Delta Airlines 2005 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2005 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

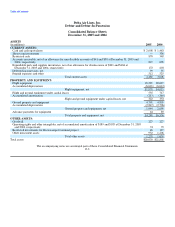

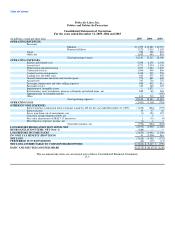

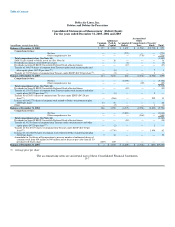

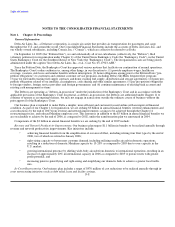

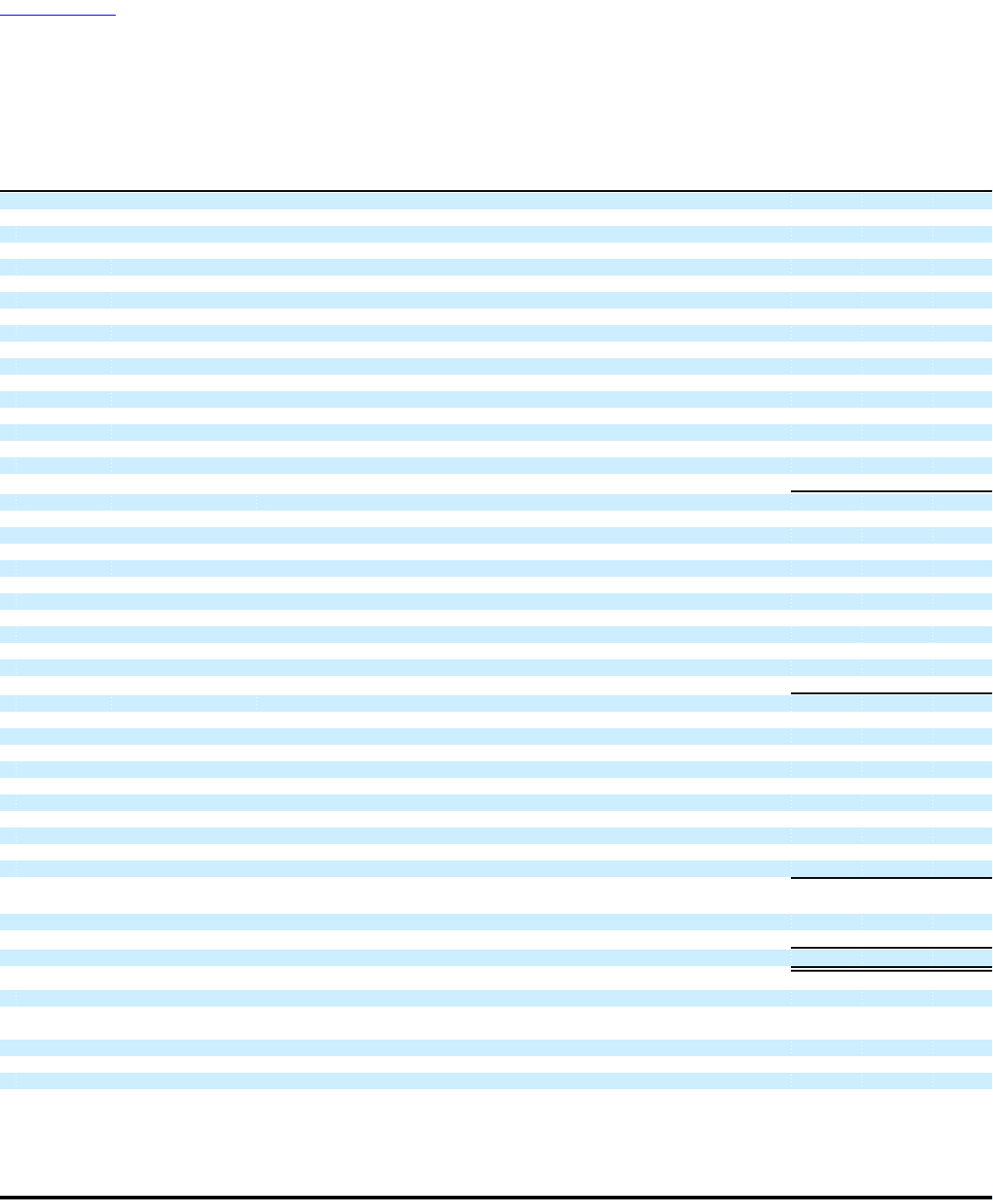

Delta Air Lines, Inc.

Debtor and Debtor-In-Possession

Consolidated Statements of Cash Flows

For the years ended December 31, 2005, 2004 and 2003

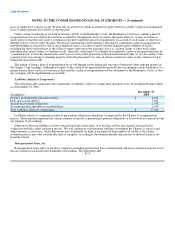

(in millions) 2005 2004 2003

Cash Flows From Operating Activities:

Net loss $ (3,818) $ (5,198) $ (773)

Adjustments to reconcile net loss to net cash provided by (used in) operating activities:

Asset and other writedowns 14 1,915 47

Depreciation and amortization 1,273 1,244 1,230

Deferred income taxes (41) 1,206 (416)

Pension, postretirement and postemployment expense in excess of (less than) payments 896 (121) 532

Reorganization items 884 — —

Gain on extinguishment of debt, net (9) (9) —

Dividends in excess of income from equity method investments — — 30

Loss (gain) from sale of investments, net 1 (123) (321)

Changes in certain current assets and liabilities:

Decrease (increase) in short-term investments, net 336 204 (311)

(Increase) decrease in receivables (122) (27) 317

Increase in prepaid expenses and other current assets (67) (151) (90)

Increase in air traffic liability 145 259 38

Increase (decrease) in other payables, deferred credits and accrued liabilities 667 (233) (276)

Other, net 16 26 237

Net cash provided by (used in) operating activities 175 (1,008) 244

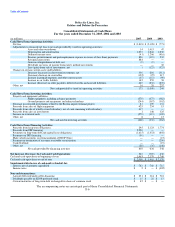

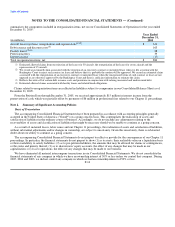

Cash Flows From Investing Activities:

Property and equipment additions:

Flight equipment, including advance payments (570) (373) (382)

Ground property and equipment, including technology (244) (387) (362)

Decrease in restricted investments related to the Boston airport terminal project 81 159 131

Proceeds from sales of flight equipment 425 234 15

Proceeds from sale of wholly owned subsidiary, net of cash remaining with subsidiary 417 — —

Proceeds from sales of investments 1 146 325

Increase in restricted cash (578) (115) (102)

Other, net 8 1 13

Net cash used in investing activities (460) (335) (362)

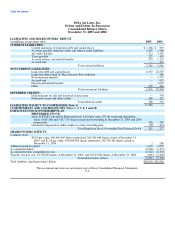

Cash Flows From Financing Activities:

Proceeds from long-term obligations 295 2,123 1,774

Proceeds from DIP financing 2,250 — —

Payments on long-term debt and capital lease obligations (1,615) (1,452) (802)

Payments on DIP financing (50) — —

Make-whole payments on extinguishment of ESOP Notes — — (15)

Payment on termination of accounts receivable securitization — — (250)

Cash dividends — — (19)

Other, net (50) (35) (140)

Net cash provided by financing activities 830 636 548

Net Increase (Decrease) In Cash and Cash Equivalents 545 (707) 430

Cash and cash equivalents at beginning of year 1,463 2,170 1,740

Cash and cash equivalents at end of year $ 2,008 $ 1,463 $ 2,170

Supplemental disclosure of cash paid (refunded) for:

Interest, net of amounts capitalized $ 783 $ 768 $ 715

Income taxes $ 2 $ — $ (402)

Non-cash transactions:

Aircraft delivered under seller-financing $ 251 $ 314 $ 718

Dividends payable on ESOP preferred stock $ 15 $ 22 $ 13

Current maturities of long-term debt exchanged for shares of common stock $ 45 $ — $ —

The accompanying notes are an integral part of these Consolidated Financial Statements.

F-6