Delta Airlines 2005 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2005 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

earned prior to the Petition Date. We believe we are not required to fund such pre-petition amounts while operating under Chapter 11

of the Bankruptcy Code. Certain entities unsuccessfully challenged this position in Bankruptcy Court, and this issue is currently on

appeal. If our DB Plans continue after we emerge from Chapter 11, we may be required to fully fund required contributions at that

date, including contributions related to benefits earned prior to our Petition Date.

Based on our preliminary five-year forecast and additional information regarding the assets and liabilities for the DB Plans, we

believe that, under current pension funding rules, we would need to seek distress termination of both the Nonpilot Plan and the Pilot

Plan in order to successfully reorganize and emerge from Chapter 11. Proposed legislation that passed in the U.S. Senate and is now

pending in a House — Senate Conference Committee would extend our funding obligations for our DB Plans over 20 years. If the

pending legislation is enacted in the form in which it passed the U.S. Senate, we hope to avoid a distress termination of the Nonpilot

Plan, though there is no assurance that we can do so. We currently believe, however, that the existence of the lump sum option in the

Pilot Plan and the significant number of early pilot retirements it may drive make it unlikely that we could satisfy our funding

obligations to that plan even if the pending legislation is enacted in the form in which it passed the U.S. Senate. See Note 12 of the

Notes to the Consolidated Financial Statements for information about the lump sum option under the Pilot Plan and our pension plans

generally.

Contract Carriers. We have long-term contract carrier agreements with the following five regional air carriers (in addition to

Comair): Chautauqua, Shuttle America, ASA, SkyWest Airlines, and Freedom. Under these agreements, the carriers operate certain of

their aircraft using our flight code, and we schedule those aircraft, sell the seats on those flights and retain the related revenues. We

pay those airlines an amount, as defined in the applicable agreement, which is based on a determination of their cost of operating those

flights and other factors intended to approximate market rates for those services.

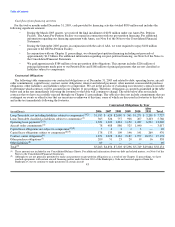

Under these long-term contract carrier agreements, we are obligated to pay certain minimum fixed obligations, which are included

in the table above. The remaining estimated expenses are not included in the table because these expenses are contingent based on the

costs associated with the operation of contract carrier flights by those air carriers as well as rates that are unknown at this time. We

cannot reasonably estimate at this time our expenses under the contract carrier agreements in 2006 and thereafter.

We may terminate the Chautauqua and Shuttle America agreements without cause at any time after May 2010 and January 2013,

respectively, by providing certain advance notice. If we terminate either the Chautauqua or Shuttle America agreements without cause,

Chautauqua or Shuttle America, respectively, has the right to (1) assign to us leased aircraft that the airline operates for us, provided

we are able to continue the leases on the same terms the airline had prior to the assignment and (2) require us to purchase or lease any

of the aircraft that the airline owns and operates for us at the time of the termination. If we are required to purchase aircraft owned by

Chautauqua or Shuttle America, the purchase price would be equal to the amount necessary to (1) reimburse Chautauqua or Shuttle

America for the equity it provided to purchase the aircraft and (2) repay in full any debt outstanding at such time that is not being

assumed in connection with such purchase. If we are required to lease aircraft owned by Chautauqua or Shuttle America, the lease

would have (1) a rate equal to the debt payments of Chautauqua or Shuttle America for the debt financing of the aircraft calculated as

if 90% of the aircraft was debt financed by Chautauqua or Shuttle America and (2) other specified terms and conditions.

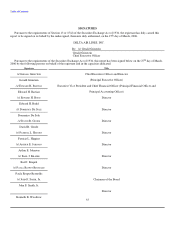

We estimate that the total fair values, determined as of December 31, 2005, of the aircraft that Chautauqua or Shuttle America

could assign to us or require that we purchase if we terminate without cause our contract carrier agreements with those airlines are

$549 million and $386 million, respectively. The actual amount that we may be required to pay in these circumstances may be

materially different from these estimates.

For additional information on contract carrier agreements see Note 10 of the Notes to the Consolidated Financial Statements.

Interest and Related Payments. Estimated amounts for future interest and related payments in connection with our debt obligations

are based on the fixed and variable interest rates specified in the associated debt agreements. We expect to pay $1.05 billion related to

interest on fixed and variable rate debt 45