Delta Airlines 2005 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2005 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

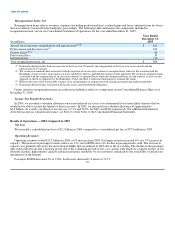

occur. We currently estimate that, in order to satisfy the Collateral Value Test on May 19, 2006, we will need to provide GECC with

additional collateral in the form of cash in the amount of approximately $50 million.

We entered into a letter of intent with GECC in December 2005 to amend the Reimbursement Agreement to eliminate the

Collateral Value Test, among other things. In February 2006, the Bankruptcy Court approved the letter of intent, but because the

completion of the transactions contemplated in the letter of intent is subject to definitive documentation and certain other conditions,

there can be no assurance that the Collateral Value Test will be amended or eliminated. If the Collateral Value Test is not amended or

eliminated, we intend to satisfy it. See Note 8 of the Notes to the Consolidated Financial Statements for further information regarding

the Reimbursement Agreement and the Bonds.

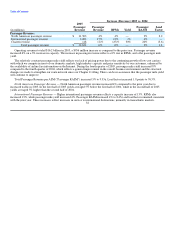

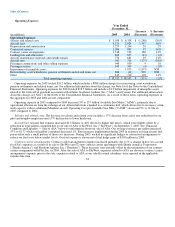

Sources and Uses of Cash

Our cash and cash equivalents and short-term investments were $2.0 billion at December 31, 2005, compared to $1.8 billion at

December 31, 2004. Restricted cash totaled $928 million and $350 million at December 31, 2005 and 2004, respectively. Cash and

cash equivalents as of December 31, 2005 include approximately $155 million, which is set aside for payment of certain operational

taxes and fees to various governmental authorities.

Cash flows from operating activities

For the year ended December 31, 2005, cash provided by operating activities totaled $175 million. This is comprised of our

consolidated net loss for the year of $3.8 billion offset by noncash adjustments totaling approximately $3.0 billion and other changes

in working capital of approximately $959 million.

• The $3.0 billion in noncash adjustments were primarily related to $1.3 billion of depreciation and amortization expense,

$896 million of pension, postretirement and postemployment expense in excess of payments, net and $884 million of

net noncash charges related to reorganization items.

• The $959 million change in working capital items was primarily related to a $336 million sale of short-term

investments, an increase of $145 million in our air traffic liability due to higher bookings and preservation of cash due

to the protection afforded to us under the Chapter 11 proceedings.

Cash flows from investing activities

For the year ended December 31, 2005, cash used in investing activities totaled $460 million, which includes the following

significant items:

• Our restricted cash balance increased $578 million. The increase primarily relates to cash holdbacks associated with our

Visa/ MasterCard credit card processing agreements and certain interline clearinghouses as a result of our Chapter 11

proceedings.

• Cash used for flight equipment additions, including advanced deposits, totaled $570 million. This includes $417 million

we paid to purchase 11 B737-800 aircraft that we sold to a third party immediately after those aircraft were delivered to

us by the manufacturer. This also includes approximately $66 million in improvements to our aircraft.

• Cash used for ground property and equipment totaling $244 million. This includes expenditures totaling $65 million

related to our Boston Airport Terminal Project, which was offset by approximately $80 million in reimbursements from

restricted investments related to this project. During 2005 cash used for technology, including updating software and

hardware infrastructure, totaled approximately $121 million.

• Cash proceeds from the sale of ASA, net of cash that remained with ASA, was approximately $417 million. For

additional information, see Note 3 of the Notes to the Consolidated Financial Statements.

42