Delta Airlines 2005 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2005 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

We cannot assure you that we will achieve the targeted benefits under our business plan or that these benefits, even if achieved,

will be adequate for us to maintain financial viability. In addition, our business plan involves significant change to our business. We

cannot assure you that we will be successful in implementing the plan. In addition, the implementation of key elements of the plan,

such as employee job reductions, may have an adverse impact on our business and results of operations, particularly in the near term.

Furthermore, our existing international operations and plans for expansion of our international operations under our business plan

could be adversely affected by factors such as reversals or delays in the opening of foreign markets, currency and political risks,

taxation and changes in international government regulation of our operations, including the ability to obtain or retain needed route

authorities and/or slots.

Our business is dependent on the price and availability of aircraft fuel. Continued periods of historically high fuel costs will

continue to materially adversely affect our operating results. Likewise, significant disruptions in the supply of aircraft fuel

would materially adversely affect our operations and operating results.

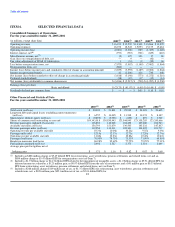

Our operating results are significantly impacted by changes in the price and availability of aircraft fuel. Fuel prices increased

substantially in 2004 and 2005 and remained at historically high levels at the end of 2005. In 2005, our average fuel price per gallon

rose 47% to $1.71 as compared to an average price of $1.16 in 2004. In 2004, our average fuel price per gallon rose 42% as compared

to an average price of 81.78¢ in 2003. Our fuel costs represented 23%, 16%, and 13% of our operating expenses in 2005, 2004 and

2003, respectively. These increasing costs have had a significant negative effect on our results of operations and financial condition.

During the months of September and October, 2005, our fuel costs and supplies were negatively impacted by two hurricanes,

Katrina and Rita, that struck the Gulf Coast region of the United States. These storms interfered with the operations of production

facilities and refineries in Louisiana and Texas. As a result, our fuel costs significantly increased during the latter part of 2005,

primarily from drastically increased costs of refining crude oil into jet fuel.

Our ability to pass along the increased costs of fuel to our customers is limited by the competitive nature of the airline industry.

We generally have not been able to increase our fares to fully offset the effect of increased fuel costs in the past and we may not be

able to do so in the future.

In addition, our aircraft fuel purchase contracts do not provide material protection against price increases or assure the availability

of our fuel supplies. We purchase most of our aircraft fuel from petroleum refiners under contracts that establish the price based on

various market indices. We also purchase aircraft fuel on the spot market, from offshore sources and under contracts that permit the

refiners to set the price. To attempt to reduce our exposure to changes in fuel prices, we periodically enter into heating and crude oil

derivatives contracts, though we may not be able to successfully manage this exposure. In December 2005, the Bankruptcy Court

authorized us to enter into fuel hedging contracts for up to 30% of our monthly estimated fuel consumption, with hedging allowed in

excess of that level if we obtained approval of the official committee of unsecured creditors appointed in our Chapter 11 proceedings

(the "Creditors Committee") or the Bankruptcy Court. In February 2006, we received approval from the Creditors Committee to hedge

up to 50% of our estimated 2006 aggregate fuel consumption, with no single month exceeding 80% of our estimated fuel

consumption. We also agreed that we would not enter into any fuel hedging contracts that extend beyond December 31, 2006 without

additional approval from the Creditors Committee or the Bankruptcy Court. Depending on the type of hedging instrument used, our

ability to benefit from declines in fuel prices may be limited.

We are currently able to obtain adequate supplies of aircraft fuel, but it is impossible to predict the future availability or price of

aircraft fuel. Weather-related events, natural disasters, political disruptions or wars involving oil-producing countries, changes in

governmental policy concerning aircraft fuel production, transportation or marketing, changes in aircraft fuel production capacity,

environmental concerns, and other unpredictable events may result in additional fuel supply shortages and fuel price increases in the

future. Additional increases in fuel costs or disruptions in fuel supplies could have additional negative effects on us.

13