Delta Airlines 2005 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2005 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

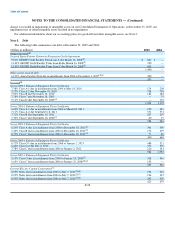

GECC for drawings under the letters of credit. Our reimbursement obligation is secured by (1) nine B767-400 and three B777-200 aircraft

("LOC Aircraft Collateral"); (2) 93 spare Mainline aircraft engines ("Engine Collateral"); and (3) certain other assets (see footnote 8 to this

table). For additional information about the letters of credit and our reimbursement obligation to GECC, see "Letter of Credit Enhanced

Special Facility Bonds" in this Note.

(6) This debt, as amended ("Spare Engines Loan"), is secured by (1) the Engine Collateral; (2) so long as the letters of credit discussed in

footnote 5 to this table are outstanding, the LOC Aircraft Collateral; and (3) certain other assets (see footnote 8 to this table). The Spare

Engines Loan is not repayable at our election prior to maturity. The Engine Collateral also secures, on a subordinated basis, up to

$160 million of certain of our other existing debt and aircraft lease obligations to GECC and its affiliates. At December 31, 2005, the

outstanding amount of these obligations is substantially in excess of $160 million.

(7) This debt, as amended ("Aircraft Loan"), is secured by (1) five B767-400 aircraft ("Other Aircraft Collateral"); (2) the Engine Collateral;

and (3) substantially all of the Mainline aircraft spare parts owned by us ("Spare Parts Collateral"). The Aircraft Loan is repayable at our

election at any time, subject to certain prepayment fees on any prepayment.

(8) This debt, as amended ("Spare Parts Loan"), is secured by (1) the Other Aircraft Collateral; (2) the Engine Collateral; and (3) the Spare Parts

Collateral. Our borrowings under the Spare Parts Loan may not exceed specified percentages of the then current market value of either the

spare parts or rotables we have pledged thereunder (each, a "Collateral Percentage Test"). In the event we exceed either Collateral

Percentage Test, we must promptly comply with that test by (1) pledging additional spare parts or rotables, as applicable; (2) posting cash

collateral; or (3) prepaying borrowings under the Spare Parts Loan. The Spare Parts Collateral also secures up to approximately $75 million

of (1) our reimbursement obligations under the letters of credit discussed in footnote 5 to this table; (2) the Spare Engines Loan; and (3) our

obligations under 12 CRJ-200 aircraft leases. It is also added to the collateral that secures, on a subordinated basis, up to $160 million of

certain of our other existing debt and lease obligations to GECC and its affiliates.

(9) In accordance with SOP 90-7, substantially all of our unsecured debt has been classified as liabilities subject to compromise. Additionally,

certain of our undersecured debt instruments have also been classified as liabilities subject to compromise. For more information on

liabilities subject to compromise, see Note 1.

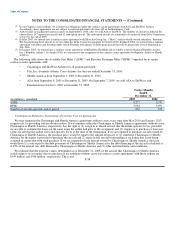

(10) Approximately $74 million principal amount of debt due in installments through June 2011 has interest rates ranging from 15.46% to

15.25%. The maximum interest rate on the remaining secured debt is 7.79% at December 31, 2005.

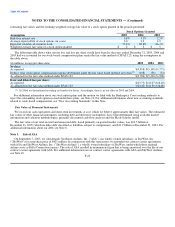

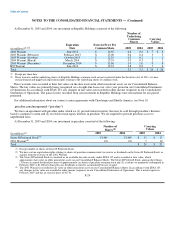

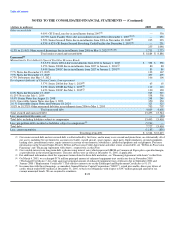

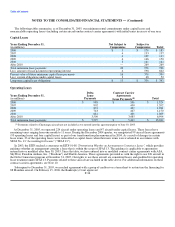

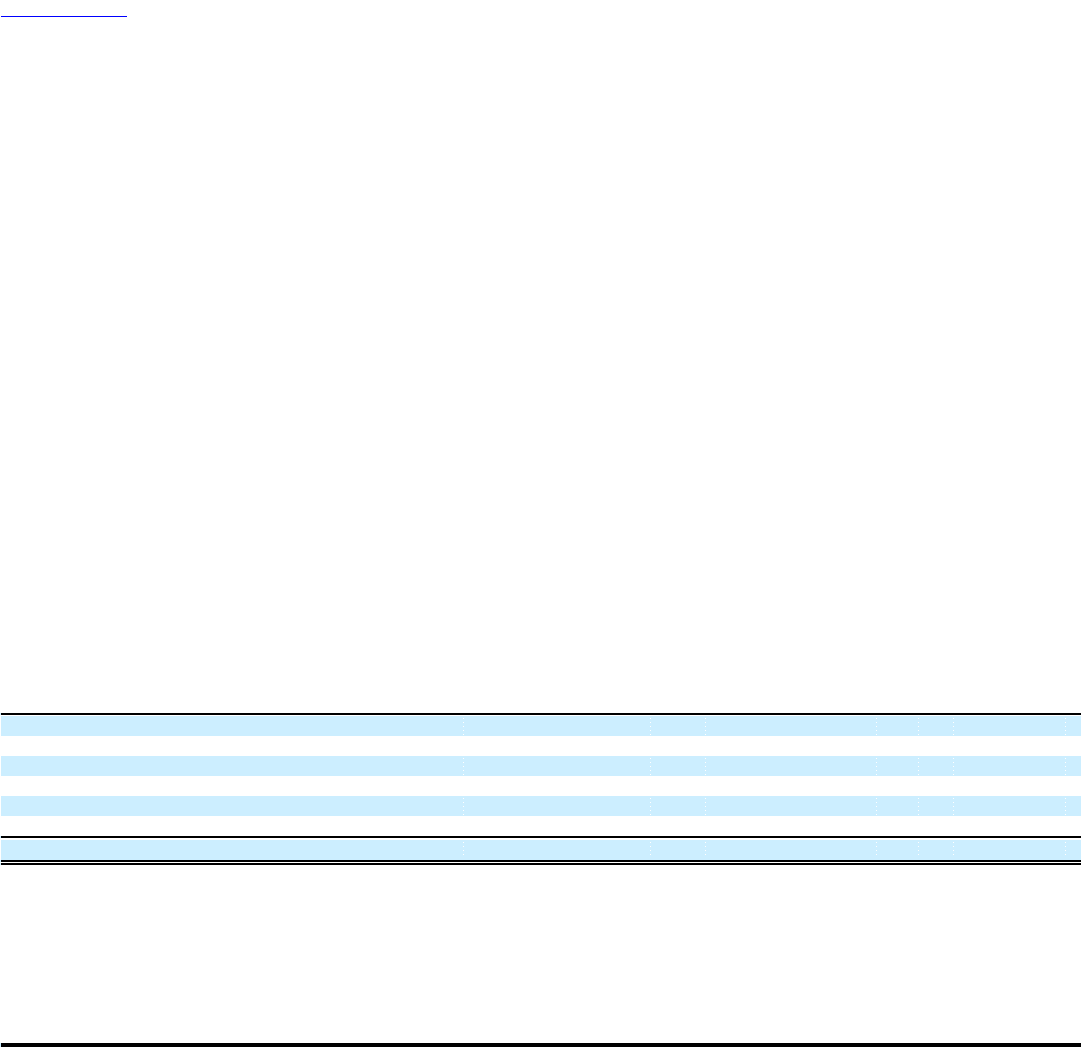

Future Maturities

The following table summarizes the contractual maturities of our debt, including current maturities, at December 31, 2005:

Principal Not Principal Total

Years Ending December 31, Subject to Subject to Principal

(in millions) Compromise Compromise Amount

2006 $ 1,183 $ 365 $ 1,548

2007 624 326 950

2008 2,080 757 2,837

2009 361 908 1,269

2010 1,271 207 1,478

After 2010 2,208 3,203 5,411

$ 7,727 $ 5,766 $ 13,493

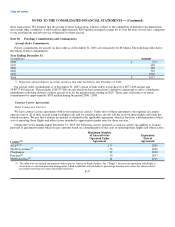

Debtor-in-Possession Financing

On September 16, 2005, we entered into a Secured Super-Priority Debtor-in-Possession Credit Agreement which, as amended

("DIP Credit Facility"), permits us to borrow up to $1.9 billion from a syndicate of lenders arranged by General Electric Capital

Corporation ("GECC") and Morgan Stanley F-30