Delta Airlines 2005 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2005 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

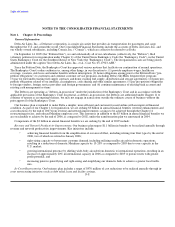

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

In accordance with GAAP, we have applied American Institute of Certified Public Accountants' ("AICPA") Statement of

Position 90-7, "Financial Reporting by Entities in Reorganization under the Bankruptcy Code" ("SOP 90-7"), in preparing the

Consolidated Financial Statements. SOP 90-7 requires that the financial statements, for periods subsequent to the Chapter 11 filing,

distinguish transactions and events that are directly associated with the reorganization from the ongoing operations of the business.

Accordingly, certain revenues, expenses (including professional fees), realized gains and losses and provisions for losses that are

realized or incurred in the bankruptcy proceedings are recorded in reorganization items, net on the accompanying Consolidated

Statements of Operations. In addition, pre-petition obligations that may be impacted by the bankruptcy reorganization process have

been classified on the Consolidated Balance Sheet at December 31, 2005 in liabilities subject to compromise. These liabilities are

reported at the amounts expected to be allowed by the Bankruptcy Court, even if they may be settled for lesser amounts (see Note 1).

While operating as debtors-in-possession under Chapter 11 of the Bankruptcy Code, the Debtors may sell or otherwise dispose of

or liquidate assets or settle liabilities, subject to the approval of the Bankruptcy Court or otherwise as permitted in the ordinary course

of business, in amounts other than those reflected in the Consolidated Financial Statements. Moreover, a plan of reorganization could

materially change the amounts and classifications in the historical Consolidated Financial Statements.

Reclassifications

We sell mileage credits in our SkyMiles frequent flyer program to participating partners, such as credit card companies, hotels and

car rental agencies. The portion of the revenue from the sale of mileage credits that approximates the fair value of travel to be

provided is deferred. We amortize the deferred revenue on a straight-line basis over the period when transportation is expected to be

provided. For the year ended December 31, 2005, the majority of the revenue from the sale of mileage credits, including the

amortization of deferred revenue, is recorded in passenger revenue on our Consolidated Statements of Operations; the remaining

portion is recorded as other revenue. Prior to 2005, the remaining portion was classified as an offset to selling expenses. We have

reclassified prior period amounts to be consistent with the current year presentation. These reclassifications resulted in an increase to

other, net revenues as well as passenger commissions and other selling expenses of $233 million and $221 million for the years ended

December 31, 2004 and 2003, respectively. Operating and net loss did not change for any period presented. We believe this

reclassification enhances the comparability of other, net revenues, as well as passenger commissions and other selling expenses, on

our Consolidated Statements of Operations.

For the year ended December 31, 2005, we classified changes in restricted cash on our Consolidated Statement of Cash Flows as

an investing activity. Prior to 2005, we presented such changes as an operating activity. We have reclassified prior period amounts to

be consistent with the current year presentation. These reclassifications resulted in an increase to cash flows from operating activities

and a corresponding decrease to cash flows from investing activities of $115 million for the year ended December 31, 2004, and

$102 million for the year ended December 31, 2003.

We have reclassified certain other prior period amounts in our Consolidated Financial Statements to be consistent with our current

period presentation. The effect of these reclassifications is not material.

Use of Estimates

We are required to make estimates and assumptions when preparing our Consolidated Financial Statements in accordance with

GAAP. These estimates and assumptions affect the amounts reported in our financial statements and the accompanying notes. Actual

results could differ materially from those estimates.

New Accounting Standards

In May 2005, the Financial Accounting Standards Board ("FASB") issued Statement of Financial Accounting Standards ("SFAS")

No. 154, "Accounting Changes and Error Corrections" ("SFAS 154").

F-15