Delta Airlines 2005 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2005 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

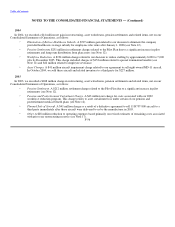

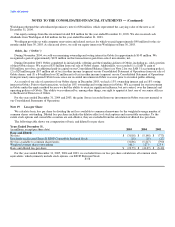

2004

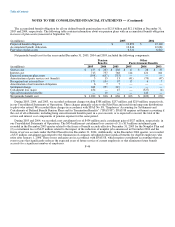

In 2004, we recorded a $41 million net gain in restructuring, asset writedowns, pension settlements and related items, net on our

Consolidated Statements of Operations, as follows:

• Elimination of Retiree Healthcare Subsidy. A $527 million gain related to our decision to eliminate the company

provided healthcare coverage subsidy for employees who retire after January 1, 2006 (see Note 12).

• Pension Settlements.$251 million in settlement charges related to the Pilot Plan due to a significant increase in pilot

retirements and lump sum distribution from plan assets (see Note 12).

• Workforce Reduction. A $194 million charge related to our decision to reduce staffing by approximately 6,000 to 7,000

jobs by December 2005. This charge included charges of $152 million related to special termination benefits (see

Note 12) and $42 million related to employee severance.

• Asset Charges. A $41 million aircraft impairment charge related to our agreement to sell eight owned MD-11 aircraft.

In October 2004, we sold these aircraft and related inventory to a third party for $227 million.

2003

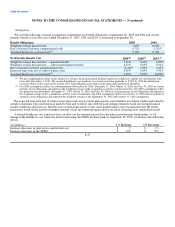

In 2003, we recorded a $268 million charge in restructuring, asset writedowns, pension settlements and related items, net on our

Consolidated Statements of Operations, as follows:

• Pension Settlement. A $212 million settlement charge related to the Pilot Plan due to a significant increase in pilot

retirements (see Note 12).

• Pension and Postretirement Curtailment Charge. A $43 million net charge for costs associated with our 2002

workforce reduction program. This charge relates to a net curtailment loss under certain of our pension and

postretirement medical benefit plans (see Note 12).

• Planned Sale of Aircraft. A $41 million charge as a result of a definitive agreement to sell 11 B737-800 aircraft to a

third party immediately after those aircraft were delivered to us by the manufacturer in 2005.

• Other.A $28 million reduction to operating expenses based primarily on revised estimates of remaining costs associated

with prior year restructuring reserves (see Note 17).

F-56