Delta Airlines 2005 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2005 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

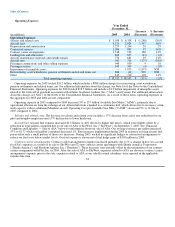

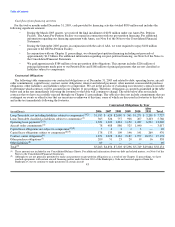

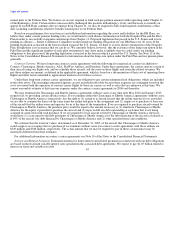

Reorganization Items, Net

Reorganization items refer to revenues, expenses (including professional fees), realized gains and losses and provisions for losses

that are realized or incurred in the bankruptcy proceedings. The following table summarizes the components included in

reorganization items, net on our Consolidated Statement of Operations for the year ended December 31, 2005:

Year Ended

December 31,

(in millions) 2005

Aircraft lease rejections, renegotiations and repossessions(1)(2) $ 611

Debt issuance and discount costs(3) 163

Facility leases(2)(4) 88

Professional fees 39

Interest income (17)

Total reorganization items, net $ 884

(1) Estimated allowed claims from our rejection of the leases for 50 aircraft, the renegotiation of the leases for seven aircraft and the

repossession of 15 aircraft.

(2) We record an estimated claim associated with the rejection of an executory contract or unexpired lease when we file a motion with the

Bankruptcy Court to reject such contract or lease and believe that it is probable the motion will be approved. We record an estimated claim

associated with the renegotiation of an executory contract or unexpired lease when the renegotiated terms of such contract or lease are not

opposed or otherwise approved by the Bankruptcy Court and there is sufficient information to estimate the claim.

(3) Reflects the write-off of certain debt issuance costs and premiums in conjunction with valuing unsecured and undersecured debt.

(4) Estimated allowed claims associated with facility leases and related bond obligations.

Claims related to reorganization items are reflected in liabilities subject to compromise in our Consolidated Balance Sheet as of

December 31, 2005.

Income Tax Benefit (Provision)

In 2004, we recorded a valuation allowance on our net deferred tax assets as we determined it was more likely than not that we

would not be able to realize the benefit of those tax assets. In 2005, we increased our valuation allowance by approximately

$1.6 billion. As a result, our effective tax rate was (1.1)% and 30.2% for 2005 and 2004, respectively. For additional information

about the income tax valuation allowance, see Note 11 of the Notes to the Consolidated Financial Statements.

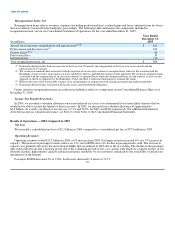

Results of Operations — 2004 Compared to 2003

Net Loss

We recorded a consolidated net loss of $5.2 billion in 2004, compared to a consolidated net loss of $773 million in 2003.

Operating Revenues

Operating revenues totaled $15.2 billion in 2004, a 6% increase from 2003. Passenger revenue increased 6% on a 9% increase in

capacity. The increase in passenger revenue reflects an 11% rise in RPMs and a 4% decline in passenger mile yield. The increase in

capacity was primarily driven by the restoration of flights that we reduced in 2003 due to the war in Iraq. The decline in the passenger

mile yield reflected our lack of pricing power due to the continuing growth of low-cost carriers with which we compete in most of our

domestic markets, high industry capacity and increased price sensitivity by our customers, enhanced by the availability of airline fare

information on the Internet.

Passenger RASM decreased 3% to 9.09¢. Load factor increased 1.4 points to 74.7%.

35