Delta Airlines 2005 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2005 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

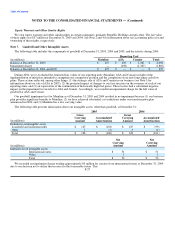

and cash equivalents as of December 31, 2005 include approximately $155 million, which is set aside for the payment of certain

operational taxes and fees to governmental authorities.

Under our cash management system, we utilize controlled disbursement accounts that are funded daily. Checks we issue, which

have not been presented for payment, are recorded in accounts payable, deferred credits and other accrued liabilities on our

Consolidated Balance Sheets. These amounts totaled $66 million and $63 million at December 31, 2005 and 2004, respectively.

Short-Term Investments

At December 31, 2005, we did not have any short-term investments. At December 31, 2004, our short-term investments were

comprised of auction rate securities. In accordance with SFAS No. 115, "Accounting for Certain Investments in Debt and Equity

Securities" ("SFAS 115"), we account for these investments as trading securities. For additional information about trading securities,

see "Investments in Debt and Equity Securities" in this Note.

Restricted Assets

We have restricted cash, which primarily relates to cash held as collateral by credit card processors and interline clearinghouses

and to support certain projected insurance obligations. Restricted cash included in current assets on our Consolidated Balance Sheets

totaled $870 million and $348 million at December 31, 2005 and 2004, respectively. Restricted cash recorded in other noncurrent

assets on our Consolidated Balance Sheets totaled $58 million and $2 million at December 31, 2005 and 2004, respectively.

We have restricted investments for the redevelopment and expansion of Terminal A at Boston's Logan International Airport.

Restricted investments included in other assets on our Consolidated Balance Sheets totaled $46 and $127 million at December 31,

2005 and 2004, respectively.

Derivative Financial Instruments

We account for derivative financial instruments in accordance with SFAS 133, "Accounting for Derivative Instruments and

Hedging Activities" ("SFAS 133"). These derivative instruments include fuel hedge contracts, interest rate swap agreements and

equity warrants and other similar rights in certain companies (see Note 6).

Fuel Hedge Contracts

We periodically enter into fuel hedge contracts that qualify for hedge accounting as cash flow hedges under SFAS 133. For these

types of hedges, we record the fair value of our fuel hedge contracts on our Consolidated Balance Sheets and regularly adjust the

balances to reflect changes in the fair values of those contracts.

Effective gains or losses related to the fair value adjustments of fuel hedge contracts are recorded in shareowners' deficit as a

component of accumulated other comprehensive loss. These gains or losses are recognized in aircraft fuel expense when the related

aircraft fuel purchases being hedged are consumed. However, to the extent that the change in fair value of a fuel hedge contract does

not perfectly offset the change in the value of the aircraft fuel being hedged, the ineffective portion of the hedge is immediately

recognized as a fair value adjustment of SFAS 133 derivatives in other income (expense) on our Consolidated Statements of

Operations. In calculating the ineffective portion of a fuel hedge contract, we include all changes in the fair value attributable to the

time value component and recognize the amount in other income (expense) during the life of the contract.

Interest Rate Swap Agreements

We record interest rate swap agreements that qualify as fair value hedges under SFAS 133 at their fair value on our Consolidated

Balance Sheets and adjust these amounts and the related debt to reflect changes in

F-17