Delta Airlines 2005 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2005 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

class of claims have voted to accept the plan and (2) at least two-thirds in amount of equity interests actually voting in each impaired

class of equity interests has voted to accept the plan.

Under certain circumstances set forth in Section 1129(b) of the Bankruptcy Code, the Bankruptcy Court may confirm a plan of

reorganization even if such plan has not been accepted by all impaired classes of claims and equity interests. A class of claims or

equity interests that does not receive or retain any property under the plan of reorganization on account of such claims or interests is

deemed to have voted to reject the plan. The precise requirements and evidentiary showing for confirming a plan of reorganization

notwithstanding its rejection by one or more impaired classes of claims or equity interests depends upon a number of factors,

including the status and seniority of the claims or equity interests in the rejecting class (i.e., secured claims or unsecured claims,

subordinated or senior claims, or common stock). Generally, with respect to common stock interests, a plan of reorganization may be

"crammed down" even if the shareowners receive no recovery if the proponent of the plan demonstrates that (1) no class junior to the

common stock is receiving or retaining property under the plan and (2) no class of claims or interests senior to the common stock is

being paid more than in full.

The timing of filing a plan of reorganization by us will depend on the timing and outcome of numerous other ongoing matters in

the Chapter 11 proceedings. Although we expect to file a plan of reorganization that provides for our emergence from bankruptcy as a

going concern, there can be no assurance at this time that a plan of reorganization will be confirmed by the Bankruptcy Court, or that

any such plan will be implemented successfully.

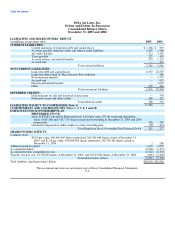

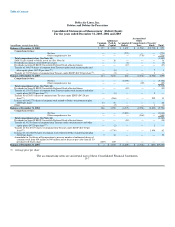

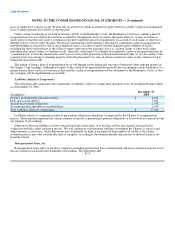

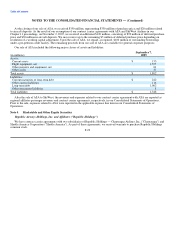

Liabilities Subject to Compromise

The following table summarizes the components of liabilities subject to compromise included on our Consolidated Balance Sheet

as of December 31, 2005:

December 31,

(in millions) 2005

Pension, postretirement and other benefits $ 8,652

Debt and accrued interest 5,843

Aircraft lease related obligations 1,740

Accounts payable and other accrued liabilities 1,145

Total liabilities subject to compromise $ 17,380

Liabilities subject to compromise refers to pre-petition obligations which may be impacted by the Chapter 11 reorganization

process. These amounts represent our current estimate of known or potential pre-petition obligations to be resolved in connection with

our Chapter 11 proceedings.

Differences between liabilities we have estimated and the claims filed, or to be filed, will be investigated and resolved in

connection with the claims resolution process. We will continue to evaluate these liabilities throughout the Chapter 11 process and

adjust amounts as necessary. Such adjustments may be material. In light of the expected large number of creditors, the claims

resolution process may take considerable time to complete. Accordingly, the ultimate number and amount of allowed claims is not

presently known.

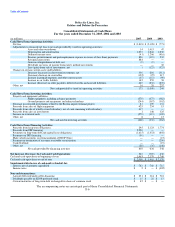

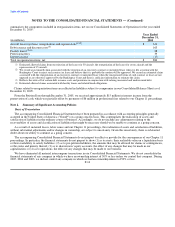

Reorganization Items, net

Reorganization items refers to revenues, expenses (including professional fees), realized gains and losses and provisions for losses

that are realized or incurred in the bankruptcy proceedings. The following table

F-13