Delta Airlines 2005 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2005 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

auction) to the highest bidder or to carriers with little or no current presence at such airports. These proposals, if enacted, could

negatively impact our existing services and our ability to respond to competitive actions by other airlines.

Fuel

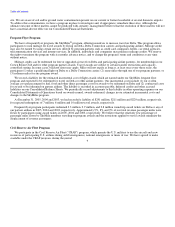

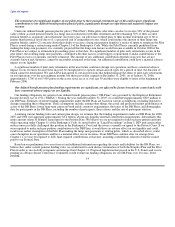

Our results of operations are significantly impacted by changes in the price and availability of aircraft fuel. The following table

shows our aircraft fuel consumption and costs for 2003-2005.

Gallons Percentage of

Consumed Cost(1) Average Price Total Operating

Year (Millions) (Millions) Per Gallon(1) Expenses

2005 2,492 $ 4,271 171.44¢ 23%

2004 2,527 2,924 115.70 16

2003 2,370 1,938 81.78 13

(1) Net of fuel hedge gains under our fuel hedging program of $105 million and $152 million for 2004 and 2003, respectively.

Our aircraft fuel purchase contracts do not provide material protection against price increases or assure the availability of our fuel

supplies. We purchase most of our aircraft fuel from petroleum refiners under contracts that establish the price based on various

market indices. We also purchase aircraft fuel on the spot market, from off-shore sources and under contracts that permit the refiners

to set the price.

While we had no fuel hedge contracts in place during 2005, we periodically enter into heating and crude oil derivative contracts to

attempt to reduce our exposure to changes in fuel prices. Information regarding our fuel hedging program, and Bankruptcy Court and

Creditors Committee approvals for fuel hedging, is set forth under "Management's Discussion and Analysis of Financial Condition

and Results of Operations — Market Risks Associated with Financial Instruments — Aircraft Fuel Price Risk" in Item 7 and in

Notes 5 and 6 of the Notes to the Consolidated Financial Statements. There can be no assurance that fuel hedging transactions can be

completed at levels authorized by the Bankruptcy Court or Creditors Committee.

Although we are currently able to obtain adequate supplies of aircraft fuel, it is impossible to predict the future availability or price

of aircraft fuel. Political disruptions or wars involving oil-producing countries, changes in government policy concerning aircraft fuel

production, transportation or marketing, changes in aircraft fuel production capacity, environmental concerns, natural disasters and

other unpredictable events may result in fuel supply shortages and fuel price increases in the future.

Employee Matters

Railway Labor Act

Our relations with labor unions in the United States are governed by the Railway Labor Act. Under the Railway Labor Act, a labor

union seeking to represent an unrepresented craft or class of employees is required to file with the National Mediation Board ("NMB")

an application alleging a representation dispute, along with authorization cards signed by at least 35% of the employees in that craft or

class. The NMB then investigates the dispute and, if it finds the labor union has obtained a sufficient number of authorization cards,

conducts an election to determine whether to certify the labor union as the collective bargaining representative of that craft or class.

Under the NMB's usual rules, a labor union will be certified as the representative of the employees in a craft or class only if more than

50% of those employees vote for union representation. A certified labor union then enters into a collective bargaining agreement with

the employer.

Under the Railway Labor Act, a collective bargaining agreement between an airline and a labor union does not expire, but instead

becomes amendable as of a stated date. Either party may request the NMB to appoint a federal mediator to participate in the

negotiations for a new or amended agreement. If no agreement is reached in mediation, the NMB may determine, at any time, that an

impasse exists and offer binding arbitration. If either party rejects binding arbitration, a 30-day "cooling off" period begins. At the end

6