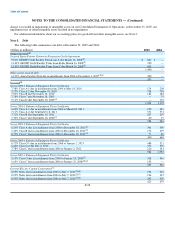

Unsecured(9)

Massachusetts Port Authority Special Facilities Revenue Bonds

5.0-5.5% Series 2001A due in installments from 2012 to January 1, 2027 $ 338 $ 338

3.35% Series 2001B due in installments from 2027 to January 1, 2031(2) 80 80

3.44% Series 2001C due in installments from 2027 to January 1, 2031(2) 80 80

7.7% Notes due December 15, 2005 122 167

7.9% Notes due December 15, 2009 499 499

9.75% Debentures due May 15, 2021 106 106

Development Authority of Clayton County, loan agreement

3.57% Series 2000A due June 1, 2029(2) 65 65

3.63% Series 2000B due May 1, 2035(2) 110 110

3.63% Series 2000C due May 1, 2035(2) 120 120

8.3% Notes due December 15, 2029 925 925

8.125% Notes due July 1, 2039 538 538

10.0% Senior Notes due August 15, 2008 248 248

8.0% Convertible Senior Notes due June 3, 2023 350 350

27/8 % Convertible Senior Notes due February 18, 2024 325 325

3.01% to 10.375% Other unsecured debt due in installments from 2006 to May 1, 2033 703 707

Total unsecured debt 4,609 4,658

Total secured and unsecured debt 13,493 13,544

Less: unamortized discounts, net — (94)

Total debt, including liabilities subject to compromise 13,493 13,450

Less: pre-petition debt classified as liabilities subject to compromise(9) (5,766) —

Total debt 7,727 13,450

Less: current maturities (1,183) (835)

Total long-term debt $ 6,544 $ 12,615

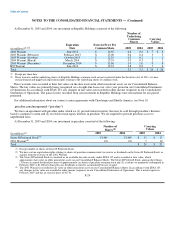

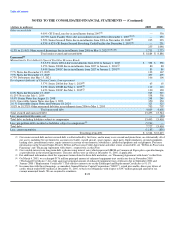

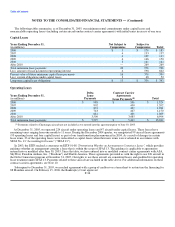

(1) Our senior secured debt and our secured debt is collateralized by first liens, and in many cases second and junior liens, on substantially all of

our assets, including but not limited to accounts receivable, owned aircraft, spare engines, spare parts, flight simulators, ground equipment,

landing slots, international routes, equity interests in certain of our domestic subsidiaries, intellectual property and real property. For more

information on the Secured Super-Priority Debtor-in-Possession Credit Agreement and other senior secured debt, see "Debtor-in-Possession

Financing" and "Financing Agreement with Amex", respectively, in this Note.

(2) Our variable interest rate long-term debt is shown using interest rates which represent LIBOR or Commercial Paper plus a specified margin,

as provided for in the related agreements. The rates shown were in effect at December 31, 2005, if applicable.

(3) For additional information about the repayment terms related to these debt maturities, see "Financing Agreement with Amex" in this Note.

(4) On March 4, 2005, we exchanged $176 million principal amount of enhanced equipment trust certificates due in November 2005

("Exchanged Certificates") for a like aggregate principal amount of enhanced equipment trust certificates due in September 2006 and

January 2008 ("Replacement Certificates"). The effective interest rate on the Exchanged and Replacement Certificates is 9.11%.

(5) In connection with these financings, as amended, General Electric Capital Corporation ("GECC") issued irrevocable, direct-pay letters of

credit, which totaled $403 million at December 31, 2005, to back our obligations with respect to $397 million principal amount of tax

exempt municipal bonds. We are required to reimburse F-29