Delta Airlines 2005 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2005 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

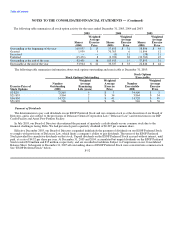

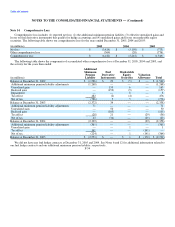

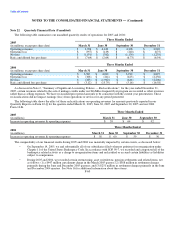

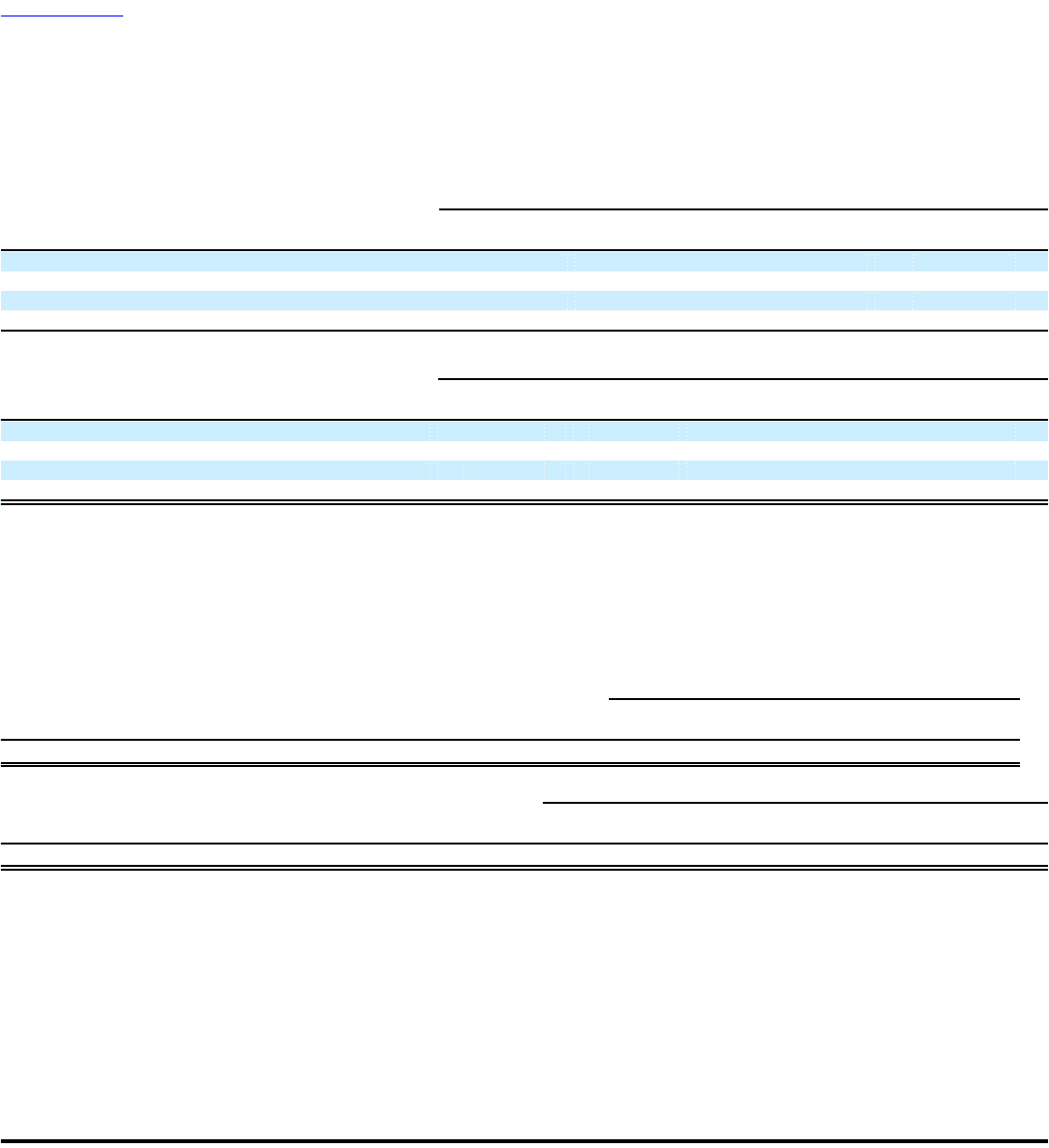

Note 22. Quarterly Financial Data (Unaudited)

The following table summarizes our unaudited quarterly results of operations for 2005 and 2004:

Three Months Ended

2005

(in millions, except per share data) March 31 June 30 September 30 December 31

Operating revenues $ 3,706 $ 4,249 $ 4,308 $ 3,928

Operating loss $ (957) $ (129) $ (240) $ (675)

Net loss $ (1,071) $ (382) $ (1,130) $ (1,235)

Basic and diluted loss per share $ (7.64) $ (2.64) $ (6.73) $ (6.54)

Three Months Ended

2004

(in millions, except per share data) March 31 June 30 September 30 December 31

Operating revenues $ 3,587 $ 4,021 $ 3,930 $ 3,697

Operating loss $ (388) $ (241) $ (423) $ (2,256)

Net loss $ (383) $ (1,963) $ (646) $ (2,206)

Basic and diluted loss per share $ (3.12) $ (15.79) $ (5.16) $ (16.58)

As discussed in Note 2, "Summary of Significant Accounting Policies — Reclassifications", for the year ended December 31,

2005, certain revenues related to the sale of mileage credits under our SkyMiles frequent flyer program are recorded as other revenues

rather than as selling expenses. We have reclassified prior period amounts to be consistent with the current year presentation. These

reclassifications did not impact earnings (loss) from operations or net loss for any period presented.

The following table shows the effect of these reclassifications on operating revenues for amounts previously reported in our

Quarterly Reports on Form 10-Q for the quarters ended March 31, 2005, June 30, 2005 and September 30, 2005 and our 2004

Form 10-K.

Three Months Ended

2005

(in millions) March 31 June 30 September 30

Increase in operating revenues & operating expenses $ 59 $ 64 $ 92

Three Months Ended

2004

(in millions) March 31 June 30 September 30 December 31

Increase in operating revenues & operating expenses $ 58 $ 60 $ 59 $ 56

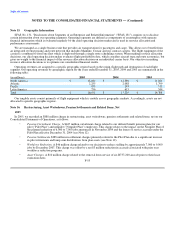

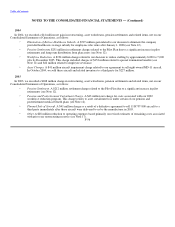

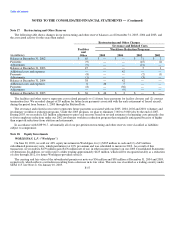

The comparability of our financial results during 2005 and 2004 was materially impacted by certain events, as discussed below:

• On September 14, 2005, we and substantially all of our subsidiaries filed voluntary petitions for reorganization under

Chapter 11 of the United States Bankruptcy Code. In accordance with SOP 90-7, we recorded and categorized all of the

bankruptcy related activity as a charge to reorganization items and reclassified or accrued certain liabilities as liabilities

subject to compromise.

• During 2005 and 2004, we recorded certain restructuring, asset writedowns, pension settlements and related items, net

as follows: (1) a $447 million curtailment charge in the March 2005 quarter; (2) $388 million in settlement charges

primarily during the June and December 2005 quarters; and (3) $251 million in settlement charges primarily in the June

and December 2004 quarters. See Note 16 for additional information about these items.

F-60