Delta Airlines 2005 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2005 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Aircraft rent. The decrease in aircraft rent expense largely reflects a 21% decrease due to our lease restructuring in the December

2004 quarter, which resulted in the reclassification of certain aircraft leases from operating to capital. As discussed below, this

reclassification increased our interest expense. The reduction in aircraft rent expense also reflects our rejection of the leases for 50

aircraft, the renegotiation of the leases for seven aircraft and the repossession of 15 aircraft in connection with our Chapter 11

proceedings during 2005.

Restructuring, asset writedowns, pension settlements and related items, net. Restructuring, asset writedowns, pension settlements

and related items, net for 2005 includes:

• Pension Curtailment Charge. A $447 million curtailment charge related to our defined benefit pension plans for our

pilot ("Pilot Plan") and nonpilot ("Nonpilot Plan") employees. This charge relates to the freeze of service accruals

under the Pilot Plan effective December 31, 2004 and the impact of the planned reduction of 6,000-7,000 jobs

announced in November 2004 on the Nonpilot Plan (see Note 12 of the Notes to the Consolidated Financial

Statements).

• Pension Settlements.$388 million in settlement charges primarily related to the Pilot Plan due to a significant increase

in pilot retirements and lump sum distributions from plan assets (see Note 12 of the Notes to the Consolidated Financial

Statements).

• Workforce Reduction. A $46 million charge related to our decision in 2005 to reduce staffing by approximately 7,000 to

9,000 jobs by December 2007. This charge was offset by a net $3 million reduction in accruals associated with prior

year workforce reduction programs.

• Asset Charges. A $10 million charge related to the removal from service of six B737-200 aircraft prior to their lease

expiration dates.

Restructuring, asset writedowns, pension settlements and related items, net for 2004 includes (1) a $527 million gain related to the

elimination of the healthcare coverage subsidy for nonpilot employees who retire after January 1, 2006; (2) settlement charges totaling

$251 million primarily related to the Pilot Plan; (3) a $194 million charge related to voluntary and involuntary workforce reduction

programs; and (4) a $41 million aircraft impairment charge related to our agreement, entered into in the September 2004 quarter, to

sell eight owned MD-11 aircraft.

Other. The increase in other operating expenses primarily reflects a 13% rise due to the increase of incremental costs associated

with our SkyMiles frequent flyer program (for further information regarding our SkyMiles frequent flyer program, see Note 2 of the

Notes to the Consolidated Financial Statements) and a 5% increase from higher fuel taxes. These increases were partially offset by the

impact of our sale of ASA.

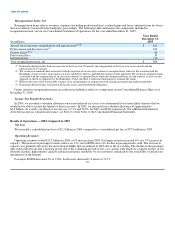

Other Income (Expense)

Other expenses, net for 2005 increased 42% to $974 million compared to other expenses, net of $684 million for 2004. This

change is primarily attributable to the following:

• Interest expense increased primarily due to a 31% increase from higher levels of debt outstanding and higher interest

rates as well as a 10% rise due to additional interest related to the reclassification of certain aircraft leases from

operating leases to capital leases as a result of renegotiations during the December 2004 quarter (see discussion of

aircraft rent expense above). These increases were offset by a 15% decrease due to the accounting treatment of certain

interest charges under our Chapter 11 proceedings (see discussion of interest expense in Note 2 of the Notes to the

Consolidated Financial Statements).

• Gain from sale of investments was $123 million in 2004 primarily due to the sale of our remaining equity interest in

Orbitz, Inc. ("Orbitz"). For additional information about the sale of our investment in Orbitz, see Note 18 of the Notes

to the Consolidated Financial Statements. 34