Delta Airlines 2005 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2005 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

Overview

On September 14, 2005 (the "Petition Date"), we and substantially all of our subsidiaries (collectively, the "Debtors") filed

voluntary petitions for reorganization under Chapter 11 of the United States Bankruptcy Code (the "Bankruptcy Code"), in the United

States Bankruptcy Court for the Southern District of New York (the "Bankruptcy Court"). The reorganization cases are being jointly

administered under the caption, "In re Delta Air Lines, Inc., et al., Case No. 05-17923-ASH."

Our Chapter 11 filing followed an extended effort by us to restructure our business to strengthen our competitive and financial

position. In 2004, we announced our transformation plan, which is intended to provide us with approximately $5 billion in annual

financial benefits by the end of 2006, as compared to 2002. While we were, and continue to be, on schedule to achieve the targeted

benefits, we experienced a liquidity shortfall in 2005 due to historically high aircraft fuel prices and other cost pressures, continued

low passenger mile yields and cash holdbacks instituted for the first time by our credit card processors. As a result, we determined that

we could not continue to operate without the protections provided by Chapter 11. In connection with our Chapter 11 proceedings, we

obtained $2.2 billion in post-petition financing, which provided net proceeds of $1.2 billion after the required repayment of certain

pre-petition facilities. For further information about our Chapter 11 proceedings and our post-petition financing, see Notes 1 and 8,

respectively, of the Notes to the Consolidated Financial Statements.

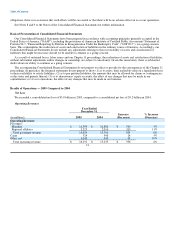

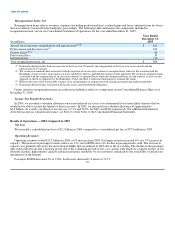

For the year ended December 31, 2005, we recorded a consolidated net loss of $3.8 billion. These results include $1.8 billion in

aggregate charges for reorganization items and pension and restructuring charges, net. See Notes 1 and 16 of the Notes to the

Consolidated Financial Statements for further information about these charges. Our cash and cash equivalents and short-term

investments were $2.0 billion at December 31, 2005, compared to $1.8 billion at December 31, 2004.

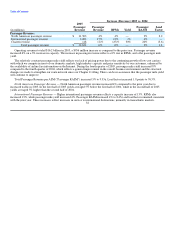

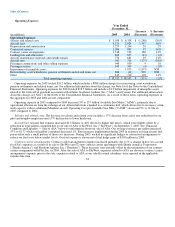

The benefits we realized under our transformation initiatives during 2005 were outpaced and masked by historically high aircraft

fuel prices, which continue to have a material adverse effect on our financial performance. During 2005, our aircraft fuel expense

increased 46%, or $1.3 billion, compared to 2004. In addition, we continue to operate in a highly competitive pricing environment,

which limits our ability to increase fares to offset high fuel costs and has had a significant negative impact on our financial results.

Although revenue passenger miles ("RPMs"), or traffic, and passenger revenue rose 6% in 2005 compared to 2004, passenger mile

yield remained unchanged from the depressed level of the prior year.

Chapter 11 Process

The Debtors are operating as "debtors-in-possession" under the jurisdiction of the Bankruptcy Court and in accordance with the

applicable provisions of the Bankruptcy Code. In general, as debtors-in-possession, the Debtors are authorized under Chapter 11 to

continue to operate as an ongoing business, but may not engage in transactions outside the ordinary course of business without the

prior approval of the Bankruptcy Court.

The Bankruptcy Court has approved various motions that facilitate our continuation of normal operations. The Bankruptcy Court's

orders authorize us, among other things, in our discretion to: (1) provide employee wages, healthcare coverage, vacation, sick leave

and similar benefits without interruption; (2) honor obligations arising prior to the Petition Date ("pre-petition obligations") to

customers and continue customer service programs, including Delta's SkyMiles frequent flyer program; (3) pay for fuel under existing

fuel supply contracts and honor existing fuel supply, distribution and storage agreements; (4) honor pre-petition obligations related to

our interline, clearinghouse, code sharing and other similar agreements; (5) pay pre-petition obligations to foreign vendors, foreign

service providers and foreign governments; and (6) continue maintenance of existing bank accounts and existing cash management

systems.

Shortly after the Petition Date, the Debtors began notifying all known current or potential creditors of the Chapter 11 filing.

Subject to certain exceptions under the Bankruptcy Code, the Debtors' Chapter 11 filing automatically enjoined, or stayed, the

continuation of any judicial or administrative proceedings or other actions against the Debtors or their property to recover on, collect

or secure a claim arising prior to the 25