Delta Airlines 2005 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2005 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

compensation expense will be approximately $50 million and $20 million for the years ending December 31, 2006 and 2007,

respectively.

Market Risks Associated with Financial Instruments

We have significant market risk exposure related to aircraft fuel prices and interest rates. Market risk is the potential negative

impact of adverse changes in these prices or rates on our Consolidated Financial Statements. To manage the volatility relating to these

exposures, we periodically enter into derivative transactions pursuant to stated policies (see Note 6 of the Notes to the Consolidated

Financial Statements). We expect adjustments to the fair value of financial instruments accounted for under SFAS 133 to result in

ongoing volatility in earnings and shareowners' deficit.

The following sensitivity analyses do not consider the effects of a change in demand for air travel, the economy as a whole, or

actions we may take to seek to mitigate our exposure to a particular risk. For these and other reasons, the actual results of changes in

these prices or rates may differ materially from the following hypothetical results.

Aircraft Fuel Price Risk

Our results of operations can be significantly impacted by changes in the price of aircraft fuel. To manage this risk, we

periodically purchase options and other similar derivative instruments and enter into forward contracts for the purchase of fuel. We do

not enter into fuel hedge contracts for speculative purposes. We did not have any fuel hedge contracts at December 31, 2005 or 2004.

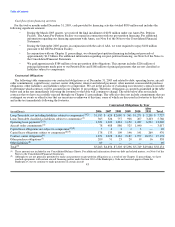

Our business plan assumes that in 2006 our aircraft fuel consumption will be approximately 2.1 billion gallons and that our

average annual jet fuel price per gallon will be approximately $1.74. Based on these assumptions, a 10% rise in that jet fuel price

would increase our aircraft fuel expense by approximately $370 million in 2006.

In December 2005, the Bankruptcy Court authorized us to enter into fuel hedging contracts for up to 30% of our monthly

estimated fuel consumption, with hedging allowed in excess of that level if we obtained approval of the Creditors Committee or the

Bankruptcy Court. In February 2006, we received approval of the Creditors Committee to hedge up to 50% of our estimated 2006

aggregate fuel consumption, with no single month exceeding 80% of our estimated fuel consumption. We also agreed that we would

not enter into any fuel hedging contracts that extend beyond December 31, 2006 without additional approval from the Creditors

Committee or the Bankruptcy Court.

For additional information regarding fuel hedging and other exposures to market risks, see Notes 5 and 6 of the Notes to the

Consolidated Financial Statements.

Interest Rate Risk

Our exposure to market risk due to changes in interest rates primarily relates to our long-term debt obligations.

Market risk associated with our fixed-rate long-term debt is the potential change in fair value resulting from a change in interest

rates. A 10% decrease in average annual interest rates would have increased the estimated fair value of our long-term debt by

$504 million at December 31, 2005 (including debt classified as liabilities subject to compromise) and by $1.6 billion at December 31,

2004. A 10% increase in average annual interest rates would not have a material impact on our interest expense in 2006. At

December 31, 2005, we had no interest rate swaps or contractual arrangements that would reduce our interest expense. For additional

information on our long-term debt agreements, see Note 8 of the Notes to the Consolidated Financial Statements.

In accordance with SOP 90-7, interest expense is recorded only to the extent that (1) interest will be paid during the bankruptcy

proceedings or (2) it is probable that interest will be an allowed priority, secured, or unsecured claim. Interest expense recorded on our

Consolidated Statement of Operations totaled approximately $1 billion for the year ended December 31, 2005. Contractual interest

expense (including 49