Delta Airlines 2005 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2005 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

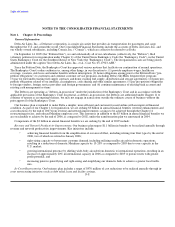

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

below issues its final order as to whether Delta is authorized to reject the pilot collective bargaining agreement under the legal

standards of Section 1113 of the Bankruptcy Code.

The interim agreement provides that Delta and ALPA will seek to negotiate a tentative comprehensive agreement, and establishes

the following time limits ("March 2006 time limits") for reaching that agreement: (1) March 1, 2006, for the parties' negotiating

committees to reach a tentative agreement; (2) March 8, 2006, for approval by the ALPA Master Executive Council; and

(3) March 22, 2006, for pilot ratification. Because the first of the March 2006 time limits was not met, pursuant to our interim

agreement with ALPA, the matter at issue in Delta's Section 1113 motion has been submitted to a mutually agreed upon, neutral panel

of three experts in airline labor matters for a binding decision on that issue. The interim agreement provides that the panel's decision

must be issued no later than 45 days after the failure to meet the applicable March 2006 time limit, which is April 15, 2006. We cannot

predict the outcome of the neutral panel's decision as to whether or not we would be authorized to reject the collective bargaining

agreement.

Comair has been and continues to be in negotiations with the International Brotherhood of Teamsters ("IBT"), the collective

bargaining representative of Comair's flight attendants, to reduce Comair's flight attendant labor costs. Because Comair was not able

to reach a consensual agreement with the IBT, on February 22, 2006, Comair filed a motion with the Bankruptcy Court to reject

Comair's collective bargaining agreement with the IBT.

See Note 10 for additional information about these and related subjects.

Payment of Insurance Benefits to Retired Employees. Section 1114 of the Bankruptcy Code addresses a debtor's ability to modify

certain retiree disability, medical and death benefits ("Covered Benefits"). To modify Covered Benefits, the debtor must satisfy certain

statutorily prescribed procedural and substantive prerequisites and obtain either (1) the Bankruptcy Court's approval or (2) the consent

of an authorized representative of retirees. The debtor must make a proposal to modify the Covered Benefits based on the most

complete and reliable information available at the time, must bargain in good faith and must share relevant information with the retiree

representative. The proposed modifications must be necessary to permit the reorganization of the debtor and must ensure that all

affected parties are treated fairly and equitably relative to the creditors and the debtor.

The Bankruptcy Court directed the appointment of two separate retiree committees under Section 1114, one to serve as the

authorized representative of nonpilot retirees, and the other to serve as the authorized representative of pilot retirees. We have not yet

made any proposal to modify retiree benefits for either nonpilots or pilots that we believe are Covered Benefits.

Magnitude of Potential Claims. The Debtors will file with the Bankruptcy Court schedules and statements of financial affairs

setting forth, among other things, the assets and liabilities of the Debtors, subject to the assumptions filed in connection therewith. All

of the schedules will be subject to further amendment or modification. Differences between amounts scheduled by the Debtors and

claims by creditors will be investigated and resolved in connection with the claims resolution process. In light of the expected number

of creditors, the claims resolution process may take considerable time to complete. Accordingly, the ultimate number and amount of

allowed claims is not presently known, nor can the ultimate recovery with respect to allowed claims be presently ascertained.

Costs of Reorganization. We have incurred and will continue to incur significant costs associated with our reorganization. The

amount of these costs, which are being expensed as incurred, are expected to significantly affect our results of operations. For

additional information, see "Reorganization Items, net" in this Note.

Effect of Filing on Creditors and Shareowners. Under the priority scheme established by the Bankruptcy Code, unless creditors

agree otherwise, pre-petition liabilities and post-petition liabilities must be satisfied in full before shareowners are entitled to receive

any distribution or retain any property under a plan of reorganization. The ultimate recovery to creditors and/or shareowners, if any,

will not be determined until confirmation of a plan or plans of reorganization. No assurance can be given as to what values, if any, will

be F-11