Delta Airlines 2005 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2005 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

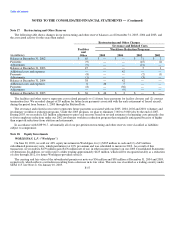

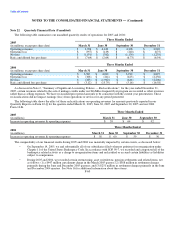

and shares of common stock issuable upon conversion of our 8.0% Convertible Senior Notes due June 3, 2023 ("8.0% Notes") and our

27/8% Convertible Senior Notes due 2024 ("27/8 % Notes") (as applicable), because their effect on loss per share was anti-dilutive. The

common stock equivalents totaled 143.2 million, 78.8 million and 51.9 million for the years ended December 31, 2005, 2004 and

2003, respectively.

During 2004, we adopted EITF 04-08, which required the adjustment to prior period diluted earnings per share amounts for

contingently convertible securities. We have outstanding two classes of contingently convertible debt securities: (1) 8.0% Notes,

which we issued in June 2003, and (2) 27/8 % Notes, which we issued in February 2004.

Due to the adoption of EITF 04-08 as of December 31, 2004, we adjusted our basic loss per share for the three months ended

June 30, 2003 to include the dilutive impact of the 12.5 million shares of common stock issuable upon conversion of the 8.0% Notes.

All other quarterly and annual diluted loss per share calculations for periods ending before December 31, 2004 were not impacted by

our adoption of EITF 04-08 due to the anti-dilutive nature of these securities.

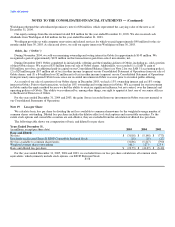

Note 20. Government Compensation and Reimbursements

During 2003, we received payments from the U.S. Government under the Emergency Wartime Supplemental Appropriations Act

totaling (1) $398 million as reimbursement for passenger and air carrier security fees, which we recorded as a reduction of operating

expenses in our 2003 Consolidated Statements of Operations, and (2) $13 million related to the strengthening of flight deck doors,

which we recorded as a reduction to previously capitalized costs.

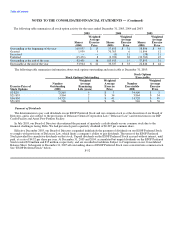

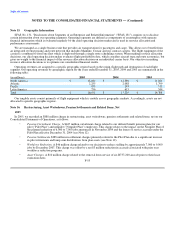

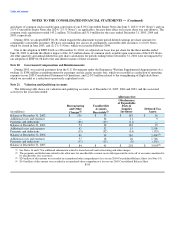

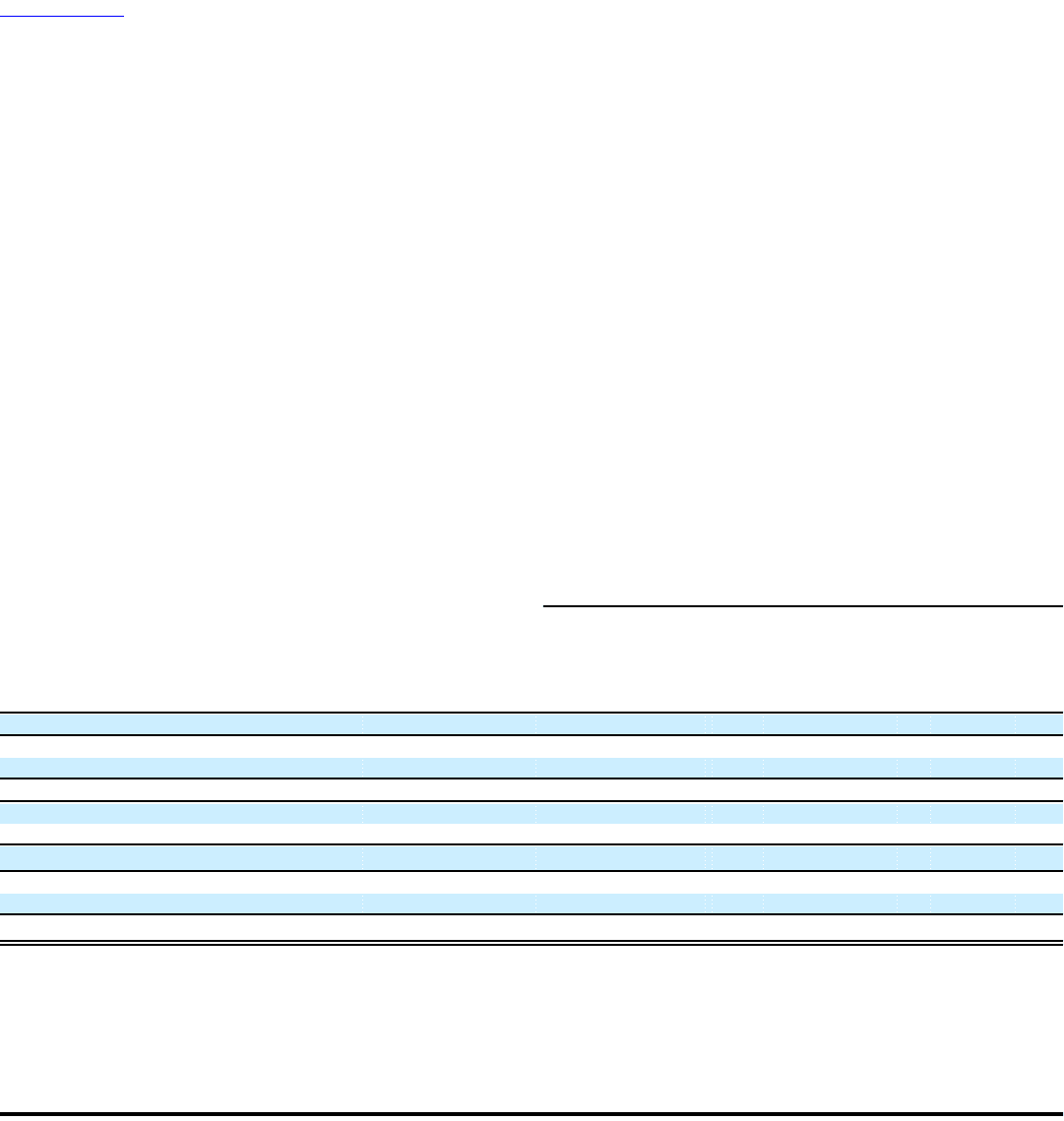

Note 21. Valuation and Qualifying Accounts

The following table shows our valuation and qualifying accounts as of December 31, 2005, 2004 and 2003, and the associated

activity for the years then ended:

Allowance for:

Obsolescence

of Expendable

Restructuring Uncollectible Parts &

and Other Accounts Supplies Deferred Tax

(in millions) Charges(1) Receivable(2) Inventory Assets

Balance at December 31, 2002 $ 139 $ 33 $ 183 $ 16

Additional costs and expenses — 34 11 9

Payments and deductions (86) (29) (11) —

Balance at December 31, 2003 53 38 183 25

Additional costs and expenses 42 32 15 2,508

Payments and deductions (15) (32) (14) (133)

Balance at December 31, 2004 80 38 184 2,400(3)

Additional costs and expenses 57 18 26 1,746

Payments and deductions (53) (15) (9) (192)

Balance at December 31, 2005 $ 84 $ 41 $ 201 $ 3,954(4)

(1) See Notes 16 and 17 for additional information related to leased aircraft and restructuring and other charges.

(2) The payments and deductions related to the allowance for uncollectible accounts receivable represent the write-off of accounts considered to

be uncollectible, less recoveries.

(3) $29 million of this amount was recorded in accumulated other comprehensive loss on our 2004 Consolidated Balance Sheet (see Note 14).

(4) $141 million of this amount was recorded in accumulated other comprehensive loss on our 2005 Consolidated Balance Sheet

F-59