Delta Airlines 2005 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2005 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

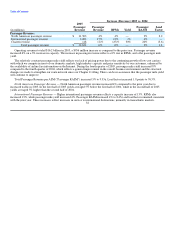

Table of Contents

financing agreements that are entitled to the benefits of Section 1110 of the Bankruptcy Code, to the extent such financing agreements

prohibit such liens.

The DIP Credit Facility includes affirmative, negative and financial covenants that impose substantial restrictions on our financial

and business operations, including our ability to, among other things, incur or secure other debt, make investments, sell assets and pay

dividends or repurchase stock.

The financial covenants require us to:

• maintain unrestricted funds in an amount not less than $750 million through May 31, 2006; $1 billion at all times from

June 1, 2006 through November 30, 2006; $750 million at all times from December 1, 2006 through February 28, 2007;

and $1 billion at all times thereafter ("Liquidity Covenant");

• not exceed specified levels of capital expenditures during any fiscal quarter; and

• achieve specified levels of EBITDAR, as defined, for successive trailing 12-month periods through March 2008.

During 2005, we were required to achieve increasing levels of EBITDAR, including EBITDAR of $644 million for the

12-month period ending December 31, 2005. Thereafter, the minimum EBITDAR level for each successive trailing

12-month period continues to increase, including $1.372 billion for the 12-month period ended December 31, 2006;

$1.988 billion for the 12-month period ending December 31, 2007; and $2 billion for each 12-month period ending

thereafter. If our cash on hand exceeds the minimum cash on hand that we are required to maintain pursuant to the

Liquidity Covenant, then the EBITDAR level that we are required to achieve is effectively reduced by the amount of

such excess cash, up to a maximum reduction of $250 million from the required EBITDAR level.

The DIP Credit Facility contains events of default customary for debtor-in-possession financings, including cross-defaults to the

Amex Post-Petition Facility and certain change of control events. The DIP Credit Facility also includes events of default specific to

our business, including if all or substantially all of our flight and other operations are suspended for longer than two days, other than in

connection with a general suspension of all U.S. flights, or if certain routes and, subject to certain materiality thresholds, other routes,

and slots and gates are revoked, terminated or cancelled. Upon the occurrence of an event of default, the outstanding obligations under

the DIP Credit Facility may be accelerated and become due and payable immediately.

On March 27, 2006, we executed an amended and restated credit agreement (the "Amended and Restated DIP Credit Facility")

with a syndicate of lenders led by GECC and Morgan Stanley that replaced the DIP Credit Facility in its entirety. The aggregate

amounts available to be borrowed are not changed from the DIP Credit Facility by the Amended and Restated DIP Credit Facility.

However, under the Amended and Restated DIP Credit Facility, the interest rates on borrowings have been reduced: the TLA bears

interest, at our option, at LIBOR plus 2.75% or an index rate plus 2.00%; the TLB bears interest, at our option, at LIBOR plus 4.75%

or an index rate plus 4.00%; and the TLC bears interest, at our option, at LIBOR plus 7.50% or an index rate plus 6.75%. The

Amended and Restated DIP Credit Facility is otherwise substantially the same as the DIP Credit Facility, including financial

covenants, collateral, guarantees, and events of default, and it allows the execution of amendments to certain other credit facilities and

the reimbursement agreement with GECC discussed below under "GECC Reimbursement Agreement Collateral Value Test" and in

Note 8 of the Notes to the Consolidated Financial Statements.

Financing Agreement with Amex

On September 16, 2005, we entered into the Modification Agreement with Amex and American Express Bank, F.S.B. pursuant to

which we modified certain existing agreements with Amex, including the Amex Pre-Petition Facility under which we had borrowed

$500 million from Amex. The Amex Pre-Petition Facility consisted of substantially identical supplements to the two existing

agreements under which Amex purchases SkyMiles from us, the Membership Rewards Agreement and the Co-Branded Credit Card

Program Agreement (collectively, the "SkyMiles Agreements"). The Bankruptcy Court approved our entering into the Modification

Agreement and our assuming the SkyMiles Agreements. Amex has the right, in certain

39