Delta Airlines 2005 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2005 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

number of early pilot retirements may make it unlikely that we could satisfy our funding obligations to that plan even if the pending

legislation is enacted in the form in which it passed the U.S. Senate.

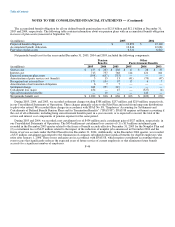

Our other postretirement benefit plans are funded from current assets. Assuming current plan design, we expect to make benefit

payments of approximately $142 million for our other postretirement benefit plans in 2006.

Benefit Payments

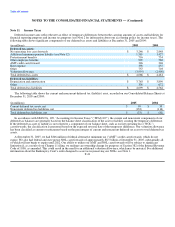

Benefit payments are based on the same assumptions used to measure the related benefit obligations and are paid from both funded

benefit plan trusts and current assets.

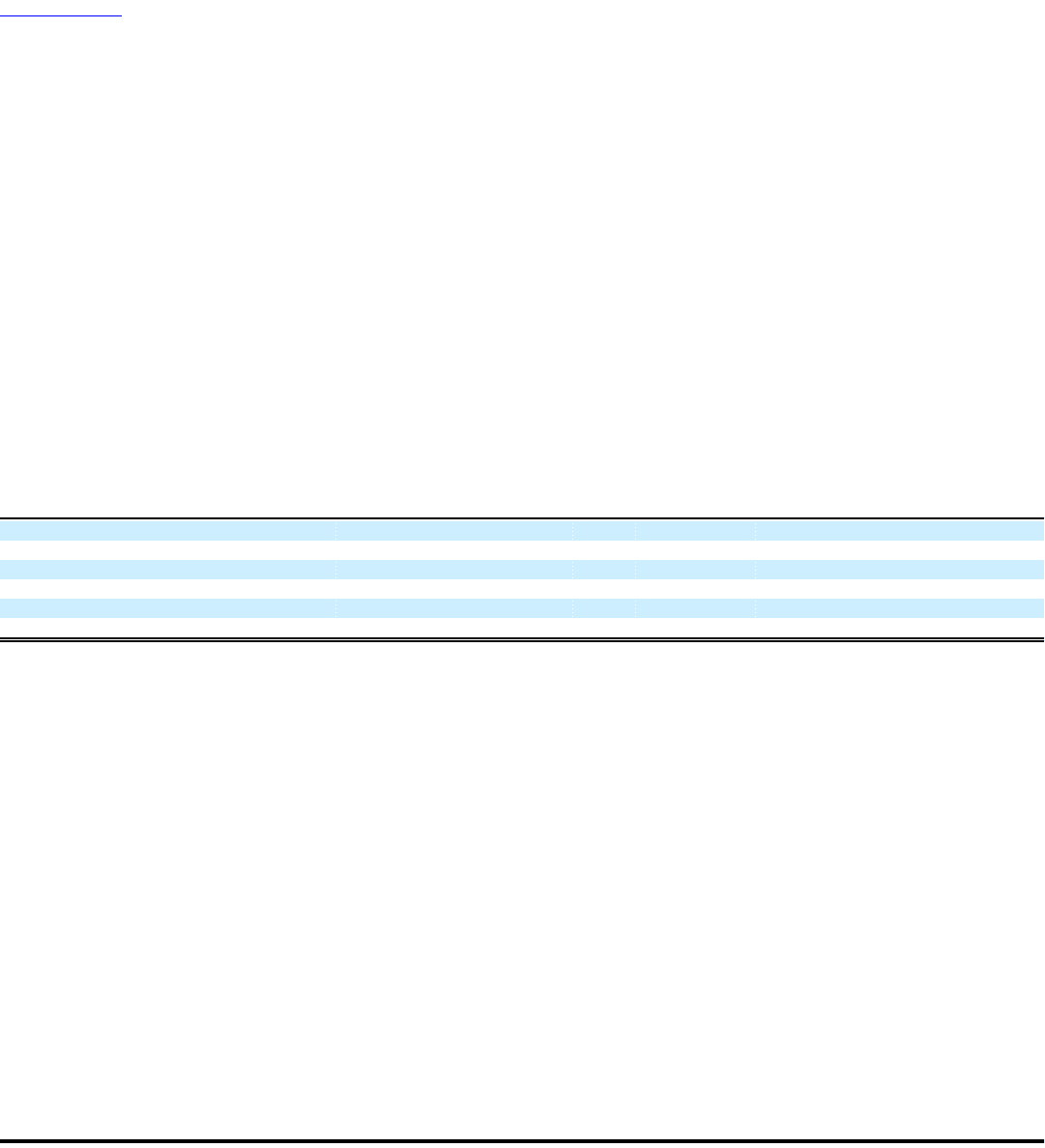

Benefit payments in the table below include payments associated with both our qualified and non-qualified defined benefit plans.

Benefits earned under our qualified pension plans are expected to be paid from funded benefit plan trusts. The benefits related to our

non-qualified plans are paid from current assets. Non-qualified benefit payments earned prior to our Petition Date ceased as of that

date. We believe we are not required to make these payments while we are operating under Chapter 11. Actual benefit payments may

vary significantly from these estimates.

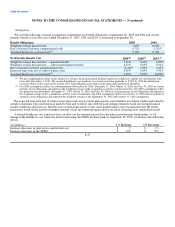

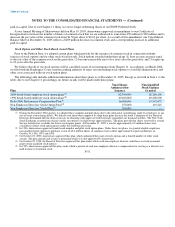

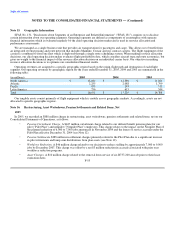

Benefit payments, which reflect expected service, as appropriate, are scheduled to be paid in the following years ending

December 31:

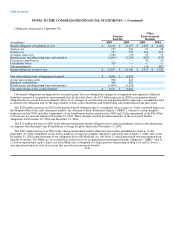

Other

Pension Postretirement

(in millions) Benefits(1) Benefits

2006 $ 924 $ 142

2007 785 145

2008 790 147

2009 797 142

2010 789 138

2011 – 2015 4,152 598

(1) Includes estimated payments of approximately $70 million to $80 million per year under our non-qualified defined benefit

plans for benefits earned prior to the Petition Date.

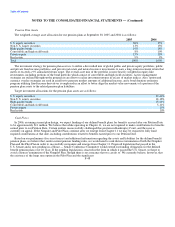

Other Plans

We also sponsor defined benefit pension plans for eligible Delta employees in certain foreign countries. These plans did not have a

material impact on our Consolidated Financial Statements in any period presented.

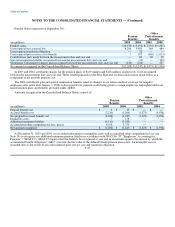

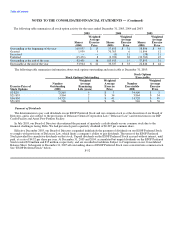

Defined Contribution Pension Plans

Pilot Defined Contribution Plan

We established a defined contribution plan ("Pilot DC Plan") for Delta pilots effective January 1, 2005. During 2005, we

recognized expense of $83 million for this plan. Eligible pilots will receive a contribution ranging from 0% to 22.9% of covered pay,

based on the pilot's age and years of service on January 1, 2005. Pilots hired on or after January 1, 2005 will receive a contribution of

10% of covered pay.

Delta Pilots Money Purchase Pension Plan ("MPPP")

We contributed 5% of covered pay to the MPPP for each eligible Delta pilot through December 31, 2004. The MPPP is related to

the Pilot Plan. The defined benefit pension payable to a pilot is reduced by the actuarial equivalent of the accumulated account balance

in the MPPP. During the years ended December 31, 2004 and 2003, we recognized expense of $65 million and $66 million,

respectively, for this plan. Although F-49