Delta Airlines 2005 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2005 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

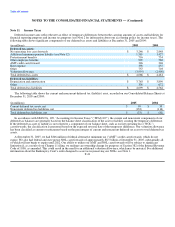

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Senior Funding, Inc. ("Morgan Stanley"), for which GECC acts as administrative agent. The Bankruptcy Court approved our entering

into the DIP Credit Facility.

The DIP Credit Facility consists of a $600 million Term Loan A arranged by GECC (the "TLA"), a $700 million Term Loan B

arranged by GECC (the "TLB") and a $600 million Term Loan C arranged jointly by GECC and Morgan Stanley (the "TLC;" together

with the TLA and TLB, collectively, the "DIP Loans"). We applied a portion of these proceeds to (1) repay in full the $480 million

principal amount outstanding under our pre-petition credit facility for which GECC was agent ("GE Pre-Petition Facility"); (2) repay

in full the $500 million principal amount outstanding under our Amex Pre-Petition Facility (defined below); and (3) prepay

$50 million of the $350 million principal amount outstanding under our Amex Post-Petition Facility (defined below). The remainder

of the proceeds of the DIP Loans is available for our general corporate purposes.

Availability of funds under the TLA is subject to a borrowing base calculation. If the outstanding amount of the TLA at any time

exceeds the borrowing base, we must immediately repay the TLA or post cash collateral in an amount equal to the excess.

The TLA, TLB and TLC each mature on March 16, 2008. Prior to the Amended and Restated DIP Credit Facility (as defined

below), the TLA bore interest, at our option, at LIBOR plus 4.50% or an index rate plus 3.75%; the TLB bore interest, at our option, at

LIBOR plus 6.50% or an index rate plus 5.75%; and the TLC bore interest, at our option, at LIBOR plus 9.00% or an index rate plus

8.25%.

We may also request the issuance of up to $200 million in letters of credit under the DIP Credit Facility, which amount must be

fully cash collateralized at all times such letters of credit are outstanding.

Our obligations under the DIP Credit Facility are guaranteed by substantially all of our domestic subsidiaries (the "Guarantors").

We will be required to make certain mandatory repayments of the DIP Loans in the event we sell certain assets, subject to certain

exceptions. Any portion of the DIP Loans that are repaid through either voluntary or mandatory prepayment may not be reborrowed.

The DIP Loans and the related guarantees are secured by first priority liens on substantially all of our and the Guarantors' present

and future assets (including assets that previously secured the GE Pre-Petition Facility) and by junior liens on certain of our and our

Guarantors' other assets (including certain accounts receivable and other assets subject to a first priority lien securing the Amex Post-

Petition Facility described below), in each case subject to certain exceptions, including an exception for assets which are subject to

financing agreements that are entitled to the benefits of Section 1110 of the Bankruptcy Code, to the extent such financing agreements

prohibit such liens.

The DIP Credit Facility includes affirmative, negative and financial covenants that impose substantial restrictions on our financial

and business operations, including our ability to, among other things, incur or secure other debt, make investments, sell assets and pay

dividends or repurchase stock.

The financial covenants require us to:

• maintain unrestricted funds in an amount not less than $750 million through May 31, 2006; $1 billion at all times from

June 1, 2006, through November 30, 2006; $750 million at all times from December 1, 2006, through February 28,

2007; and $1 billion at all times thereafter ("Liquidity Covenant");

• not exceed specified levels of capital expenditures during any fiscal quarter; and

• achieve specified levels of EBITDAR (earnings before interest, taxes, depreciation, amortization and aircraft rent, as

defined) for successive trailing 12-month periods through March 2008. During 2005, we were required to achieve

increasing levels of EBITDAR, including EBITDAR of $644 million for the 12-month period ending December 31,

2005. Thereafter, the minimum EBITDAR level for each successive trailing 12-month period continues to increase,

including $1.372 billion for the 12-month period ended December 31, 2006; $1.988 billion for the 12-month period

ending December 31, 2007; and $2 billion for each

F-31